EU calls for further no-deal Brexit preparations

- •According to media, EU leaders at their summit next week are to call upon EU member states to increase preparations for the case that no Brexit deal is reached.

- •Despite progress being marked on a number of matters, the EU seems to be worried about the Irish border issue mainly.

- •A warning could also be expressed that should there be no Brexit deal, there will be no transition period.

- •On the UK side, PM May prepares to face a showdown in parliament regarding the House of Commons “meaningful vote” on Brexit.

- •Should there be further negative headlines we could see the pound weakening.

USD pushed by increasing treasury yields

- •As per analysts, the greenback strengthened yesterday, as treasury yields picked up from a three week low.

- •The strengthening was capped against the yen as trade tensions linger in the background, but was further fueled against the EUR.

- •ECB president Draghi’s comments about patience regarding the next rate hike date, strengthened EUR/USD bears.

- •Should the rise in the US treasury yields continue, we could see the USD strengthening even further.

Today’s other economic highlights

- •Germany: Producer Prices for May, Survey: +0.4% mom Prior: +0.5% mom, 06:00 (GMT), could weaken EUR

- •US: Current Account for Q1, Survey:-129.0 Prior:-128.2B, 12:30 (GMT), could weaken USD

- •US: Existing Home Sales for May, Survey: 5.52m Prior: 5.46m, 14:00 (GMT), could support USD

- •US: EIA weekly crude oil inventories, Survey: -1.898m Prior: -4.143m, 14:30 (GMT), Could support Oil Prices

- •Speakers: ECB’s President Mario Draghi (13:30 GMT), RBA Governor Philipp Lowe (13:30, GMT), Fed Chair Jerome Powell (13:30, GMT) and FOMC’s Bullard (13:30, GMT) speak.

