Gold and silver prices surged on Friday on market hopes of a “breakthrough moment” in the eurozone debt crisis, following the conclusion of the latest European Council meeting in Brussels. Though the European Union is taking concrete steps to move the eurozone towards a banking union – with the new $634 billion European Stability Mechanism to be up and running shortly, which will supply funding for bank rescues – EU leaders are still stalling on the question of “Eurobonds” and other moves towards full fiscal union.

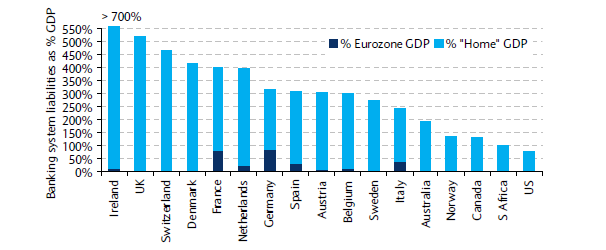

The bank plans still needs to be approved by national parliaments. On top of this, the Spanish bank bailout is expected to cost $125bn, while over at the Washington Post Brad Plumer speculates that Italian banks could end up claiming as much as $200bn from the fund. As the following chart from his article illustrates, Europe’s problem – among others – is that its banking sector remains enormous as a proportion of the continent’s GDP.

Irish bank liabilities alone amount to around $1.74 trillion, so it’s not hard to see why the ESM could prove insufficient to the task of rescuing the eurozone. And given that Germany remains adamant that no more German money will be given to the fund – though as we’ve found out over the last few years, “no” often means “maybe” as far as Angela Merkel in concerned – we could very soon be back to that familiar sense of eurozone desperation.

This all comes back to the easily understood point that central-bank money printing is the only thing than can save Europe’s banking system, and by extension, European governments. “Happily” for the UK, it looks like the Bank of England is about to oblige, with another £50bn of quantitative easing expected this week. More will follow in the months and years ahead.

Silver gained more than 5% on Friday finishing just above $27.50, while gold was up 3.5%, settling just north of $1,600. Both have slipped a little in trading this morning, however, and given that less has changed in Europe than many had been expecting, the metals may continue to struggle in the short-term.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Polski

- Português (Portugal)

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

EU Bank Moves Lift Precious Metals

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.