Investing.com’s stocks of the week

A deal on Cypriot banks was reached last night allowing the vital liquidity line between the ECB and Cyprus to remain open. The broad tenets of the deal leave depositors under EUR100k spared however, those over that threshold could see losses of near 40% of their holdings. This does not come in the form of a tax however, but is instead the result of the restructuring of the Cypriot banking sector that will see Laiki Bank, the country’s 2nd largest lender, go to the wall.

Banks in Cyprus will remain closed today and until further notice as the discussion on capital controls continues. The bank run problem seems to be limited to Cyprus with little activity elsewhere. The major impact of this all has been political and another round of distrust between those in power and the voters.

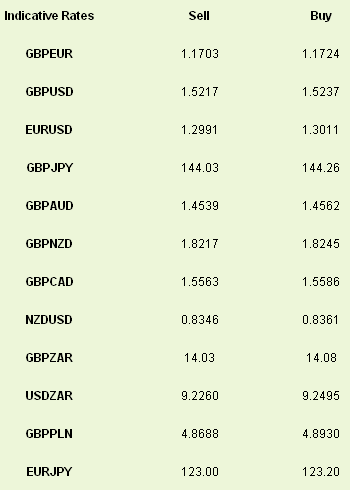

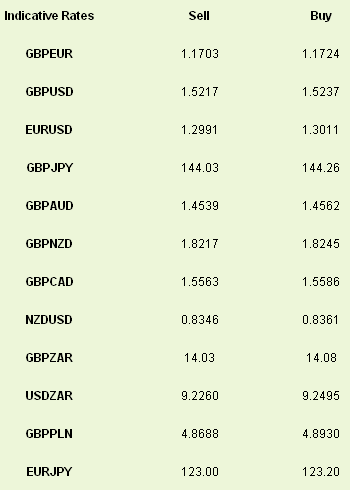

Asian markets welcomed the news with EURUSD squirting above 1.30 overnight as near-term fears over a Cypriot exit from the Eurozone can be priced out of the market.

How the euro now behaves is an interesting one. The one thing that this whole sordid affair shows is that there are limitations to how well protected the market feel as a result of the ECB’s OMT program. This has been the backstop of all the euro strength that we have seen for the best part of 8 months and we must now ask whether too much damage has been done to the sentiment suit of armour.

The retail sales powered boost in sterling continued on Friday with GBPUSD touching 1.5250 and GBPEUR getting above 1.18. This was despite a note from Fitch late on Friday that they had put the UK’s credit rating on a “negative watch” and would have a decision by April. This comes as little surprise to us; we knew that a review would take place following the Budget and we feel that it is more than likely that Fitch will join Moody’s in seeing us lose our AAA rating.

The overall global market story will now switch away from Cyprus and back towards the longer issue of the divergence between the Eurozone and the US in economic fundamentals. This could mean further pressure on currencies versus the USD through the week and into the Easter weekend.

Banks in Cyprus will remain closed today and until further notice as the discussion on capital controls continues. The bank run problem seems to be limited to Cyprus with little activity elsewhere. The major impact of this all has been political and another round of distrust between those in power and the voters.

Asian markets welcomed the news with EURUSD squirting above 1.30 overnight as near-term fears over a Cypriot exit from the Eurozone can be priced out of the market.

How the euro now behaves is an interesting one. The one thing that this whole sordid affair shows is that there are limitations to how well protected the market feel as a result of the ECB’s OMT program. This has been the backstop of all the euro strength that we have seen for the best part of 8 months and we must now ask whether too much damage has been done to the sentiment suit of armour.

The retail sales powered boost in sterling continued on Friday with GBPUSD touching 1.5250 and GBPEUR getting above 1.18. This was despite a note from Fitch late on Friday that they had put the UK’s credit rating on a “negative watch” and would have a decision by April. This comes as little surprise to us; we knew that a review would take place following the Budget and we feel that it is more than likely that Fitch will join Moody’s in seeing us lose our AAA rating.

The overall global market story will now switch away from Cyprus and back towards the longer issue of the divergence between the Eurozone and the US in economic fundamentals. This could mean further pressure on currencies versus the USD through the week and into the Easter weekend.