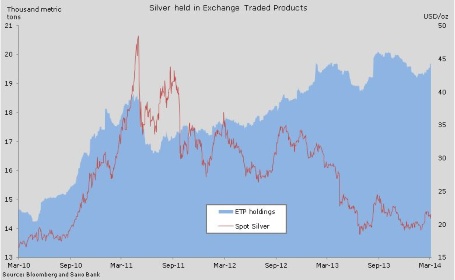

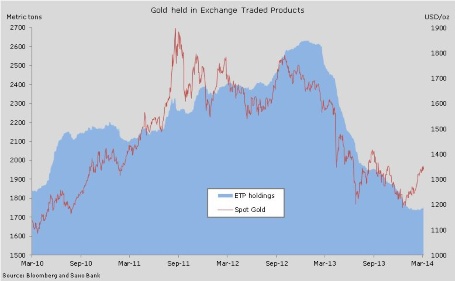

Holdings in exchange traded products backed by physical gold rose by 8.1 tonnes last week in the first back to back weekly increase since last August. Silver holdings rose again and almost 400 tonnes have been added to total holdings during the past four weeks. Key drivers last week sent mixed signals to the precious metals market and as a result the net change over the week was relatively small considering the amount of important news traders had to deal with.

Gold has rallied by more than 11 percent year-to-date but so far the total holdings in ETP's are down by 9 tonnes despite the first back-to-back weekly increase since last August. Support for gold last week was provided by fear over a potentially escalating Russo—Ukraine conflict, as well as a weaker dollar . However, against this we saw weaker Asian demand combined with a stronger than expected US jobs report which helped push already rising bond yields up by almost 20 basis points during the course of the week. Speculative net-long positions in the futures market rose to a December 2012 high but it is primarily being driven by short-covering, which continues to leave the metal exposed to a correction.

Near-term the yellow metal remain range-bound between USD 1,300/oz and USD 1,360/oz with support being represented by the 200-day moving average. This level, when broken to the upside recently, triggered an increased amount of buying which now will leave it vulnerable on a break back below.

Silver holdings rose despite the negative news coming from the industrial metal sector where copper slid to a seven-month low.