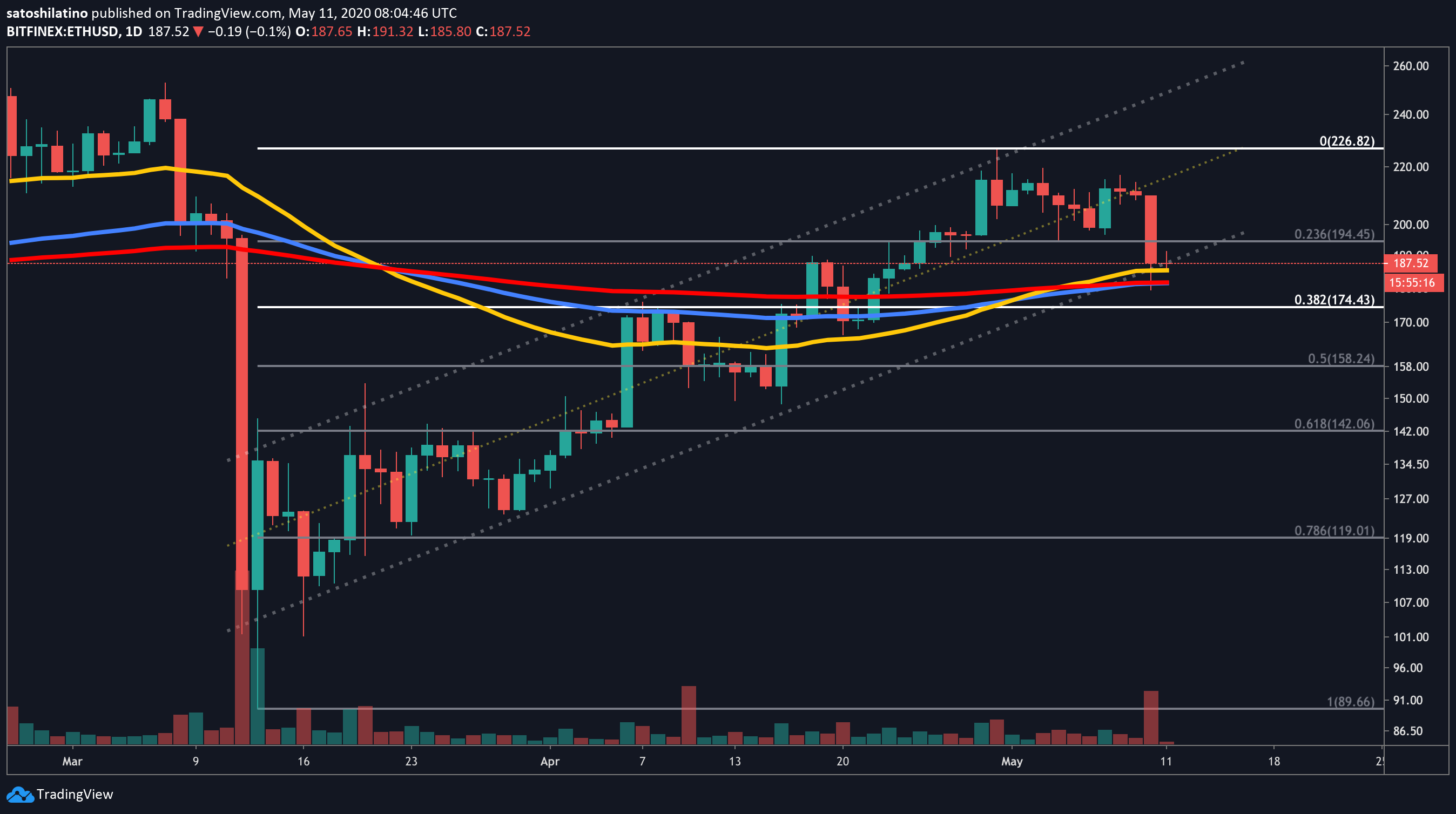

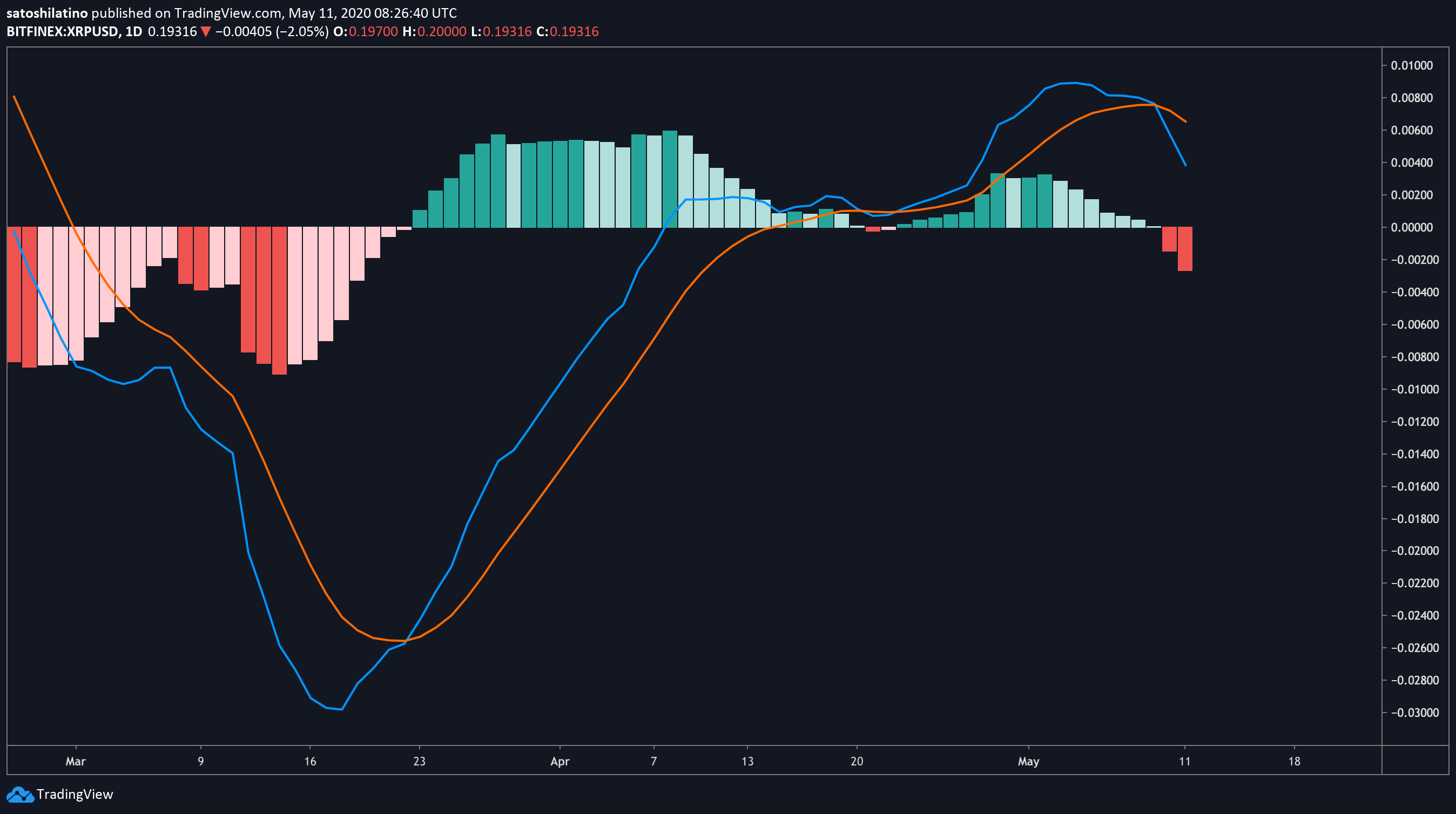

Following a massive retracement over the weekend, the cryptocurrency market appears to consolidate as it waits for volatility to strike back. With Bitcoin’s halving just a few hours away, the cryptocurrency market appears to have entered a stagnation phase. Ethereum, XRP, and Litecoin are currently held by critical support levels that will determine where they are headed next. Ether’s price action appears to be contained within an ascending parallel channel that developed on its daily chart since the March crypto market free-fall. Each time ETH rises to the upper boundary of this channel, it retraces down to hit the lower boundary, and from this point, it bounces back up again. This is consistent with the characteristics of a channel. Under this premise, the Apr. 30 high of $227 represented a retest of the top of the channel. This resistance barrier prevented ETH from further advance as it has tested this high over the past three months. Subsequently, resulting in a pullback to the bottom of the channel, which coincides with the downward impulse seen over the weekend. If the ascending parallel channel continues to hold, it is reasonable to expect a bounce back to the middle or upper boundary of this technical pattern. Such a bullish outlook seems very likely considering the strength that the lower boundary of the channel has shown. Alongside this barrier sit the 50-, 100-, and 200-day exponential moving averages, which provide an extra layer of support. Therefore, a spike in demand from the current price levels could see Ethereum climbing to the middle or the top of the channel once again. These resistance walls sit at $227 and $250, respectively. An increase in the selling pressure behind Ethereum can still jeopardize such an optimistic scenario. If this were to happen, a key level of support to watch out for is the 38.2% Fibonacci retracement level that is located around $174. A daily candlestick close below the aforementioned support barrier could be catastrophic for Ethereum as it