Ethereum (ETH) is a platform and operating system which integrates blockchain technology with smart contracts. Ether is the cryptocurrency traded on the Ethereum platform.

Between Mar 6 and 14, 2019, ETH has seen gradual decreases in price. A high of nearly $144 was reached on Mar 6 with lows below $131 experienced six days later. Prices subsequently rose to touch the resistance before a slight decline.

Currently, ETH is trading in the middle of the channel. At the time of writing, prices have stabilized around $134. Based on other trends and indicators, we predict that price will likely move back toward the resistance with an eventual breakout leading to new highs above the resistance.

Fundamental Analysis

From a fundamental perspective, Ethereum (ETH) has shown signs of relative weakness in 2019. It’s Constantinople hard fork was delayed in Jan after a previous postponement in October 2018. Though it successfully forked on Feb 28, not until about a week later was it receiving much coverage in the media.

Furthermore, the platform still hosts high gas fees for transactions while competitors like Tron have no transaction fees. This combined with scalability issues and other problems have left Ethereum with many dApps and few users. Tron, EOS, and Steem have deployed more active dApps than Ethereum. These four may be contenders in the dApp race, Ethereum appears to be losing.

Proof-Of-Something

Ethereum was initially released using a Proof-of-Work (PoW) consensus algorithm. Similar to Bitcoin (BTC), Ethereum used PoW to validate transactions on the blockchain. The plan, however, was to shift to a Proof-of-Stake (PoS) protocol.

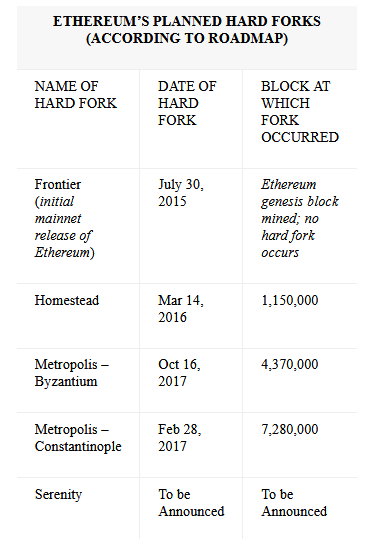

A roadmap was released to describe how the Ethereum mainnet would undergo a number of hard forks until PoS was attained. Below is a list of planned forks along with the date and block number at which they occurred:

Five updates were initially announced to occur with the Constantinople hard fork. A vulnerability discovered in one of the updates caused Constantinople to be delayed—it was initially to take place at block 7,080,000.

The four current updates decrease transactions fees, increases ease-of-use of the Ethereum network, and enables users to interact with future addresses yet to be created. Most notably, it decreases the mining reward and delays the difficulty bomb—which is designed to make mining next to impossible following the shift to PoS.

A full PoS consensus algorithm may be implemented with Serenity.

Centralized Control

Unlike Bitcoin, which can only soft fork on the main chain through complete miner consensus, Ethereum has a more centralized approach. It allows the developers and core team to make, what appear to be, relatively centralized and arbitrary decisions for the platform without widespread user approval.

In other words, the centralized control of the Ethereum Network by the Ethereum Foundation led them to delay the hard fork without necessarily receiving consensus from the community. This violates the basic principles of decentralization upon which Bitcoin is built.

However, Ethereum is not Bitcoin, and if the delay had not occurred, a vulnerability in one of the updates could have been exploited. This would have possibly allowed bad actors to steal user funds. The centralized governance of the Ethereum Foundation may have ultimately prevented thefts or fraud.

Nonetheless, the discovery of the vulnerability, however, did not come from the Foundation or the Core Developers. ChainSecurity discovered the vulnerability on Jan 15, 2019—only days before the hard fork was projected to occur. Unable to fix the vulnerability in time, the Foundation chose to delay the fork.

