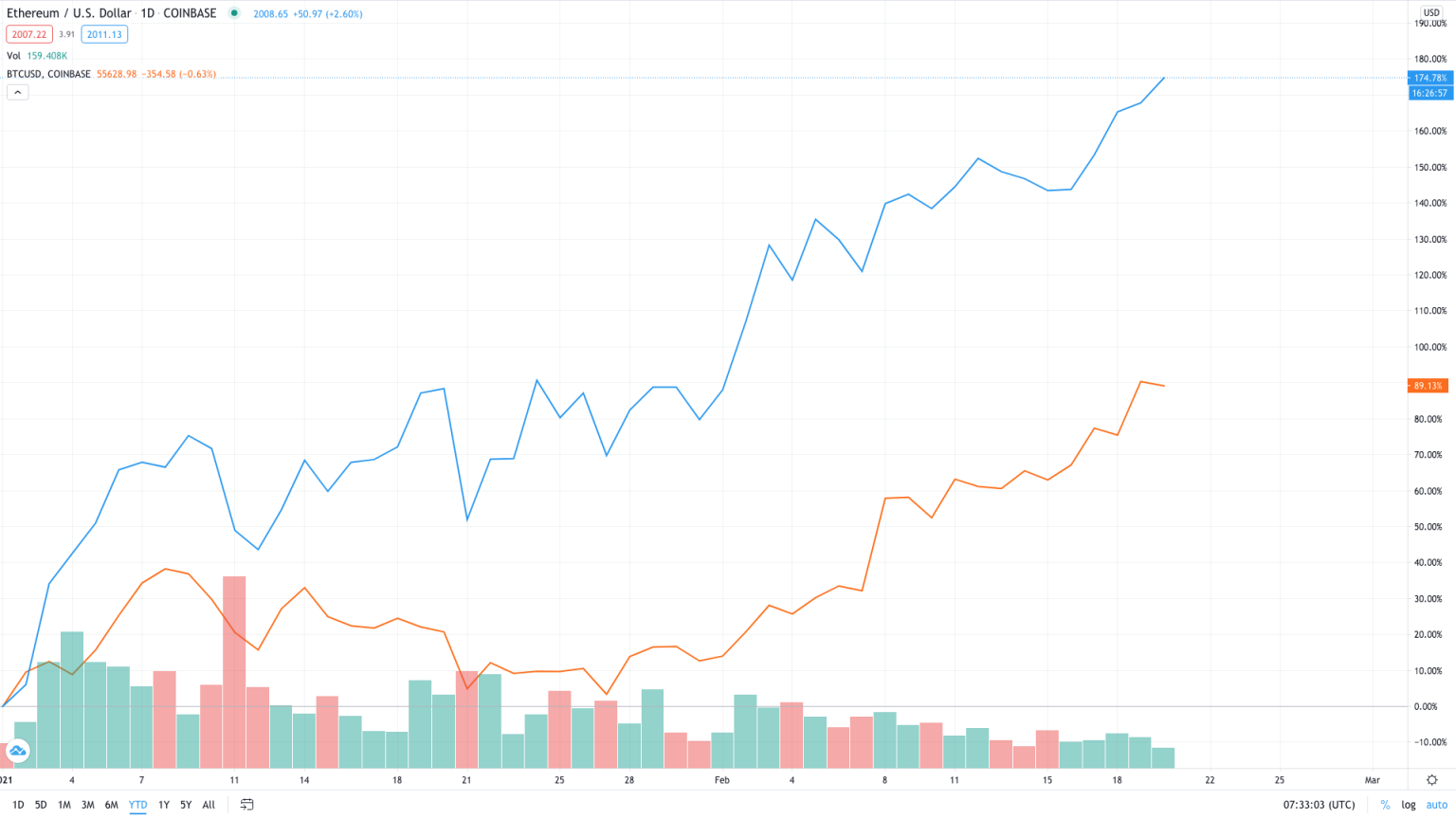

Ethereum's ascent continues. The second-ranked crypto just set a new all-time high above $2,000. Ethereum has broken a key psychological resistance barrier at $2,000. ETH has crossed $2,000 for the first time. It’s trading at $2,014 at the time of writing. The digital asset has experienced a violent rise in recent weeks. On Jan. 4, it crossed $1,000 amid a flurry of activity across the crypto markets. The run then intensified, with ETH touching $1,430 on Jan. 19, a record high at the time. ETH had previously topped out at $1,420 in January 2018, but it then suffered a heavy crash during a prolonged crypto bear market. It was trading as low as $80 less than a year later, a 94% drop. Along with Bitcoin, the second-ranked crypto asset has been hitting new all-time highs every few days throughout January and February. $2,000 is a key psychological resistance barrier for ETH, similar to BTC’s recent $50,000 milestone. The Bitcoin price run intensified back in December when it crossed $20,000 for the first time. The asset has seen a new level of mainstream attention over the last few months, helped by large companies like MicroStrategy (NASDAQ:MSTR) and Tesla (NASDAQ:TSLA) buying in. ETH often rallies when BTC does, so growing belief in BTC’s 'digital gold' value proposition has doubtless helped its run. ETH often outperforms BTC, however. It’s up roughly 175% year-to-date, while BTC is up 89%. Ethereum has also had various wins of its own recently. On Feb. 8, ETH futures launched on CME Group, the world’s largest derivatives exchange. The NFT space, which runs on top of Ethereum, has also enjoyed a boom this year. Several notable celebrities and musicians have piled into the craze, among them Mark Cuban, Logan Paul, and Soulja Boy. This week, iconic auction house Christie’s announced its plans to list an NFT by Beeple. They’ll accept ETH in the auction. DeFi, meanwhile, continues to grow. There’s over $43 billion locked in DeFi protocols today, according to DeFi Pulse. Despite competition from growing platforms like Polkadot, DeFi mostly centers around the Ethereum ecosystem today. One major Ethereum development on the horizon is the EIP-1559 update, which could drop by the end of 2021. Described as an ETH buyback mechanism by EIP-1559 Tim Beiko, the update will see gas fees get burned to reduce the supply of ETH. Ethereum’s market cap is now $232.8 billion.Key Takeaways

Ethereum on a Rally

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Polski

- Português (Portugal)

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Ethereum Crosses $2,000, Setting A New All-Time High

Published 02/21/2021, 01:14 AM

Ethereum Crosses $2,000, Setting A New All-Time High

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.