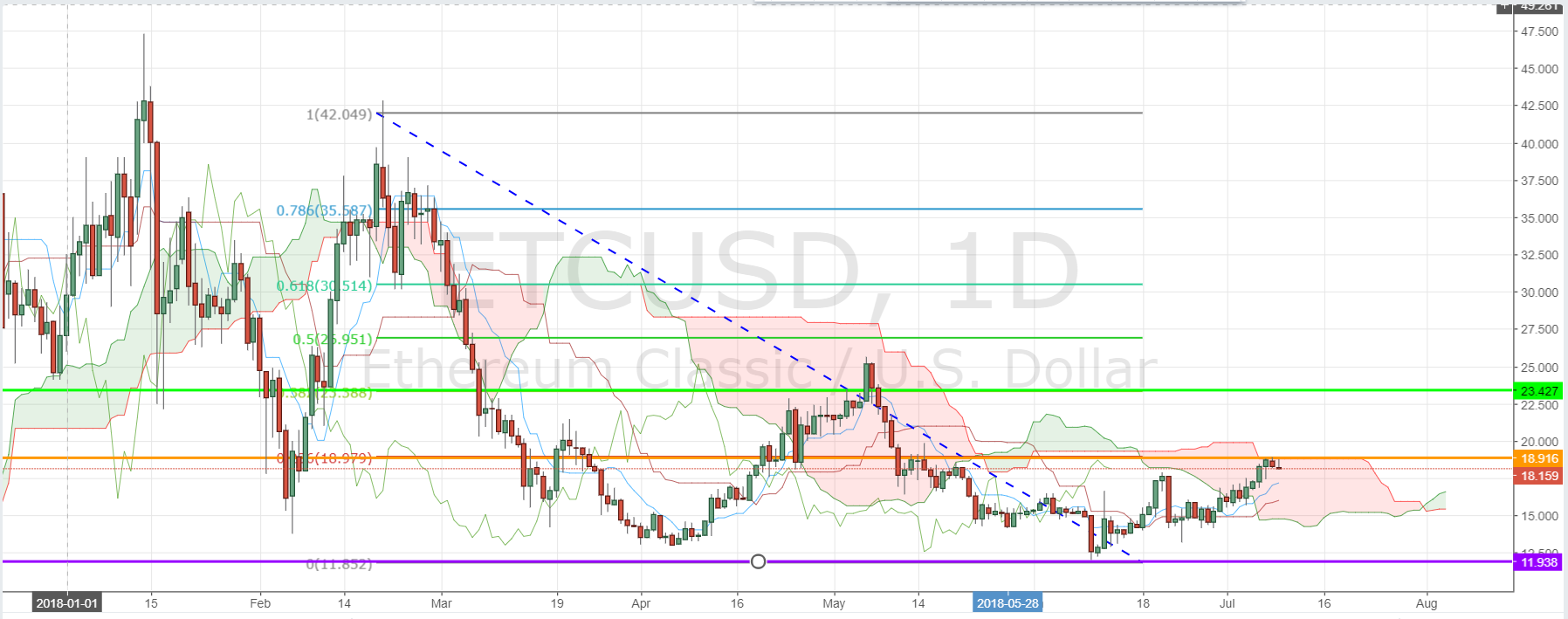

The last time we talked about Ethereum Classic (ETC) it was right after Coinbase exchange had announced its plans to add the cryptocurrency on its platform. One month later, and the token’s price has certainly picked up from June’s lows of around $12. But it appears to be stuck right below a key resistance level, which falls on the upper band of the daily Ichimoku Kinko Hyo’s cloud and the 23% Fibonacci retracement level.

ETC/USD Technical Analysis

ETC/USD has been testing this level at $18.9 for three consecutive days with no luck in breaking above it. However, the future Ichimoku cloud appears to be turning bullish. Other Ichimoku moving averages, such as the Tenkan line and the Kijun line are also moving upwards. The Chiko span though is also awaiting a break above the cloud to confirm the continuation of the current uptrend.

A break above this resistance level could open doors for further gains towards the 38% Fibonacci retracement level of $23.42.

Reasons Behind ETC's Uptrend

The Coinbase listing appears to have been a game-changer for the Ethereum Classic community. But there could another reason behind the new uptrend. That is the fact that ETC was among seven cryptocurrencies to be approved by Thailand’s regulatory body, The Securities and Exchange Commission.

The inclusion of Ethereum Classic by both Coinbase and Thailand’s SEC is interesting. That’s because there are many other cryptos they could have chosen instead of ETC, which is currently ranked 15 on the market cap list, having moved up from #18 since the listings were announced last month.

Ethereum Classic is a result of a technical hard fork in Ethereum following a dispute within the Ethereum community back in October 2016. Like Ethereum, Ethereum Classic plans to become a platform for decentralized applications.

As the 4th point of the IDDA technique, you must calculate your risk tolerance before deciding on the investment strategy that is suitable for your portfolio.

Don't forget to complete your risk management due-diligence before developing your investment strategy.

*This article was originally published here.