- Cryptocurrency markets have experienced a downturn post-Bitcoin halving, marked by lower trading volumes.

- Ethereum and Solana are struggling to break key resistance levels at $3,200 and $150, respectively.

- XRP remains volatile amid the ongoing legal battle with the SEC, facing hurdles at $0.52-$0.55 range.

- Invest like the big funds for less than $9 a month with our AI-powered ProPicks stock selection tool. Learn more here>>

Despite a brief upward swing following last week's Bitcoin halving, cryptocurrency markets have dipped in the second half of the week. Lower trading volumes are characteristic of the post-halving period.

Among major altcoins, Ethereum has attempted a comeback, nearing the $3,200 mark, but a clear reversal hasn't materialized yet.

Solana faces a similar situation, battling to break above $150. XRP remains particularly volatile as the ongoing SEC lawsuit against Ripple heats up.

1. Ethereum Eyes Breakout After Correction

Ethereum's decline took a breather last week, finding support near $3,000. During the April 13-19 trading sessions, the daily chart suggests buying activity (reaction purchases) emerged around the $2,920 zone.

This coincides with the Fibonacci 0.618 retracement level of the Q1 rally, hinting that the recent correction might be over.

However, ETH's week-long uptrend has struggled to overcome the $3,200 resistance due to low trading volume. In the past 24 hours, selling pressure has intensified, with $3,150 acting as a key hurdle.

Analysts warn that a daily close below $3,150 could signal a continuation of the downtrend. A potential weekly close under $2,920 could open the door for a further slide towards $2,600.

Conversely, a surge in buying volume that pushes ETH above $3,150 would be a significant breakout. This would signify an end to the downtrend that began in March and could pave the way for a return to the $3,600-$3,800 zone in the short term.