If Ethereum was governed by decentralized consensus—instead of the Foundation’s centralized authority—the vulnerability might still have been stopped. The users on the network might have reached consensus to delay the hard fork.

Technical Analysis (Completed November 2018)

2017 was a strong year for Ethereum, seeing its value drastically grow from just over $10 in January up to a monumental $1,400 just a year later. This growth cannot be said to be unique to ETH, however, as practically all digital currencies in the top 10 by market capitalization experienced similar growth.

However, since the overall trend in 2018 was extremely bearish, ETH has completely collapsed in value — losing over 90 percent of its value compared to its all-time high and more than 76 percent in the last year.

Compared to the Bitcoin price, Ethereum has fallen significantly faster — losing three-quarters of its value against BTC since February this year.

Despite this, during each bullish wave in the past year, ETH has outperformed BTC. While it is likely that the continued bear trend will see ETH/USD continue to fall, gains against BTC are possible with each bounce.

Specialists’ Perspective

The majority of expert predictions made earlier in the year painted an extremely bullish 2018 for Ethereum, with Olaf Carlson-Wee, CEO of the hedge fund Polychain Capital, predicting that Ethereum’s market cap will exceed Bitcoin’s by the end of the year. In January, Ethereum co-founder Steven Nerayoff suggested that Ethereum could double or triple by year-end due to the growing interest surrounding cryptocurrency.

Investing Haven is bullish on the crypto industry in general, expecting that 2019 will be a strong year for major digital assets, predicting that Ethereum will reach $1,000 sometime in 2018 or beyond.

Mike Cagney, previously CEO of student loan refinancer SoFi, is bullish on Ethereum — arguing that its infrastructure applications far exceed Bitcoin’s.

On the other hand, Josh Case, CEO of Antigua-based cryptocurrency exchange Ethershift, has been predicting bearish prices all year, telling us that “we have a very bear winter ahead of us, that will end with Bitcoin under $3,000 and Ethereum under $70.”

Case’s bearish predictions are echoed by Ethereumprice.org, which predicted that Ethereum has a 10 percent chance of seeing $200 again by the end of the year, whereas the odds of $500 or $1,000 are almost negligible at 4.99 percent and 3 percent, respectively.

MegaCryptoPrice is, on the other hand, mega bullish for the long term, forecasting 490 percent growth by the end of 2019 — which would see Ethereum reclaim $600 while its 5-year prediction sees ETH approach its all-time high at $1377.

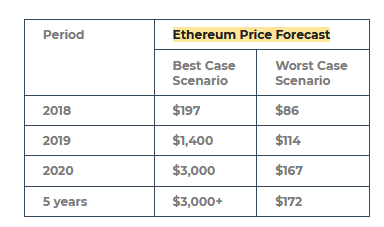

Ethereum Price Prediction 2018

With the entire cryptocurrency market in the midst of what may be an unprecedented bear period in terms of size and severity, few cryptocurrencies are looking promising. Since the beginning of 2018, close to $700 billion has been wiped from the industry market cap, $120 million of which was from the Ethereum (ETH) crash.

When the bear period first began around mid-January of this year, ETH was hit hard — quickly losing close to 40 percent of its value in under a week.

Since then, Ethereum has crashed through several key resistance zones before hovering around $200 for two months — which was then broken in early November.

While it’s very unlikely that we will see a huge 2017-esque bull run this year, it is also unlikely that Ethereum will continue to drop much further due to the strong resistance at $100. If any coin is expected to break the cycle this early, it doesn’t appear to be Ethereum, as almost all indicators suggest otherwise.

However, the relative strength index (RSI) indicates that Ethereum and the cryptocurrency market, in general, is extremely oversold, indicating that we are somewhere near the bottom. As it stands, it appears that Ethereum’s position will continue to weaken against BTC and XRP as 2018 concludes, likely struggling to hold $100.

