EU members have finally agreed on a watered-down ban on Russian oil and refined product imports. The move is still relatively supportive for the market, given the ban covers the bulk of Russian oil flows to the EU.

What the EU has agreed to

The EU has spent a month trying to reach an agreement on a Russian oil ban. The original proposal was for all Russian crude oil imports into the EU to be banned.

However, this led to some opposition from Hungary and other Central and Eastern Europe (CEE) countries, which are heavily dependent on Russian pipeline oil.

Therefore, the EU has agreed to exempt pipeline flows for now and instead ban just seaborne imports over the next six months. Refined product imports will be wound down over the next eight months.

While pipeline flows are exempt from the ban, it is likely that we still see these flows reduced. Germany and Poland have signaled that they will work towards reducing Russian flows to zero.

This is important, given that they are the largest recipients of Russian oil from the Druzhba pipeline.

The exemption of pipeline flows will also likely be temporary. The EU will still work towards getting Hungary and other CEE countries to cut their dependence on Russian oil over a longer time period.

Full details of the EU ban are yet to be published.

How easily can the EU replace Russian supply?

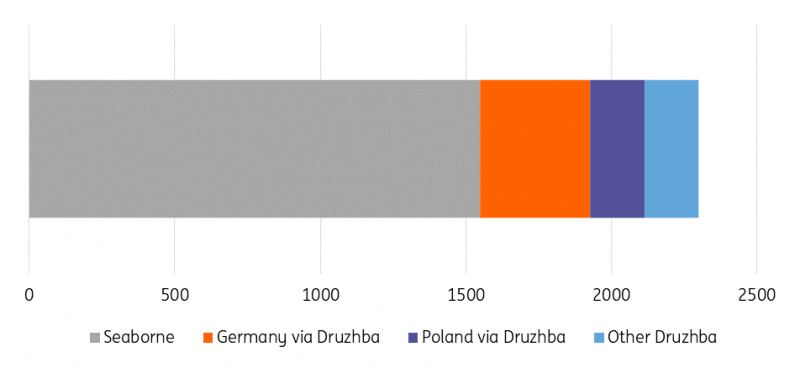

The EU imports around 2.3MMbbls/d of crude oil from Russia, which is about 26% of total crude oil imports. About two-thirds of these imports are seaborne, while the remainder comes through the Druzhba pipeline.

However, if Germany and Poland stick to their plan of reducing Russian oil imports to zero, rather than seeing flows cut by two-thirds by year-end, we could see closer to 90% of Russian imports into the EU affected.

Source: Eurostat, IHS Markit, ING Research

The EU also imports a significant amount of refined product from Russia, specifically gasoil, naphtha, and fuel oil. Eurostat numbers show that the EU imported in excess of 800Mbls/d of these three products from Russia in 2020, of which more than 55% was gasoil. Russia meets more than 40% of total EU imports for all three of these products.

The more lenient ban on Russian oil will make it easier for EU member countries to stomach the latest round of sanctions, particularly those who are heavily dependent on Russian pipeline oil flows.

We will need to see how Germany and Poland logistically handle a reduction in flows from Russia, if they are serious about ending their dependency on Russian oil.

Refiners in these countries which rely on the Druzhba pipeline can use other pipeline routes from Gdansk and Rostock. Although it will be difficult for a couple of German refiners to fully offset Druzhba pipeline flows.

Apart from some potential logistical issues, refiners will also want to replace Urals with a crude of similar quality. Urals are generally a medium sour crude, and so that is what refiners will want to target as a replacement.

If a refiner changes its crude inputs this could have an impact on the refinery yields. Given the tightness in the middle distillate market, refiners will want to ensure they take grades which will yield more middle distillates. US shale alone will be just too light as a replacement for a lot of these refiners.

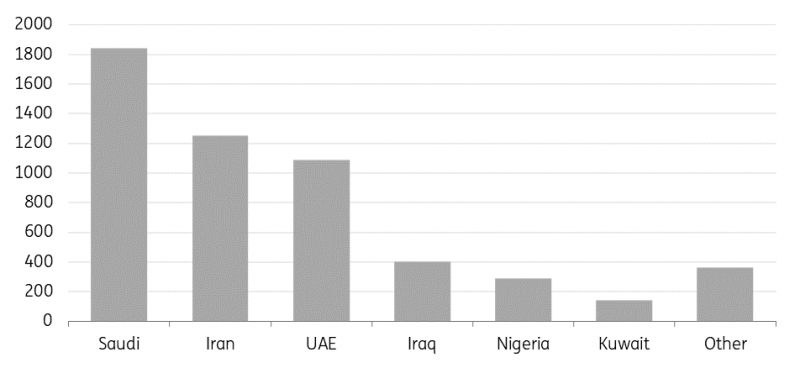

The other key issue is whether there is enough spare capacity within the oil industry, which would allow EU buyers to simply switch to other suppliers. OPEC members are sitting on 4.12MMbbls/d of spare capacity according to the International Energy Agency (IEA), and when you include Iran, this increases to 5.4MMbbls/d.