increases the odds for a steeper decline towards $142 or even $119. Crypto Briefing has repeatedly warned investors about the strength of XRP’s 100- and 200-day moving averages. As predicted, this supply zone was able to reject Ripple’s token from posting more gains. Consequently, putting a stop to the bullish momentum seen in late April. Now, the cross-border remittances token has dropped to try to find support around its 50-day moving average. This support level appears to be holding steady, but may be weakening. Indeed, the moving average convergence divergence, or “MACD,” recently turned bearish within the same timeframe. This technical indicator follows the path of a trend and calculates its momentum. As the 12-day exponential moving average moved below the 26-day exponential moving average, the odds for a further decline increased. Like Ether, the 38.2% Fibonacci retracement level is also key to XRP’s trend. A spike in sell orders that allows the international settlements coin to close below the support area ahead may trigger panic among investors. Such a bearish impulse would likely see XRP crash to $0.14 or even make a new yearly low as trading veteran Peter Brandt estimated. Nonetheless, XRP may continue to consolidate around the current price level, which could see a sudden rise in demand. If so, an increase in the buying pressure behind this cryptocurrency might allow it to bounce back to the 100- or 200-day moving averages and retest their resistance. The 100-day exponential moving average has proven to be a major resistance wall impeding bulls from taking control of Litecoin’s price action. On eight different occasions over the past two weeks, this barrier was contained LTC from advancing further up. The most recent rejection from this resistance level was so significant that it flipped the parabolic stop and reverse, or “SAR,” on the 1-day chart. Every time the stop and reversal points move above the price of an asset, it is considered to be a negative sign. The recent parabolic SAR flip estimates that the direction of Litecoin’s trend changed from bullish to