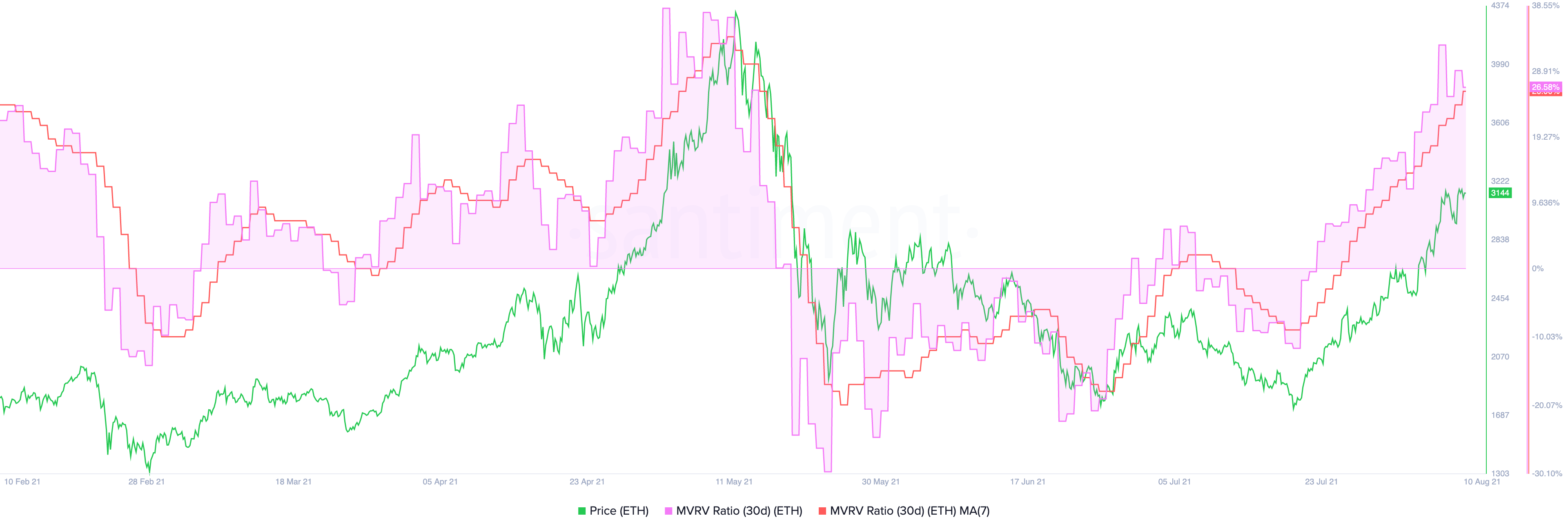

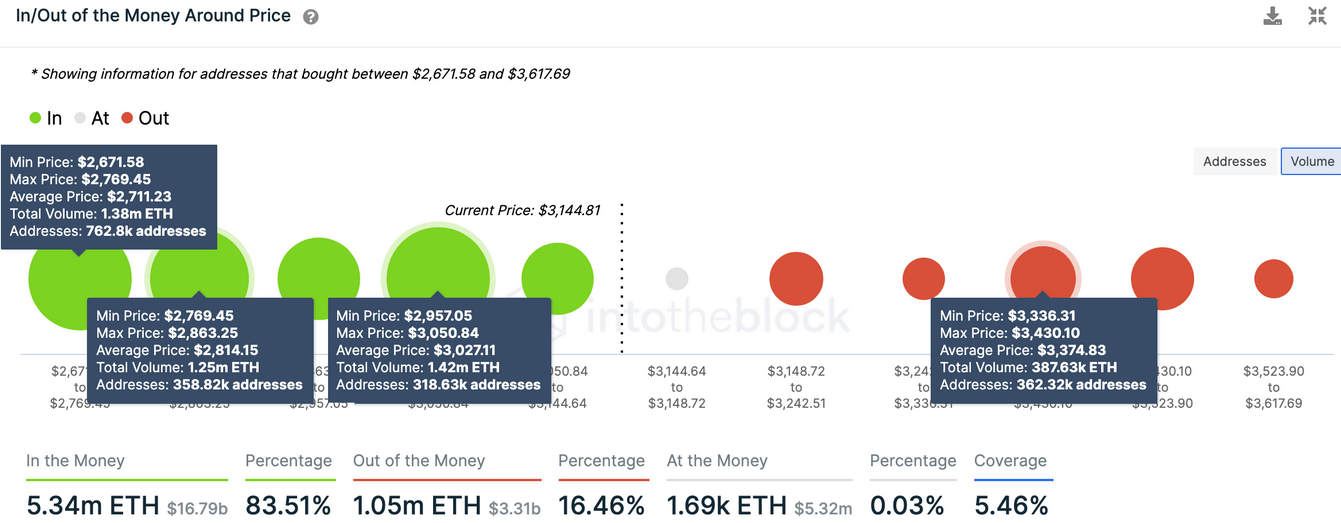

Ethereum has rallied hard over the last couple of weeks, but it could be due for a retrace. Market participants have rushed to buy ETH following Ethereum’s much-anticipated London hardfork. Although prices have risen due to the growing demand, some technical and on-chain metrics suggest that a spike in profit-taking is underway. Despite the bullish momentum, Ethereum could be facing an imminent correction. ETH has enjoyed an impressive run-up after breaking out of a descending triangle on July 22. Since then, the second-largest cryptocurrency by market cap has surged by nearly 60% to reach a high of $3,200. Now that the projected target has been met, multiple red flags are beginning to pop up. The Tom DeMark (TD) Sequential indicator has presented a sell signal on ETH’s daily chart. The bearish formation developed as a green nine candlestick, anticipating a one to four daily candlesticks correction or the beginning of a new downward countdown. Ethereum’s Market Value to Realized Value or MVRV adds credence to the pessimistic outlook. This on-chain metric quantifies the average profit or loss of all addresses that have purchased ETH within a specific period. The 30-day MVRV ratio is currently hovering at 26.58%, suggesting that all addresses that have bought ETH in the past 30 days sit at an average profit of 26.58%. According to behavior analytics platform Santiment, the higher the MVRV ratio, “the higher the risk that Ethereum holders will begin to sell and reduce their exposure.” Given the significant unrealized profits among ETH holders, Ethereum is currently in a danger zone. Historical trends indicate that a spike in profit-taking may be underway, translating into a short-term correction. IntoTheBlock’s In/Out of the Money Around Price (IOMAP) model reveals that Ethereum is sitting on top of multiple demand barriers that could prevent it from a sudden downswing. The first significant interest area is between $2,960 and $3,050, where nearly 320,000 addresses have previously purchased over 1.4 million ETH. The second and most crucial support barrier lies between $2,670 and $2,860. Around this price point, more than 1.12 million addresses have acquired 2.63 million ETH. Such a critical support wall suggests that a spike in selling pressure could be short-lived as the bears may struggle to push prices down. On the other hand, the IOMAP model shows no supply barrier will prevent the second-largest cryptocurrency by market cap from advancing further. There is only one area of interest between $3,340 and $3,430, where over 360,000 addresses are holding nearly 390,000 ETH. This supply zone may have the ability to absorb some of the recent buying pressure, but if ETH can slice through this hurdle, it could climb to $3,500.Key Takeaways

Sell Signals Appear for Ethereum

Ethereum Sits On Top Of Stable Support

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Ethereum Shows Red Flags Following 60% Rally

Published 08/10/2021, 07:42 AM

Ethereum Shows Red Flags Following 60% Rally

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.