Ethereum leads the way as Web3 developer interest and activities remain strong despite the onset of this crypto winter.

Despite the ensuing bear market exacerbated by the TerraUSD implosion, Celsius’ bankruptcy, and Three Arrow liquidation, web3 developers’ interest remains strong, a new report has revealed. Telstra (OTC:TLSYY) Ventures, a data-focused venture capital firm, released the report titled “Blockchain Open-Source Developers Signal Strength of Web3 Community.”

The report examined developer activity on Solana, Ethereum, and Bitcoin blockchains by applying data science tools and methodologies. The data analysts analyzed 1,000 active organizations contributing to over 30,000 open source Web3 projects before concluding. The results highlighted that despite the crypto market downturn, developer interest and activities remained high and robust.

Web3 Contribution Continues Fast-Paced Growth

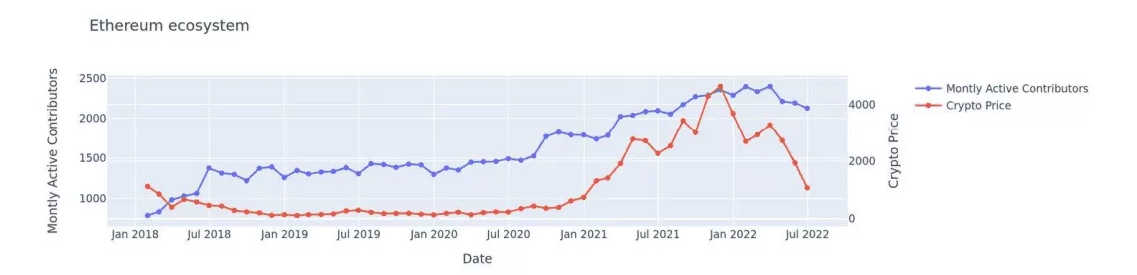

Of the three blockchains examined, the Ethereum network came out tops as having the biggest and most reliable community. Critical insight showed that its contributor community grew at a compound annual growth rate of 24.9% since January 1, 2018.

Source: Telstra Ventures Report

Furthermore, the investigation showed that since Ethereum’s price peak in November 2021, the number of monthly active contributors had a drawdown of 9.0%. The chart above shows that the number of monthly active users across the chain has grown steadily over the past four years before the current slump.

The report further cites increasing developer enthusiasm evidenced in ETH’s price rally ahead of the network’s upcoming merge. The update will see it transition from a proof-of-work(PoW) to a proof-of-stake(PoS) consensus mechanism, bringing further innovation to the network.

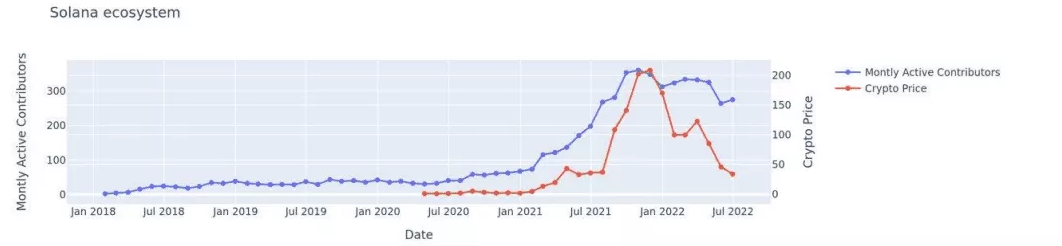

Source: Telstra Ventures Report

Meanwhile, the Solana developer community is the fastest growing amongst the three blockchains investigated. Established in late 2017, the contributors are growing at a 173.0% compound annual growth rate since January 1, 2018. However, its monthly active contributors have moved somewhat in tandem with its price, as seen in the chart above. Nonetheless, while SOL has dropped almost 75% from its November 2021 peak, the active contributors have declined by only 21%.

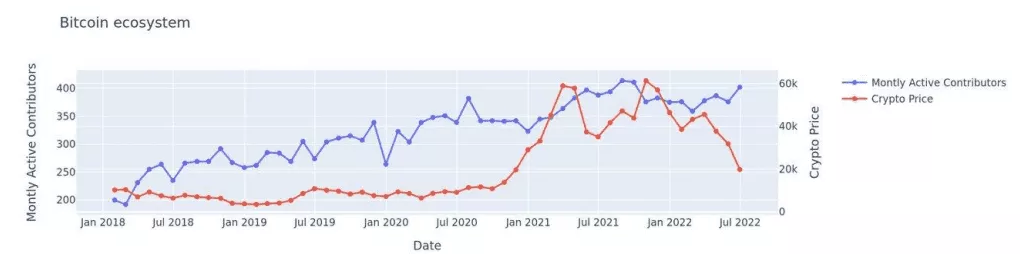

Source: Telstra Ventures Report

Finally, the Bitcoin network saw steady growth for its developer community over the past eight years. Meanwhile, it recorded a compound annual growth rate of 17.1% over the last four years. However, of the lot, it was the only ecosystem that saw an increase in developer count following the slump in BTC’s price from its $69,000 peak in November 2021. The shows that month active contributors grew by 8.2%

Further insight from the Telstra Ventures report showed that each of the three main ecosystems’ strong blockchain development is supported by institutional investors. Seven of the top ten fastest-growing projects are backed by venture capitalists or corporations. At the same time, institutional investors support at least four or more of the ten fastest-growing repositories in each ecosystem.

Methodology of the Research

To arrive at the results, the Telstra Ventures team analyzed 1,000 active organizations contributing to more than 30,000 open-source projects in the Web3 ecosystem. To be considered for the study, these projects needed at least 100 stars in relevant GitHub repositories with active contributions between January and April 2022.

Furthermore, monthly active contributors were tabulated at the repository level based on the total number of unique contributors per repository during a given month. Total unique contributions were calculated at the organizational level using the total unique contributors who made a monthly commitment to any organic repositories inside that company.

Following a good month of July, which saw the prices of digital assets rally, August has brought a slump in these cryptocurrencies. Yesterday, Bitcoin continued its 5-day streak of losses slumping by 1%. Ethereum, however, was able to arrest its downward slide, increasing by 1.4% to end its four days consecutive decline.

Meanwhile, other altcoins were not spared as they all saw their prices fall. Polkadot’s DOT token fell 3%, while Polygon’s MATIC and Chainlink’s LINK dropped 1.62% and 3.25%, respectively.