The key releases for Wednesday include industrial production for the European Union, the quarterly inflation report from the Bank of England and retail sales for the US.

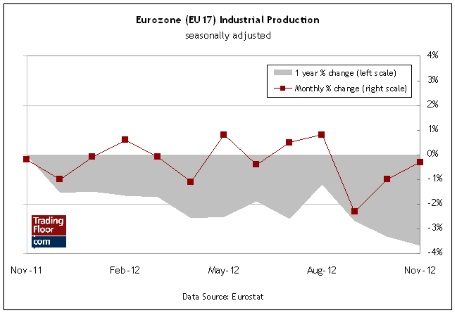

EU Industrial Production (10:00 GMT) Today’s update will likely show that Europe’s recession is easing. Perhaps the slump has, in fact ended, but it’s too soon to say. A somewhat more confident view is that the rate of contraction is slowing.

New evidence for thinking positively is expected to show up in December's report for industrial production. The consensus forecast calls for a 0.2 percent increase in 2012’s final month against November, which posted a 0.3 percent decline (based on the 17-nation bloc). Anticipating a December rebound is plausible, in part because industrial production figures for Europe’s big three economies - Germany, France and Italy - are already published and the general trend looks favorable. Germany posted a handsome 0.8 percent rise in December and Italy reported a 0.4 percent gain, according to Eurostat. France’s industrial production was flat, but the overall picture is still upbeat. In short, the odds look quite high for a favourable report today. One decent month for industrial activity is hardly a game changer. But in context with several encouraging macro numbers released this month, another sign of progress will further strengthen the argument that the worst has passed.

BoE Inflation Report (10:30 GMT) Consumer price inflation in the UK eased in January, falling 0.5 percent for the month versus December. But the year-over-year rate remains stuck at 2.7 percent, or well over the central bank’s 2 percent target. Indeed, inflation’s annual pace has been running well over 2 percent since late 2009, a fact that’s likely to dominate today’s quarterly inflation report from the Bank of England.

The central bank already noted last week that inflation has remained “stubbornly above the 2 percent target”, and that more of the same is likely over the next two years. The not-so-subtle hint is that monetary policy is likely to err on the side of the hawks. The weak economy in Britain may soften the resolve a bit, depending on how the macro numbers look in the weeks and months ahead. Overall, the question is whether the BoE will cut its growth outlook in today's report and maintain its projections for inflation above the target. Most analysts think that's a sound bet, and there's nothing in the recent economic news to suggest otherwise. The grim combination of sluggish growth and relatively high inflation, in short, are likely to keep the BoE struggling to find the optimal monetary policy for the year ahead.

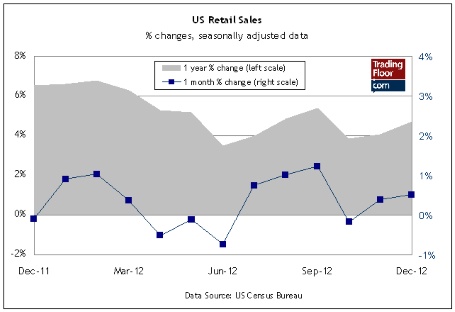

US Retail Sales (13:30 GMT) Consumer spending grew modestly in the last two months of 2012, but a slower pace is expected for January. Economists see retail sales barely rising in 2013’s first month, based on consensus surveys. My econometric modelling projects a slightly higher gain, although all the forecasts anticipate a substantial slowdown versus December’s 0.5 percent increase.

A broad read on the economic numbers still leans comfortably on the side of moderate growth, but a weak report in retail sales numbers may rattle the markets. Slow growth remains a reasonable forecast for the economy, but the consumer may be off to a rough start in the new year. Indeed, private payrolls posted the smallest gain in January in four months and something similar may be in store for today's news on retail sales. But with several leading retailers already reporting upbeat numbers for January, the odds still look decent for at least a small advance in the broad measure of spending.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

EU Industrial Production, UK Inflation And US Retail Sales

Published 02/13/2013, 04:54 AM

Updated 03/19/2019, 04:00 AM

EU Industrial Production, UK Inflation And US Retail Sales

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.