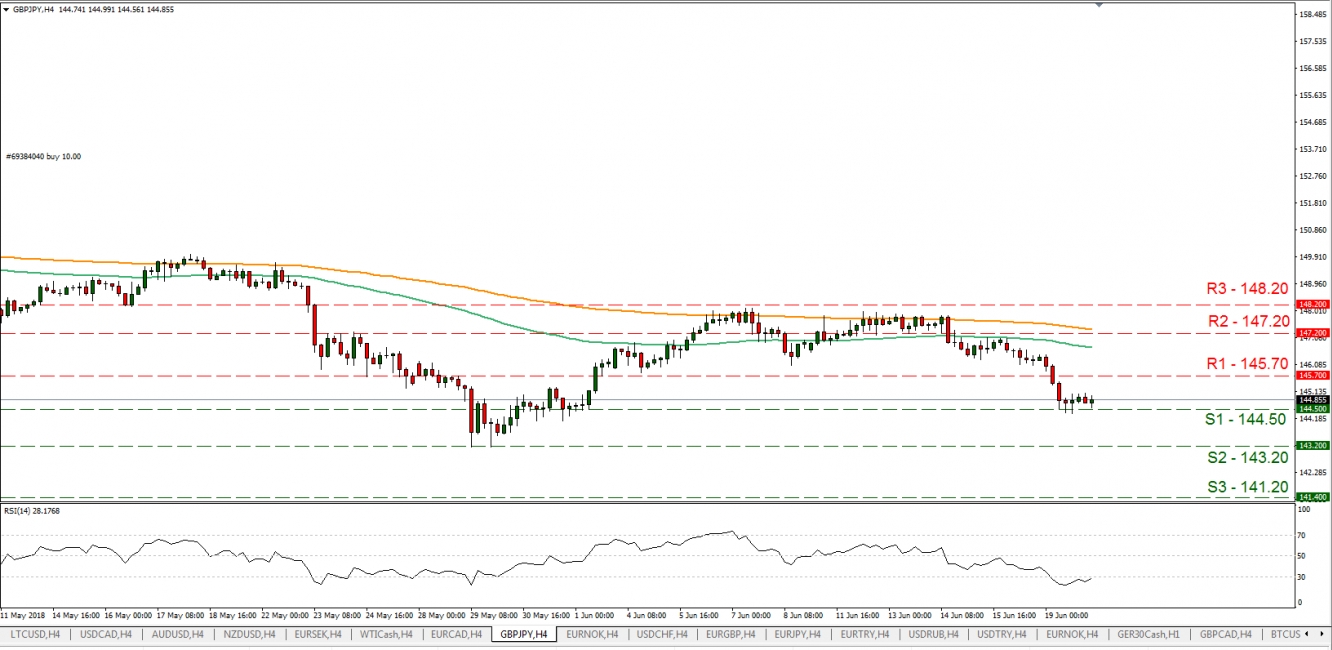

·Support: 144.50(S1), 143.20(S2), 141.20(S3)

·Resistance: 145.70(R1), 147.20(R2), 148.20(R3)

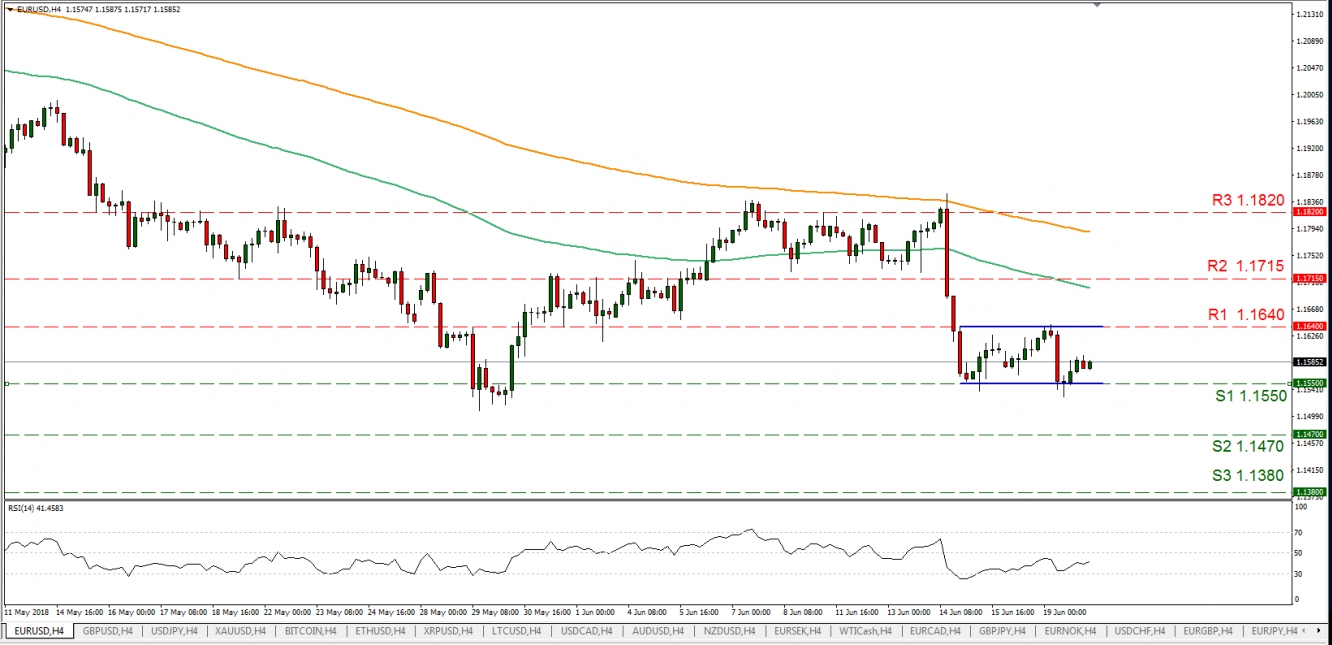

EUR/USD

·Support: 1.1550(S1), 1.1470(S2), 1.1380(S3)

·Resistance: 1.1640(R1), 1.1715(R2), 1.1820(R3)