So, theoretically, members could tap into this spare capacity, which would help offset Russian supply. Although, there are questions around OPEC capacity, given that members have consistently fallen short of production targets in recent months.

In addition, if US crude oil output grows by around 840Mbbls/d between now and year-end, as expected, it would provide only a further buffer.

However, the issue is that OPEC members have been reluctant to tap into their spare capacity. Up until now, OPEC has said that volatility in the markets reflects geopolitical risks rather than a supply/demand imbalance.

However, it’s important to remember that Russia is part of the OPEC+ pact, and so would have an influence on the broader group’s production policy. In addition, OPEC is not sitting on a significant amount of spare capacity.

The bulk of it sits in the hands of Saudi Arabia and the UAE. If they were to tap into this spare capacity, it would likely not take the market too long to shift away from a narrative of the need for additional OPEC supply to a narrative that the market is more vulnerable given shrinking spare capacity.

Source: IEA, ING Research

We are assuming that OPEC+ will not deviate away from its current production policy of modest supply increases every month. So, therefore, the EU will have to partly rely on crude oil trade flows to change.

Non-EU buyers who could meaningfully increase their purchases of Russian oil would be India and China. Given that demand from EU buyers will fall significantly over the next six months, there is the potential for even larger discounts for Russian crude oil, providing a strong incentive to other buyers to snap up Russian oil.

China is already a large buyer of Russian oil, with imports in 2021 averaging 1.6MMbbls/d, 16% of total imports. In the short term, Chinese demand will be affected by COVID lockdowns, but in the medium to longer term, we could see an increased buying appetite for Russian crude.

The latest trade data from China for April shows that imports over the month averaged 1.6MMbbls/d, so no signs of an increase yet.

India historically is a very small buyer of Russian oil, with it making up around 1% of imports. India imported around 4.2MMbbls/d of crude oil in 2021.

However, the large discounts we have seen on Urals have already attracted Indian buying interest, and this is a trend that is likely to continue, particularly if we see even larger discounts on offer for Urals.

According to reports, India increased its share of Russian oil imports to 5% of total seaborne imports in April.

What this means for oil prices

The challenge when it comes to forecasting how the global oil balance will evolve over the next several months is figuring out how much additional demand we could see from other non-EU buyers of Russian oil.

Large discounts should ensure alternative buyers. However, there is the risk that we see the US imposing secondary sanctions on Russian oil. This would make it difficult for any buyers to purchase Russian oil, and so would tighten up the global market even more than we are currently expecting.

Although, given that the EU ban is a partial ban, the US administration might hold off from imposing secondary sanctions for now.

Through a combination of already announced government sanctions along with self-sanctioning, we see Russian supply falling in the region of 3.5MMbbls/d by the end of this year.

The US, UK, Japan, Korea, and Canada have either already imposed bans or are at least shunning Russian oil. The market will struggle to fully offset this supply loss, and so we forecast that the oil market will be in deficit over 2H22.

However, lower demand growth estimates (due to China's lockdowns and expectations of lower economic growth) mean that the deficit is more manageable than originally expected.

US supply growth, continued growth in OPEC+ production (minus Russia) and the assumption that we will see a lifting in Iranian sanctions should mean the market is relatively more balanced in 2023.

This should see prices coming off from the higher levels we have seen this year. However, the market will still be left vulnerable, particularly if Russian supply losses exceed our expectations and if Iranian supply does not make a strong return over the course of 2023.

A gradual ban on Russian oil means that the strength in the market shouldn’t be as abrupt as it could have been had we seen an immediate ban. Instead, we expect prices to trend higher through the course of the year.

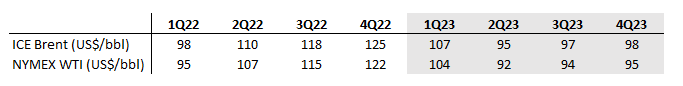

We have revised higher our 2H22 ICE Brent forecast from US$109/bbl to US$122/bbl. In addition, we have increased our full-year 2023 forecast from US$93/bbl to US$99/bbl.

However, as mentioned, clear upside risks to our 2023 forecasts include potential secondary sanctions on Russian oil and US sanctions against Iran staying in place over 2023.

Source: ING Research

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more