Few seem to care about the potential for monstrous declines when stock assets are within a few percentage points of all-time highs. In fact, it becomes increasingly difficult for an objective observer to see the investment environment as it is.

At times like these, bears go into hibernation. Meanwhile, bulls present shopping lists of upbeat reasons to participate. And the herd blindly follows.

Consider the positives as they are presented in the financial media. Central banks around the world are buying their respective sovereign country debt without the threat of giant increases in the cost of living. As long as the Federal Reserve or the Bank of Japan (BOJ) or the European Central Bank (ECB) are able to amass large quantities of government bonds with their electronically printed currencies, interest rates can remain near historic lows. Consumers can then borrow cheaply, boosting an economy via the money spent on homes, computers, automobiles and stocks.

Is this really a case of “no-harm-no-foul?” Probably not. Despite recent protestations by developed world countries in the G-7, currencies from the dollar to the yen to the British pound have been weakened by the ongoing monetary policies of the U.S., Japan and England. The idea that policy-makers can stimulate an economy for long periods of time simply by creating money and buying your own country’s debt, hasn’t fared particularly well in history.

Back in the 70s, Chilean leaders nationalized a variety of industries and substantially increased social spending. How was the ambitious agenda paid for? With ultra-accomodative monetary policy. Economic growth recovered at first, but inflation eventually overwhelmed the nation. Chile defaulted on its debts shortly thereafter.

In neighboring Peru in the 1980s, the impoverished nation had initially benefited from enormous amounts of foreign investment. Leaders used the funding on scores of public needs and wants. Foreign investment began to disappear in subsequent years, leaving Peruvians without a private or public sector growth machine for paying back its debts.

On the one hand, Chile and Peru are small economies, and printing money was sure to decimate the value of their currencies. On the other hand, the ability for the U.S., England, Japan and the European Central Bank to increase money supply without adverse consequence flies in the face of the laws of supply and demand. The more electronic printing, the less money can be worth; the less a dollar or yen or pound or euro is ultimately worth, the more stuff will cost. (At least that’s the inflationary argument.)

The dollar may never meet its ultimate demise. And cost of living increases stateside may never emulate Peru in the 1980s.

That said, rising interest rates are a distinct possibility. Foreign investors may lose confidence in repayment and demand a greater return for the risk of downgraded treasuries. Consumer prices may rise at a much faster and much quicker pace than anticipated, leaving the Federal Reserve at a crossroads for hiking rates.

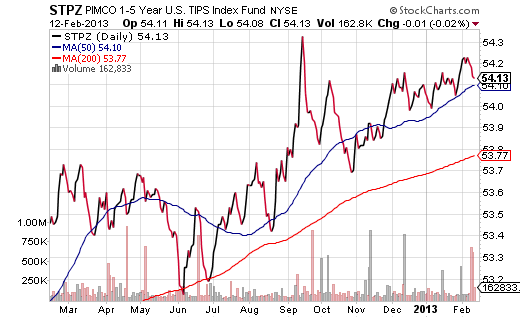

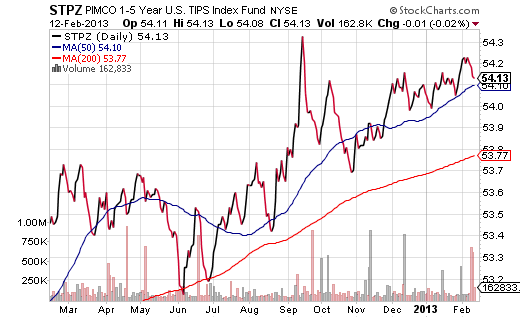

One ETF that may help an investor preserve capital as well as achieve a real return above inflation is PIMCO 1-5 Year U.S. TIPS (STPZ). Short maturity TIPS also offer exceptionally low volatility. And unlike intermediate and longer-term treasuries, STPZ has maintained its uptrend.

The inflationary bear of 1972-1974 eroded more than 50% of the stock market’s value. So one shouldn’t count on stocks for a textbook hedge against inflation. Metals tend to fare better, with gold being the patron saint. Note: Gold investors can certainly head for the sunny yellow metal shores of iShares Gold (IAU) for that textbook hedge.

