VAP Analysis confirms weak resistance volume zone ahead. Near-term support is precarious, caution should still be maintained.

Ethereum’s Volume Profile

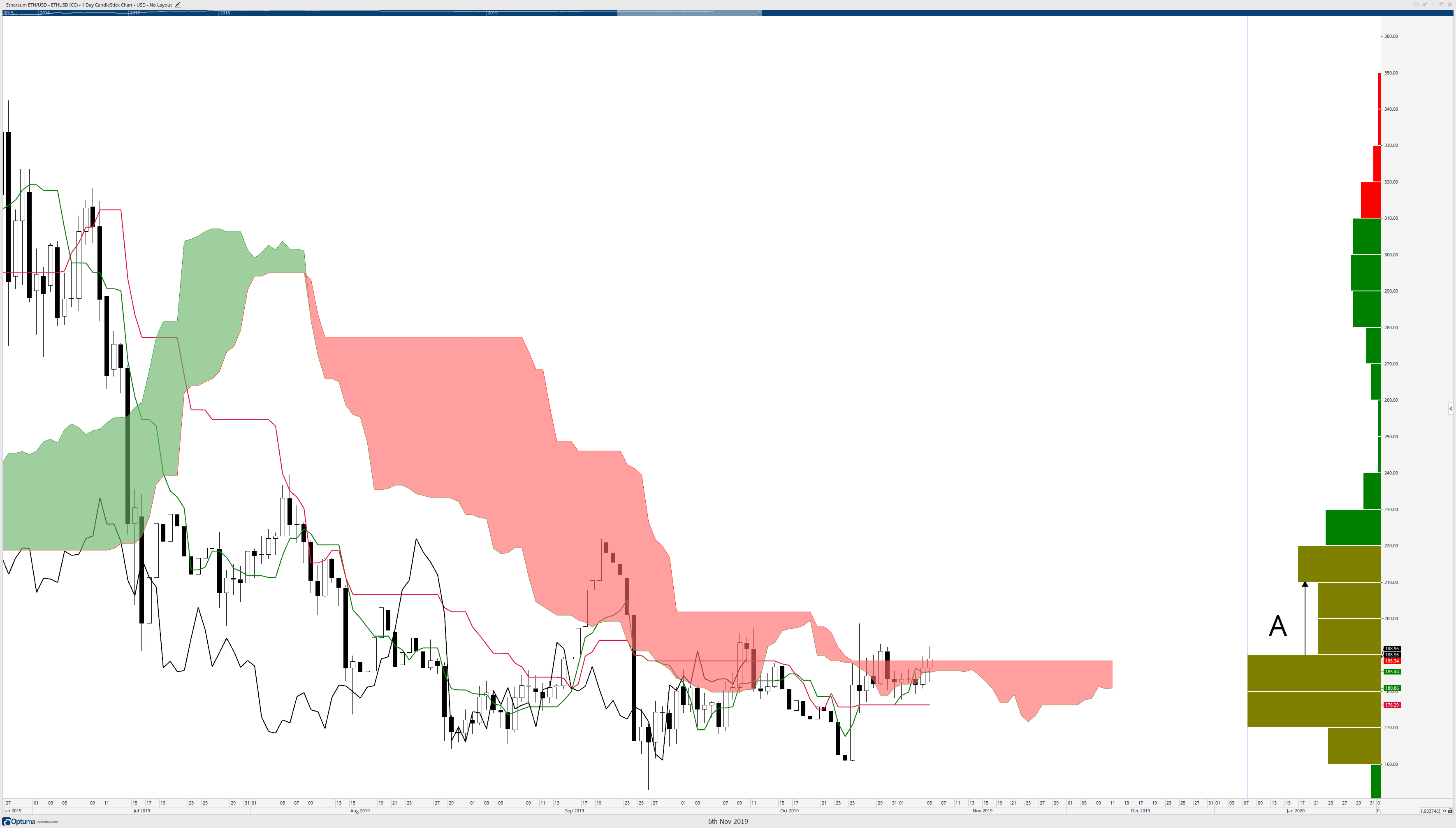

VAP (Volume-At-Price) Analysis provides a measurement of how much of something was traded at a particular price. These levels offer sturdy support and resistance levels. Areas where significant amounts of volume have traded, are called high volume nodes. Areas, where volume is vacant, is known as low volume nodes. The chart above is Ethereum’s daily chart beginning at the top of the 2019 market on June 27th, 2019. The highest volume node on this chart is between $170 and $190, with a near equal distribution of volume occurring in those price zones. The next high-volume node is within the same deviation (First Deviation, gold-colored bars) and is between $210 and $215. It is the area between the two high volume nodes that are of particular importance.

The letter A represents the price ranges between $190 and $210. Because this volume range is less than the high-volume node above and below, this area is known as a low volume node. I sometimes call them volume troughs. Where high volume nodes represent a source of equilibrium and strength – an agreement among bulls and bears of fair value – low volume nodes offer weakness. Trading with the Volume Profile has a particular strategy that involves identifying breaks above or below high-volume nodes. This is where low volume nodes become essential. When price breaks above a high-volume node and enters a low volume node, the low volume nodes act a sort of vacuum and suck price up or down towards the next high volume node. These kinds of moves are often met with little resistance and can result in flash crashes or flash spikes.

If Ethereum can breakout and close above the $190 value area on the daily chart, this will more than likely result in a flash spike towards $125. This move would be very complimentary to those who utilize the Ichimoku system. One of the last and principal conditions for any bullish breakout of the Cloud is when the Chikou Span moves and closes above the Cloud. All other conditions that exist in the Ichimoku system point to impending bullish terms for a long-term time frame. The Future Senkou Span A needs to cross above Future Senkou Span B along with the Chikou Span above the Cloud are the final two conditions for a new bull trend. But traders should be aware of the near term bearish conditions.

The chart above shows Ethereum’s weekly chart. The blue horizontal line at $147.50 represents the final breakdown level on Ethereum’s chart. As bullish as the condition on the daily chart is, the weekly chart shows how quickly and easily Ethereum could collapse. The ideal bearish breakout on an Ichimoku chart is much easier to accomplish on the weekly chart than a bullish breakout. If price moves down to $147, then two final nails in Ethereum’s bullish coffin will be complete. A move to $147 means both price and the Chikou span have broken below the cloud. But the Chikou Span will have move below the candlesticks and putting it into what is known as ‘open space.’ When the Chikou Span enters open space, this means that there is nothing keeping price from moving swiftly and easily lower. This would more than likely create a new bear trend for not just Ethereum, but the entire cryptocurrency market as a whole.