French and German (flash) manufacturing PMI are to be released on Thursday, before the crucial European release. These two countries are to be watched for any significant moves away from or towards the 50.0 mark which denotes the border between economic expansion and contraction.

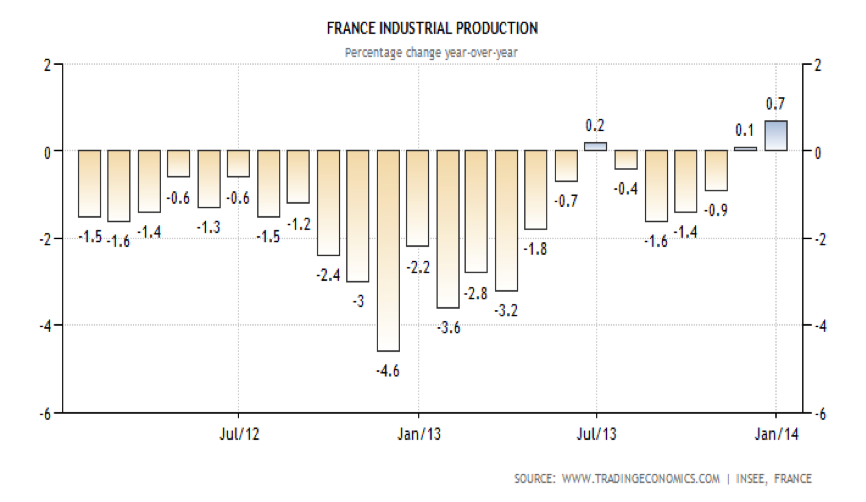

France is the weaker of the two largest economies in Europe and has only just experienced an increase in industrial production,

which was accompanied by a decrease (0.3%) in capacity utilisation,

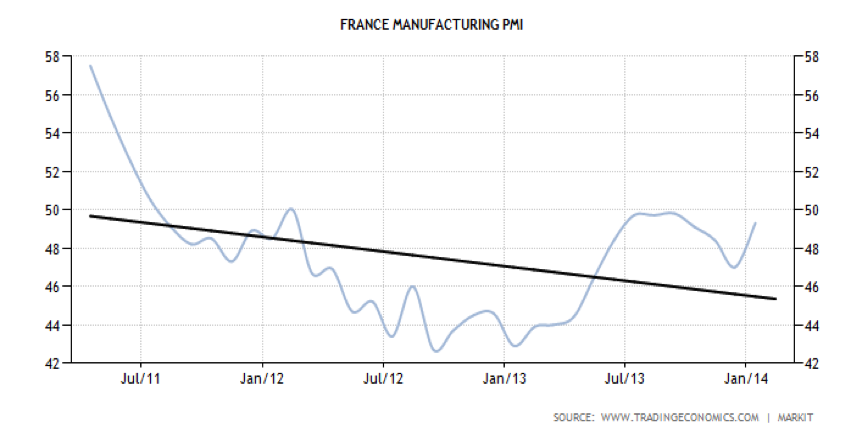

However, French PMI estimates suggest a rise of 0.5, from 49.3 to 49.8, though one must bear in mind that five of the last six releases disappointed the market and a negative trend is seen over the years 2002 to 2014 (although note the recent uptick last year).

German PMI figures are in safer territory with a previous value of 56.5 expected to undergo no change:

However, December 2013 to January 2014 saw a large jump from 54.3 to 56.5 and is a comparative jump in the next figure (Feb. 2014) takes the market by surprise we will see a bullish run on EUR.

With respect to the Eurozone, the PMI is not predicted to change by many analysts, staying static at 54.0;

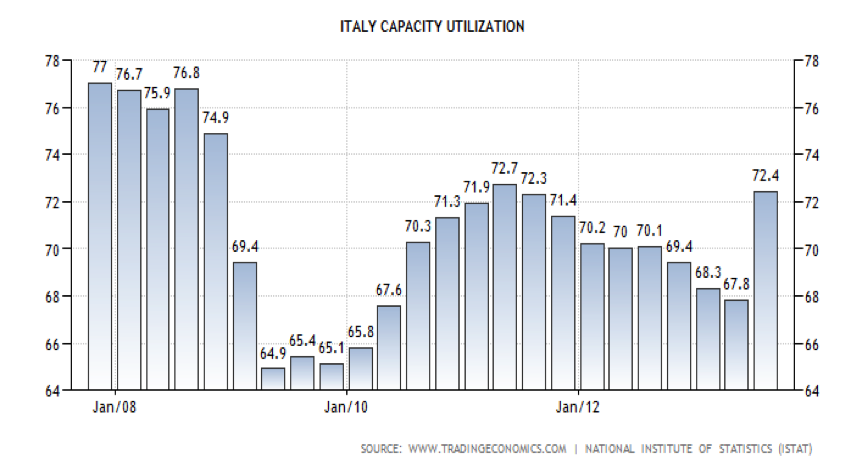

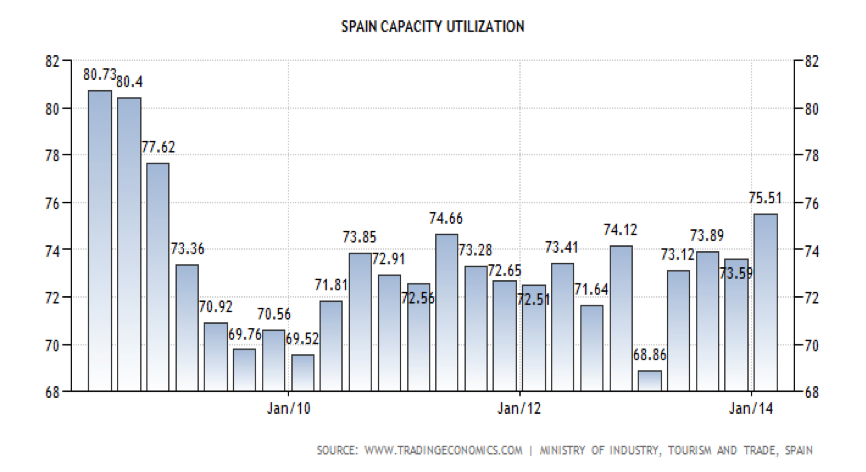

which seems odd since Germany (see above) is doing well and Italy and Spain have both undergone a significant increase in capacity utilization, as may be seen below:

In conclusion, the Eurozone PMI figure may well surprise on the up-side this Thursday though not with significant magnitude. If so the EUR will see a bullish run.