The world’s number-two cryptocurrency, Ethereum, has had trouble recapturing and holding the key $200 level and the longer it stays below that mark, the greater the chance of a big pullback.

Since hitting an all-time high of just under $400 back on June 13, Ethereum has been in steep decline. Unlike its counterpart, Bitcoin, which recovered considerably from the recent blockchain rift-fueled dip, ETH continues to make a series of lower highs.

From a technical standpoint, this is very bad news for Ethereum investors. News BTC has an in-depth look at the struggling technicals:

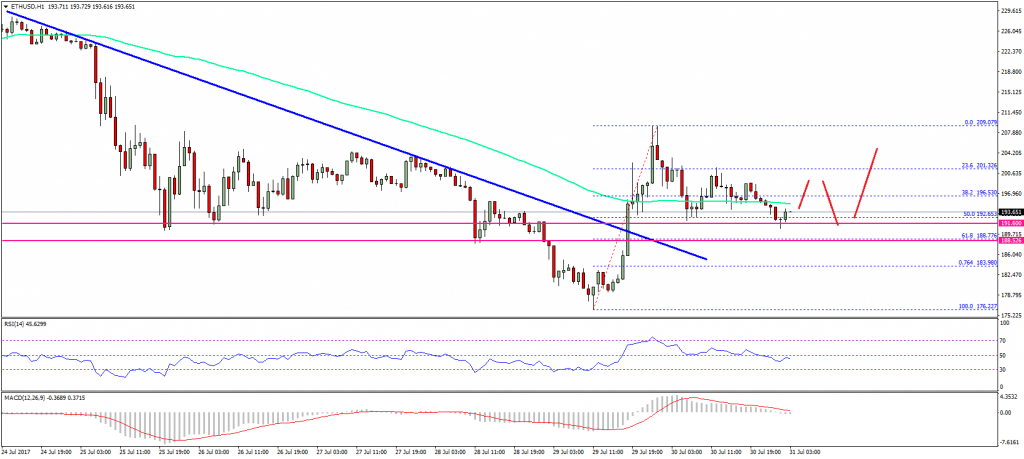

There was a recovery wave started from the $176 level in ETH price against the US Dollar. The price managed to move above the $172 resistance and the 23.6% Fib retracement level of the last decline from the $218 high to $176 low. There was even an upside break above the $192-200 resistance. The price traded above the 100 hourly simple moving average and as high as $209. There was even a break above a bearish trend line at $188 on the hourly chart of ETH/USD.

Later, buyers lost momentum and the price moved back below $200 and the 100 hourly simple moving average. The price traded below the 23.6% Fib retracement level of the last wave from the $176 low to $209 high. However, the downside move was protected by the $192-190 support. The 50% Fib retracement level of the last wave from the $176 low to $209 high also stopped the downside move. The price is currently attempting a bounce back, but struggling to clear the 100 hourly simple moving average and $200.

Simply put, we need to see ETH close above $200 to see any more gains in the near term. If we get that, the next technical target is $209, then $218.

However, if Ethereum can’t put together a decent rally soon, downside targets are at the $140 and $135 levels. Below that, the next stop is $100.

Ethereum was trading at $193.35 on Monday morning, down 2.05% on the day.