On January 15, 2019, Ethereum (ETH) developers formally announced the delay of the Constantinople hard fork.

The hard fork was supposed to take place at block 7,080,000 and was expected to occur sometime between January 16 and 17. It has since been rescheduled until block 7,280,000 — which is expected to occur in late February.

In October 2018, a similar postponement of the Constantinople hard fork was announced. This postponement, however, differed from the current delay in several ways.

First, the delay proved a prediction false — but it did not delay a formally announced hard fork.

Secondly, the price of ETH rose during the five days after the announced October postponement — while price dropped during the five day period after the announcement of the more recent delay.

Initial Price Losses on January 15

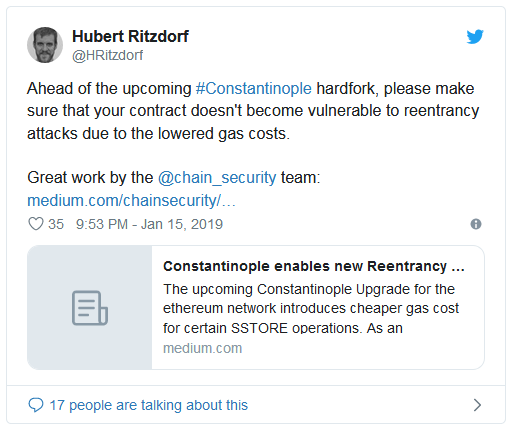

A potential security vulnerability was found within one of the expected updates by ChainSecurity not long before the hard fork. It was reported to the Ethereum Foundation (EF) at 3:09 AM Pacific Time (PT). Five hours later, the EF asked chain security to publicly disclose the vulnerability — which it did two minutes later (at 8:11 AM PT).

At 8:11 AM, the price of ETH opened at USD($)129.08 on Bitfinex. When the EF decided to delay the fork at 12:08 PM, the price had dropped to $128.23. Within 31 minutes, the price had dropped to $119.29, losing nearly 7 percent of its total value.

The price subsequently began to rise before facing a small dip. By the time the Ethereum Foundation announced the delay across its communication channels and social media accounts at 1:30 PM, the price of ETH had risen to $121.55 — a gain of just over 1.5 percent.

Shortly after, the price of ETH began to fall once again — reaching a low of $120.16 at 4:02 PM, before reversing its downward trend.

Five Day Losses

Over the next several five days, ETH experienced general volatility with several rises and dips. It climbed to a five day high of $132.36 during the early afternoon of January 19. Subsequently, ETH dropped in value — opening at $118.94 at 8:00 AM PT on January 20.

ETH lost nearly 8 percent of its total value during the five-day period between January 15 and 20. It dropped from $129.08 to $118.94.

October Postponement

The current delay is the second postponement of Constantinople’s release.

In mid-October 2018, Hudson Jameson of the EF predicted that Constantinople would be released on the ETH main net approximately one month after Devcon 4. This conference took place between October 30 and November 2 of last year. This meant that a release between late November and early December seemed reasonable.

The block at which the fork was expected to occur was never announced, however. With a definitive release lacking, Jameson appears to have been stating what he and the Ethereum Foundation hoped for. He did not state that a fork was to occur in 2018 — only that it was possible.

Between 6:00 and 7:00 AM PT on October 19, 2018, the biweekly Ethereum Core Develops meeting was live-streamed. Toward the end of the meeting, it was predicted that the Constantinople hard fork would likely not occur until 2019. Hudson’s prediction proved false.

A later prediction was announced by the team developing the fork. However, no formal delay was announced until early January 2019. The hard fork was formally announced to occur at block 7,080,000. Block 7,080,000 was successfully reached on January 17. Because of the delay, the hard fork did not occur.

Five Day Price Fluctuations

Within twelve hours of the predicted postponement on October 19, 2018, the price of ETH dropped by just under one percent. 24 hours later, ETH reached a high of $212 for the five-day period.

Over the next three and a half days, ETH decreased to $207.01. During the five-day period between October 19 and 24, ETH increased in value by about two-thirds of one percent.

Conclusion

Since the announced delay, ETH has announced a release date for Constantinople — likely in late February.

Currently, the fork is expected to occur at block 7,280,000 — hopefully with a solution to the vulnerability exposed by ChainSecurity.