Ethereum has been an outperformer this week in the crypto space, after breaking out of a bullish wedge. Week to date, Ethereum (ETH) has rallied over 17 whilst a tailgating Ripple (XRP) is hot on its heels, both of which have left Bitcoin (BTC) for dust which traders -0.3% lower. Yesterday it was announced that Aztec, a company focussed on privacy-centric tools, has begun a 30-day ignition ceremony to roll out its workaround for “private transactions” on ETH, which appears to have helped it break above 203.95 resistance.

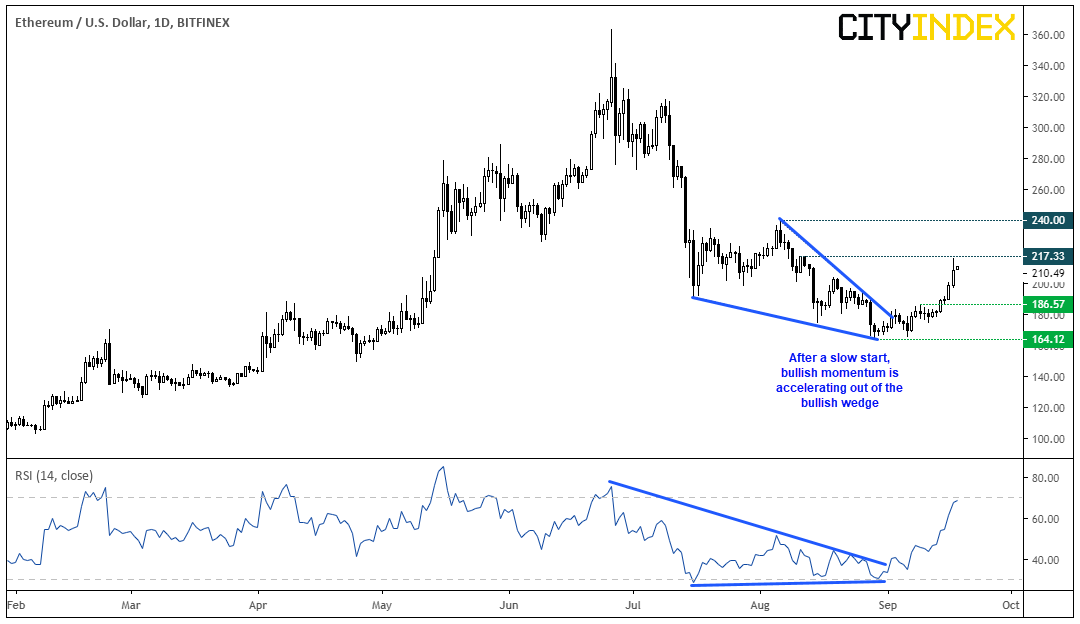

We can see on the daily chart that ETH produced a slight bullish divergence with RSI while its bullish wedge took shape. After a lacklustre breakout, it appeared the pattern was on the brink of failure, yet prices held above the 164.12 low before building up bullish momentum ahead of the trend’s acceleration. RSI has not reached overbought territory on the daily chart. And besides, a momentum high does not always mean a price high (as we need to allow for a divergence to form).

With the bullish wedge now in play, bulls could target the $240 high at the base of the wedge.