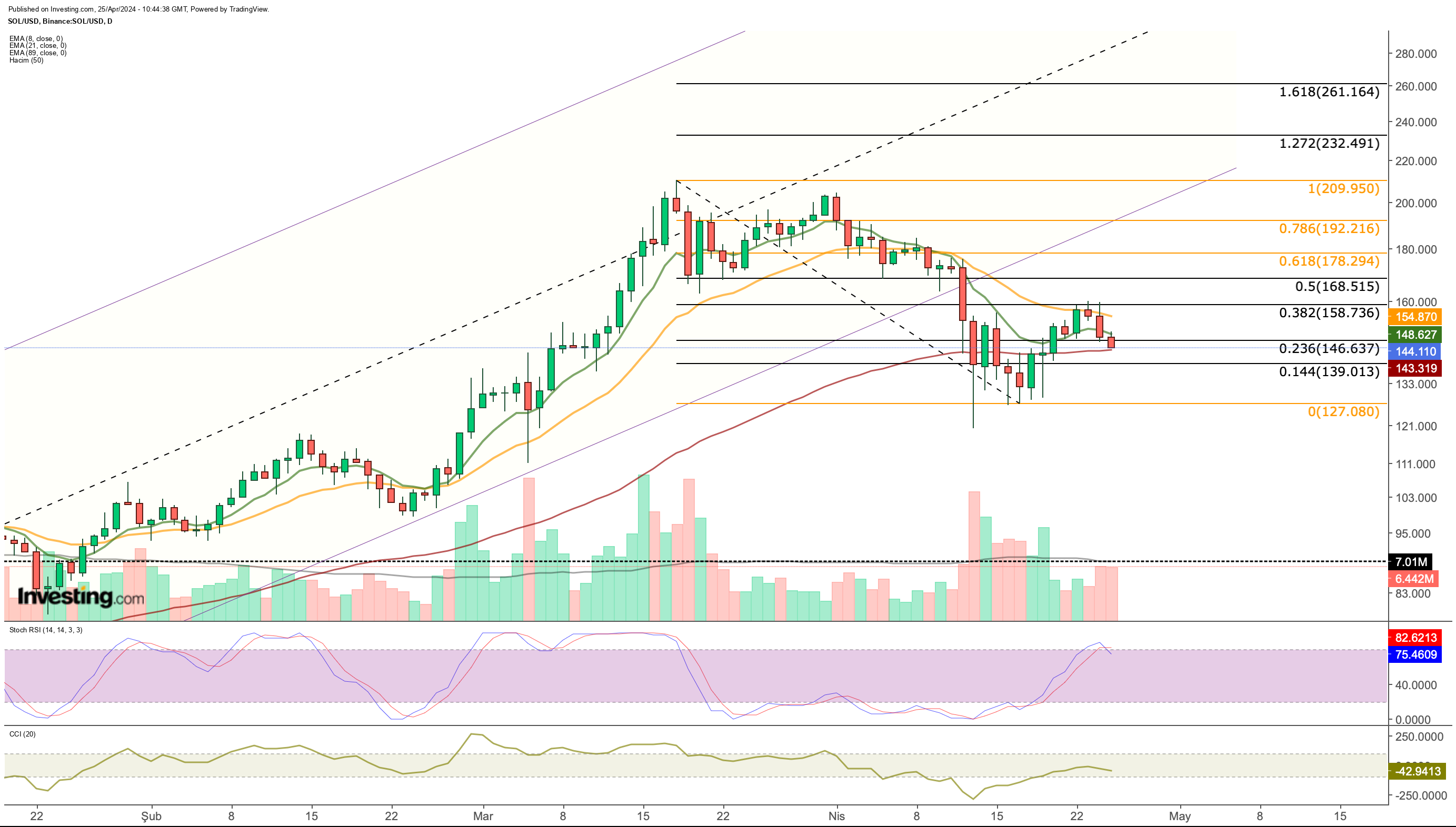

2. Solana Breaks Support, Faces Downward Pressure

Solana started April on a concerning note, breaking below the ascending channel it had followed since October 2023. This downward breakout came with significant trading volume, pushing SOL to an average price of $127 last week.

The recent price movement suggests a corrective phase for SOL. While the token has attempted a recovery since last week, it remains capped at an average of $158.

This week, the $139-$143 range becomes crucial support for SOL. Failure to hold this level could see SOL experience a significant decline, potentially dropping below $100 as the downward trend strengthens.

Daily closes above $160 are essential to confirm a reversal of the downtrend. As long as SOL remains below this price point, selling pressure could push it further down.

Maintaining an average of $140 would also be a positive sign, potentially slowing the decline.

On the upside, if SOL can establish a solid foundation at $160, the next potential targets could be the $180-$190 range.

3. XRP Faces Volatility as Legal Battle Heats Up

XRP's price has been on a rollercoaster ride this week, reflecting the ongoing legal battle between Ripple and the SEC. The market reacted negatively to Ripple's recent rejection of the SEC's proposed fine, halting the recovery XRP experienced last week.

From a technical perspective, XRP dipped below its long-term upward channel earlier this month. While there were attempts to return to the channel last week, a significant resistance level emerged around $0.55, hindering further progress.

The long-term outlook for XRP presents another hurdle in the form of resistance at $0.52 (Fib 0.236). A weekly close above this crucial $0.52-$0.55 range is critical for XRP to reverse its current trend. Failure to do so could lead to a short-term decline towards the support level at $0.43 (Fib 0.144).

Looking ahead, with Ripple's response submitted and the SEC's defense still to come, the XRP market is likely to experience increased volatility in the coming months. The final court decision is expected to be a major factor influencing XRP's price as we approach summer.

***

Take your investing game to the next level in 2024 with ProPicks

Institutions and billionaire investors worldwide are already well ahead of the game when it comes to AI-powered investing, extensively using, customizing, and developing it to bulk up their returns and minimize losses.

Now, InvestingPro users can do just the same from the comfort of their own homes with our new flagship AI-powered stock-picking tool: ProPicks.

With our six strategies, including the flagship "Tech Titans," which outperformed the market by a lofty 1,745% over the last decade, investors have the best selection of stocks in the market at the tip of their fingers every month.

Subscribe here and never miss a bull market again!

Disclaimer: This content, which is prepared purely for educational purposes, cannot be considered as investment advice. We also do not provide investment advisory services.