Ethereum Price Prediction 2019

Though Ethereum will almost certainly close 2018 around $100, the long-term forecasts look far more promising. 2019 is slated to be the year when several significant upgrades to Ethereum’s blockchain technology are implemented, beginning with Constantinople and ending with the Caspar upgrade.

Caspar stands to significantly augment the way that the Ethereum blockchain is secured and maintained, switching from a pure proof-of-work (POW) system to a hybrid system also including proof-of-stake. According to reports by Vitalik Buterin, this hybrid consensus will initially favor POW, but will gradually place more importance on the POS part.

Switching from POW to POS is expected to massively increase the security and scalability of Ethereum, boosting its value as a blockchain and significantly increasing the value of ETH as large amounts become locked up in the new staking model.

Most experts agree that 2019 is shaping up to be a big year for Ethereum and that the price of ETH should begin to blossom as enthusiasts stock up in preparation for staking. Because of this, a price of between $250-300 should be attainable by year-end.

Ethereum Price Prediction 2020

Whilst 2017 and 2018 might have been dominated by ICOs, 2020 will likely be dominated by decentralized applications.

As it stands, the number of transactions the Ethereum blockchain can handle is severely limited by a number of factors — including the inefficient POW consensus algorithm and Ethereum Virtual Machine. By 2020, the transition to the new serenity implementation should be almost complete, which should provide drastic improvements to the capabilities of the Ethereum network.

As DApp developers begin to take advantage of the new and improved Ethereum, we should see a surge in high-quality applications built on Ethereum, driving up the ETH price as DApps begin consuming an increasing amount of gas.

Because of this, it is widely expected that in 2020, Ethereum will be one of if not the strongest cryptocurrencies still in use, potentially achieving a value exceeding $1,400.

Ethereum Price Prediction 5 years

In just four short years, Ethereum managed to achieve a market capitalization of almost $140 billion at its peak —, a feat that took Bitcoin, currently the most popular cryptocurrency, eight years to achieve. If Ethereum manages to keep the same pace, it may dethrone Bitcoin as the king of cryptos.

However, Ethereum faces stiff competition from other smart-contract capable platforms, including NEO, Cardano, and Stellar — all of which have their own wildly ambitious roadmaps ahead. Whether or not Ethereum manages to fend off these promising upstarts will have a lot to do with how accurately it follows up its own roadmap.

The Ethereum Foundation’s commitment to the project is widely considered to be industry leading, with currently dozens of different Ethereum improvement proposals (eIPs) being worked on simultaneously. With the Serenity upgrade shaping up to be a genuine game-changer, it is certainly within the realm of possibility to see Ethereum massively exceed its all-time high, perhaps even passing the $3,000 mark.

Our Prediction

Here at BeinCrypto, we base our forecasts on the long-term potential of the Ethereum project with the assumption that the 2018 bear market is not a recurring concern.

With strong fundamentals and a solid plan to maintain relevance in the face of strong competition and technical challenges, Ethereum has proven itself to be one of the few projects genuinely preparing for the long haul.

Overall, we see a strong future for Ethereum (ETH), with the potential to rise upwards of $3,000 within the next several years — assuming it can indeed deliver on its promise of a massively scalable distributed computing platform. We find it unlikely that Ethereum will fall significantly below $110, and will likely hover between $100 and $200 until we see a move to proof-of-stake.

Nevertheless, investors should always do their own research and tread lightly before buying Ethereum coins. The market is notoriously volatile, and anyone investing in both Bitcoin and Ethereum should be prepared to lose their entire investment.

What do you think of our ETH price prediction in 2019 and our Ethereum forecast for the future? Do you think ETH can recover in 2018? Let us know your thoughts in the comments below!

Disclaimer: The contents of this article are not intended as financial advice, and should not be taken as such. BeInCrypto and the author are not responsible for any financial gains or losses made after reading this article. Readers are always encouraged to do their own research before investing in cryptocurrency, as the market is particularly volatile. Those seeking advice should consult with a certified financial professional.