bearish. The TD sequential indicator within the same time frame adds credence to the pessimistic outlook. This technical index presented a sell signal the moment the current red two candlestick began trading below the close of the preceding red one candlestick. Due to the strength of the setup trendline and the 100-day exponential moving average, the range between these support and resistance levels is a reasonable no-trade zone. A daily candlestick close below $40 or above $48 will determine where Litecoin is headed next. Regardless of the popular belief that Bitcoin’s halving is the catalyst for a full-blown bull market, data shows that in the short-term that might not necessarily be the case. In a recent report, OKEx analyzed how Bitcoin and other altcoins behaved before and after their respective halvings. The Malta-based cryptocurrency exchange concluded that this event usually turns into a “buy the rumor, sell news” scheme. Smart investors usually “long before halving, short on the halving date, and unwind the final position three days after halving,” according to the report. The exchange added: “The theory behind it is that due to the heated discussion and news on halving, the demand for that coin will increase prior to the event; but as the news dies down after it halves, the buying pressure is gone and the coin price would drop,” said OKEx. Under this premise, one could argue that the cryptocurrency market is poised for a steeper decline. Thus, it is very important to pay close attention to the support levels mentioned in this analysis. Waiting for confirmation is one of the best ways to avoid getting caught on the wrong side of the trend.Key Takeaways

Ethereum Sits on Top of Massive Support Wall

XRP’s Technical Index Turns Bearish

Litecoin Is in a No-Trade Zone

Moving Forward: Ethereum, XRP, and Litecoin

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Ethereum, XRP And Litecoin Prices Await Bitcoin’s Halving

Published 05/11/2020, 07:23 AM

Ethereum, XRP And Litecoin Prices Await Bitcoin’s Halving

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.