Investing.com’s stocks of the week

Etsy Inc (NASDAQ:ETSY) has been quiet on the charts in recent weeks, per the stock's 30-day historical volatility of 31.2%, which registers in the low 11th annual percentile. However, ETSY shares tend to make big moves after the online retailer reports earnings, and with the Amazon (NASDAQ:AMZN) rival's results due after the close this Wednesday, May 8, the options market is pricing in a major swing for Thursday's trading.

At last check, Trade-Alert pegged Etsy's implied earnings deviation at 16.3%, wider than the 11.1% next-day moving the stock has averaged over the past two years. Five of these eight earnings reactions have been positive, with three being large enough to match or exceed what the options market is expecting this time around (a 16.3% surge in February, a 23.7% rally in November, and a 20.4% pop in February 2018).

Amid relatively light absolute volume, options traders have been positioning for a move to the upside for Etsy stock. At the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), the security's 10-day call/put volume ratio of 3.52 ranks in the 68th annual percentile, meaning the rate of call buying relative to put buying has been quicker than usual.

It's possible some of this activity may be at the hands of short sellers hedging against another post-earnings jump. The 8.81 million ETSY shares currently sold short represents a healthy 8.6% of the equity's available float or 5.1 times the average daily pace of trading. This high level of skepticism could create tailwinds for Etsy on a continued move higher.

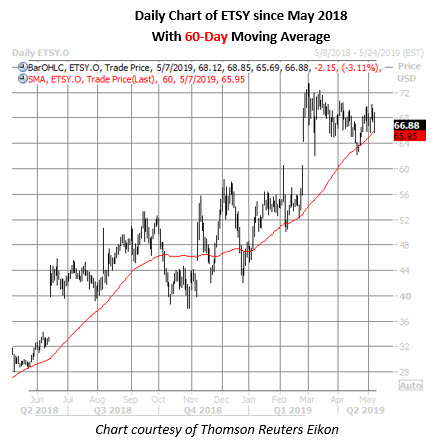

Looking closer at the charts, ETSY shares have more than doubled on a year-over-year basis, and are up 40.5% year-to-date. And while the stock is down 3.1% today to trade at $66.88 amid stiff broad-market headwinds, the selling has stalled out near $66 -- a level that's served as steady support since that late-February post-earnings bull gap and is currently home to the equity's 60-day moving average.