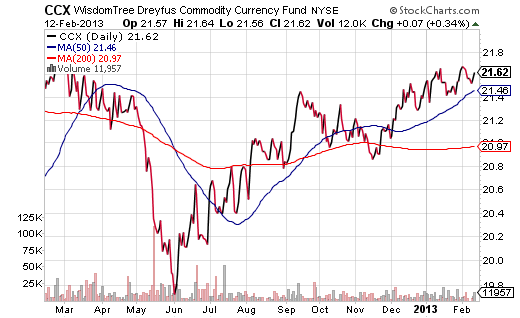

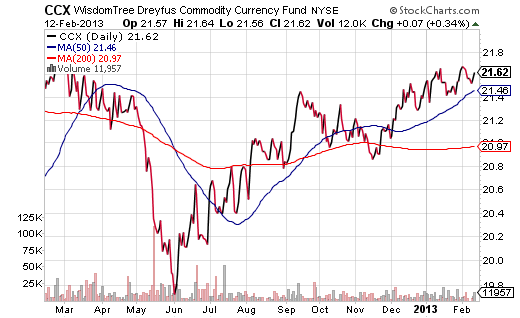

There are other means for taming consumer price inflation, however. WisdomTree Commodity Currency Fund (CCX) recognizes the historical benefit of owning the currencies of commodity producing countries. CCX currently has exposure to the Canadian, Australian and New Zealand dollar, the Chilean peso, the Brazilian real, the Norwegian Krone and the South African rand.

Finally, as an avid reader of historical fiction, I recall how “The Coffee Trader” by David Liss had an enormous impact on my understanding of financial markets and their origins. It also brought the critical nature of the coffee bean into focus.

Simply put, one of the world’s most important commodities is coffee. The entire world drinks it, and the bean may very well be a surprisingly robust hedge. The iPath DJ Coffee Total Return ETN (JO) has never been lower in its 4+ year history, though it may be close to finding a bottom. Manage the risk of additional declines with stop-limit loss orders.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.

At times like these, bears go into hibernation. Meanwhile, bulls present shopping lists of upbeat reasons to participate. And the herd blindly follows.

Consider the positives as they are presented in the financial media. Central banks around the world are buying their respective sovereign country debt without the threat of giant increases in the cost of living. As long as the Federal Reserve or the Bank of Japan (BOJ) or the European Central Bank (ECB) are able to amass large quantities of government bonds with their electronically printed currencies, interest rates can remain near historic lows. Consumers can then borrow cheaply, boosting an economy via the money spent on homes, computers, automobiles and stocks.

Is this really a case of “no-harm-no-foul?” Probably not. Despite recent protestations by developed world countries in the G-7, currencies from the dollar to the yen to the British pound have been weakened by the ongoing monetary policies of the U.S., Japan and England. The idea that policy-makers can stimulate an economy for long periods of time simply by creating money and buying your own country’s debt, hasn’t fared particularly well in history.

Back in the 70s, Chilean leaders nationalized a variety of industries and substantially increased social spending. How was the ambitious agenda paid for? With ultra-accomodative monetary policy. Economic growth recovered at first, but inflation eventually overwhelmed the nation. Chile defaulted on its debts shortly thereafter.

In neighboring Peru in the 1980s, the impoverished nation had initially benefited from enormous amounts of foreign investment. Leaders used the funding on scores of public needs and wants. Foreign investment began to disappear in subsequent years, leaving Peruvians without a private or public sector growth machine for paying back its debts.

On the one hand, Chile and Peru are small economies, and printing money was sure to decimate the value of their currencies. On the other hand, the ability for the U.S., England, Japan and the European Central Bank to increase money supply without adverse consequence flies in the face of the laws of supply and demand. The more electronic printing, the less money can be worth; the less a dollar or yen or pound or euro is ultimately worth, the more stuff will cost. (At least that’s the inflationary argument.)

The dollar may never meet its ultimate demise. And cost of living increases stateside may never emulate Peru in the 1980s.

That said, rising interest rates are a distinct possibility. Foreign investors may lose confidence in repayment and demand a greater return for the risk of downgraded treasuries. Consumer prices may rise at a much faster and much quicker pace than anticipated, leaving the Federal Reserve at a crossroads for hiking rates.

One ETF that may help an investor preserve capital as well as achieve a real return above inflation is PIMCO 1-5 Year U.S. TIPS (STPZ). Short maturity TIPS also offer exceptionally low volatility. And unlike intermediate and longer-term treasuries, STPZ has maintained its uptrend.

The inflationary bear of 1972-1974 eroded more than 50% of the stock market’s value. So one shouldn’t count on stocks for a textbook hedge against inflation. Metals tend to fare better, with gold being the patron saint. Note: Gold investors can certainly head for the sunny yellow metal shores of iShares Gold (IAU) for that textbook hedge.

There are other means for taming consumer price inflation, however. WisdomTree Commodity Currency Fund (CCX) recognizes the historical benefit of owning the currencies of commodity producing countries. CCX currently has exposure to the Canadian, Australian and New Zealand dollar, the Chilean peso, the Brazilian real, the Norwegian Krone and the South African rand.

Finally, as an avid reader of historical fiction, I recall how “The Coffee Trader” by David Liss had an enormous impact on my understanding of financial markets and their origins. It also brought the critical nature of the coffee bean into focus.

Simply put, one of the world’s most important commodities is coffee. The entire world drinks it, and the bean may very well be a surprisingly robust hedge. The iPath DJ Coffee Total Return ETN (JO) has never been lower in its 4+ year history, though it may be close to finding a bottom. Manage the risk of additional declines with stop-limit loss orders.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.