Ethereum remains stagnant within a tight price range, while the number of new addresses on the network appears to be increasing.

Key Takeaways

- Ethereum continues to consolidate between $2,500 and $3,000.

- The number of new daily Ethereum addresses joining the network appears to be increasing.

- A sustained uptrend in the number of new addresses could see prices test the $3,100 resistance.

The Ethereum network appears to be gaining the activity it needs for a price recovery. Still, Ethereum is yet to see a steady increase in new addresses to support the bullish narrarive.

Ethereum Consolidates Ahead of the Merge

Ethereum is stuck within a tight price range between $2,500 and $3,000, with little indication of where it is heading next.

The second-largest cryptocurrency by market cap remains stagnant while the activity on its network continues to slow down. Network growth is often considered one of the most accurate price predictors. Generally, a steady decline in the number of new addresses created on a given blockchain leads to falling prices over time and vice versa.

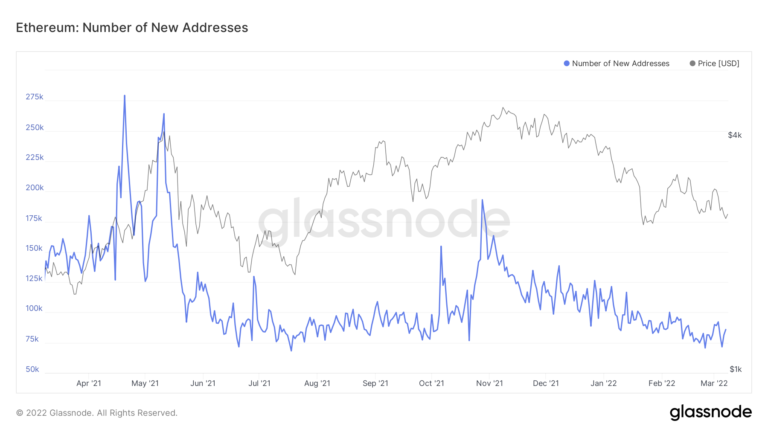

On-chain data from Glassnode shows that the number of new daily Ethereum addresses joining the network has sharply declined since prices peaked in November 2021. The number of new addresses hit a high of 193,000 on Oct. 28, 2021, and posted a low of 70,600 on Feb. 24.

Although the number of new daily addresses created appears to be recovering as it hovers at around 86,000 addresses at press time, there is no still clear trend reversal. A higher high of 93,000 new addresses joining the network per day could signal the beginning of a new uptrend.

While speculation around Ethereum’s upcoming switch to Proof-of-Stake consensus, otherwise known as “the merge,” could help ETH rally, a new uptrend would only likely be supported by a spike in network growth. The merge is expected to ship in Q2 but the launch date is still to be confirmed.

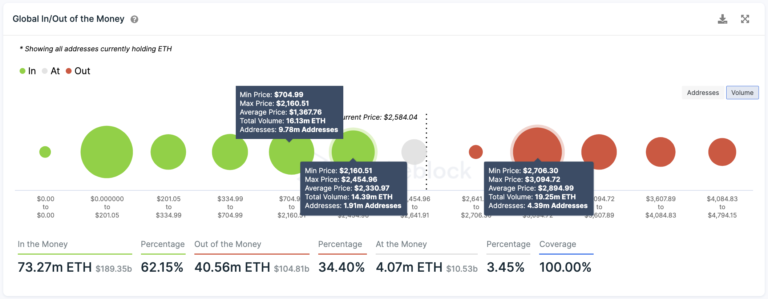

If prices increased ahead of Ethereum’s long-awaited protocol upgrade, transaction history shows that the most significant concentration of ETH was acquired at an average price of $3,100. According to IntoTheBlock’s Global In/Out of the Money model, roughly 4.4 million addresses have previously purchased 19.25 million ETH around this price level.

Only a decisive daily candlestick close above the large supply wall at $3,100 is likely to lead to the resumption of the uptrend.

It is worth noting that the $2,160 support level is currently acting as a strong foothold that could prevent ETH from incurring further losses. Although it is reasonable to believe that it will hold above this price point, any signs of weakness at $2,160 could result in a correction to $1,800 or even $1,400 to form a market bottom.