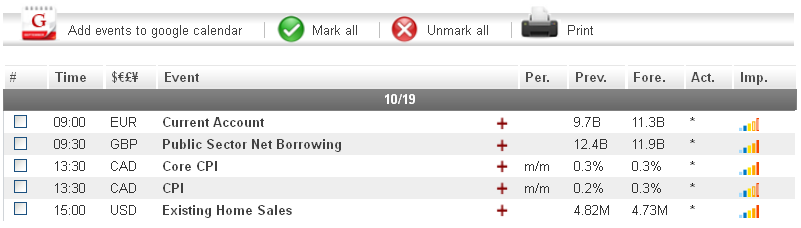

Yesterday, U.S. Jobless claims affected all major currencies and pairs when the Unemployment Claims came in higher than expected. Today, traders should look to continue following reports out of the EU Economic Summit as it goes into its second day. U.S. Existing Home Sales will also be released at 14:00 GMT, which will be a good indicator for trading in many currencies and commodities.

Economic News

USD - U.S. Jobless Claims Erase Greenback Gains

On Thursday, the EUR/USD held steady around 1.3100 in the afternoon trading session after data showed applications for U.S. unemployment benefits jumped to 388K in the week ending Oct. 13th, erasing gains in the greenback from the prior week, and the GBP/USD fully retraced its rally on better than expected UK Retail Sales during the London session with a beginning low of 1.6115 to reach a high of 1.6170 before declining to a low of 1.6120.

Today, look to the U.S. Existing Home Sales to be released at 14:00 GMT as a leading indicator of economic health. A better than expected result today may signal positive changes in the U.S. economy and could help the dollar in afternoon trading.

EUR - 2nd Day of EU Economic Summit

Yesterday was the first day of the EU Economic Summit. The euro hit a five-month high against the yen, 104.13, during Thursday afternoon trading, buoyed by solid demand at a Spanish bond sale and greater optimism on the global economy. Yesterday, the Swiss Franc continued its declining trend against the euro that it started about a month ago.

Today, euro traders will want to pay attention to the euro-zone German PPI and Current Account data, scheduled to be released at 6:00 GMT and 8:00 GMT, respectively. The EU Economic Summit meets all day today, for the second day, to discuss Spain, Greece, banking union, and plans for monetary and economic integration. If the EU Economic Summit suddenly voices a pessimistic note with regards to the euro-zone economic recovery, the common-currency could turn bearish during mid-day trading.

CAD - Canadian Core PPI and PPI On Tap

Canadian Whole Sales numbers were released better than expected yesterday at 0.5%. After bottoming out in the 0.9763 region Thursday morning (session low), the USD/CAD has pared its losses on the heels of economic data in both the United States and Canada, whereby regaining over 35 pips to test the 0.9800 range again during the waning stages of European trading Thursday. The EUR/CAD rose throughout Thursday trading and seeing about a 20 pip jump upward at 14:30 GMT.

Today, there are two major Canadian news releases Canadian investors should note, Canadian Core CPI and Canadian CPI, to be released at 12:30 GMT. Any better than expected Canadian data could result in the CAD recouping some of yesterday's losses against the euro.

Crude Oil - Crude Oil Falls to $90.65

Crude Oil dropped to $90.65 a barrel in early Thursday afternoon trading, pressured by signs of a healthier supply outlook and a rise in U.S. jobless claims, offsetting Chinese data signaling stabilization in the economy of the world's second-largest oil consumer. Then after a few hours of trading, crude oil had recouped its losses.

As for today, traders are advised to watch carefully after the leading stock markets and the major economic indicators which will be published from the U.S. and Euro-Zone, such as U.S. Existing Home Sales and EU Current Account data, in order to predict next movements in oil prices.

Technical News

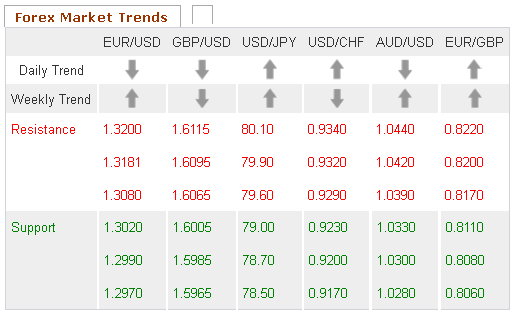

EUR/USD

The EUR/USD cross has experienced a bullish trend for the past week. However, it seems that this trend may be coming to an end. For example, the weekly chart's Stochastic Slow signals that a bearish reversal is imminent. A downward trend today is also supported by Williams Percent Range. Going short with tight stops may turn out to pay off today.

GBP/USD

The cross has experienced much bullishness in the last 2 days, and currently stands at the 1.6125 level. There is much evidence in the chart's oscillators that supports a possible bearish correction today. This is supported by weekly chart's Slow Stochastic. Going short with tight stops may turn out to bring big profits today.

USD/CHF

The USD/CHF cross has experienced a bearish trend for the past 2 weeks. However, it seems that this trend may be coming to an end. The Williams Percent Range of the Weekly chart shows the pair floating in the over-sold territory, indicating that an upward correction will happen anytime soon. Going long with tight stops might be a wise choice.

USD/JPY

The pair has been range-trading for a while now, with no specific direction. The Daily chart's Slow Stochastic providing us with mixed signals. The 4 hour charts do not provide a clear direction as well. Waiting for a clearer sign on the hourlies chart might be a good strategy today.

The Wild Card

DAX 30

DAX prices rose significantly in the last week and peaked at 7440.75. However, the daily charts' RSI is floating in an overbought territory suggesting that a recent upwards trend is loosing steam and a bearish correction is impending. This might be a good opportunity for forex traders to enter the trend at a very early stage .

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

EU Economic Summit To Meet For Second Day

Published 10/19/2012, 03:41 AM

Updated 02/20/2017, 07:55 AM

EU Economic Summit To Meet For Second Day

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.