As long as interest rates remain low, excess money eventually moves into riskier areas on the spectrum. Higher yielding bonds, convertibles, preferreds, stocks… they all benefit.

Of course, if fewer people buy treasuries because they pursue greater risks, the Federal Reserve must continue to offset waning demand. Is $85 billion per month enough? It better be.

Consider just how far the U.S. Fed has been willing to go to keep respective interest rates artificially depressed. Chairman Ben Bernanke has been serving up 0% target rates for banks for more than 4 years, while currently supporting the largest “print-dollars-and-buy-treasury-bond” program ever.

At this point, in fact, the vast majority of the developed world’s central banks have chosen to follow America’s lead. Mario Draghi hinted last July that the European Central Bank (ECB) would purchase the toxic debt of weaker eurozone member nations. The Bank of England has its program of bond asset purchasing as well as additional credit easing measures. Meanwhile, Premier Shinzo Abe is already winning accolades for getting the markets to depreciate the yen by 20% and for encouraging the Bank of Japan’s (BOJ) to install its own open-ended asset purchasing plan.

With the S&P 500 on a 7-week run, and sitting a few percentage points below all-time highs, the emergency room procedures clearly engender greater confidence in stocks. Indeed, European and Japanese equity markets have benefited as well.

It doesn’t seem to matter, however, that the extraordinary measures have not been all that successful at reviving various economies. Investments, yes. Economies, no.

It follows that there may come a time when ultra-loose monetary policies by themselves will not be enough to juice investor returns. Corporate profits? They’re contracting. Outlooks? They’re noticeably hum-drum.

Nevertheless, the rationality or irrationality of uptrends should not determine whether or not you participate. You can ride an irrationally exuberant tidal wave like Garrett McNamara. You just need an unemotional plan for when to exit for the safety of the shore.

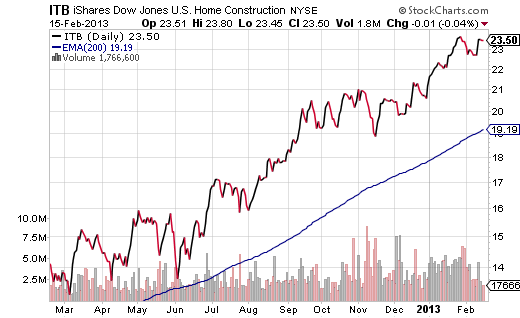

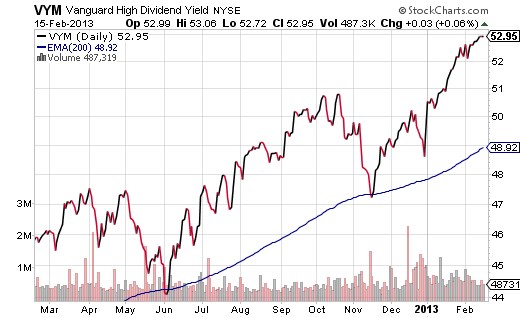

My clients have been invested in a wide variety of ETFs. At the same time, there are investors out there who want to put cash to work, but don’t want to get burned from the get-go. In order to do so, they may want to incrementally purchase into funds that are less than 7% above a 200-day exponential moving average. In that manner, they can avoid purchasing something that is extremely overbought on a technical basis.

Here is an example of what I mean: Let’s say that you see evidence of a recovery is residential real estate. And let’s say that you think that a natural extension of your observation would be to invest in homebuilders via iShares DJ Home Construction (ITB). You’d be getting an investment when it is 22% above a 200-day trendline. Statistically speaking, investors don’t tend to make a lot of money when they buy an ETF that is 22% above an exponential moving average.

In contrast, there are a variety of investments that have are less likely to experience a bearish pullback of 20 percentage points before finding long-term trend support. Vanguard High Dividend Yield (VYM) comes to mind. Granted, it too may be ripe for a pullback. Yet as long as VYM remains above its long-term trend, you can continue surfing like Garrett McNamara.

In truth, it may be wise to simply wait for a 3%-4% corrective period before getting on that surfboard. Assets clear across the stock spectrum are overdue.

By the same token, when you do choose to “get on,” you may feel a little less exposed to the elements with funds like iShares DJ Pharmaceuticals (IHE), Global X Super Dividend (SDIV) or iShares High Dividend Equity (HDV). Each of these funds are between 4%-7% above a respective 200-day, where the percentage drop to support is not outrageously steep.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

ETFs Worth Considering…Even After the S&P 500’s 7-Week Streak

Published 02/17/2013, 02:38 AM

ETFs Worth Considering…Even After the S&P 500’s 7-Week Streak

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.