There are scores of erroneous beliefs that mislead the investing public. However, few are as dangerous to one’s portfolio as the notion that economic growth correlates to stock market performance.

Consider the inglorious ride for Chinese equities via SPDR S&P China (GXC). In 2010, China’s GDP growth rate topped 10%, while GXC managed a modest total return of 7.5%. The S&P 500 SPDR Trust (SPY) garnered double digit percentage gains in spite of sub-par GDP. In 2011, China’s GDP still grew at a relatively robust 9.5%, but that didn’t stop GXC from registering an abysmal -16.7%. Even with a disappointing total return of 2%, SPY outperformed without substantive economic growth to go with it.

In 2012, GXC bounced back considerably, powering ahead with a total return of 23%. Not only was this better than SPY, but it occurred in spite of a troubling economic slowdown whereby GDP finished below 8%.

Of course, most of the 2012 gains for GXC came on the heels of a 3-month super-spurt. The manufacturing sector shifted from contraction to expansion, and has held firm over the last 3 readings. Moreover, after 7 consecutive quarters of declining quarterly GDP rates, Q4 2012 picked up considerably. Better yet, the Chinese economy is expected to recover and grow above 8% in 2013.

The rocky road for Chinese stocks teaches us that stocks respond not to the growth rate itself, but the directionality, or the trend, of economic activity. China’s economic growth rate drifted lower for several years with little stimulus by its banking authorities. 10% to 9% to 7.5% is far more troublesome for folks than a steady, but paltry 2%, in the United States.

Indeed, the evidence is pointing to a winning hand for investors in Chinese equities. Not only is GDP finally trending upward, but leaders have more boldly expressed a willingness to employ monetary/fiscal stimulus to support a 7.5% growth rate. (They’re likely to see north of 8% without stimulative measures.) And with a variety of benchmark indexes offering forward P/Es of 9 to 10, stocks tied to China look better than they have in years.

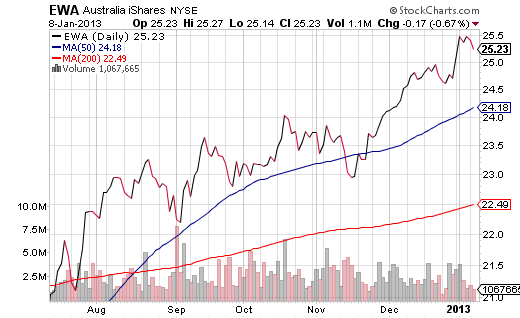

While there are those who may view exchange-traded favorites like SPDR S&P China (GXC) and iShares FTSE China 25 (FXI) as lower risk assets due to their diversification, I tend to favor trading partners in the Asia-Pacific region. If you’re intrigued by the manufacturing angle, iShares MSCI Australia (EWA) beckons as one of China’s most important providers of materials. (And you shouldn’t shake a stick at that 4.1% SEC distribution yield.)

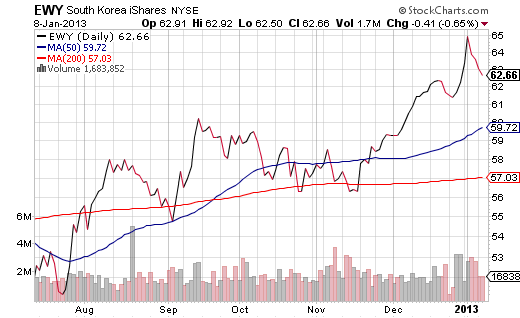

South Korea (EWY) is another key trading partner with China. Whereas the U.S. and Europe import a staggering amount of goods/services from the mainland, Korea, the 5th largest trading partner, is a net exporter. For believers in the idea that China is in the process of transitioning to a powerful consumer class, EWY is a solid ETF in the Asian neighborhood.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

ETFs For Rising Consumption And Manufacturing Activity In China

Published 01/09/2013, 12:30 AM

Updated 03/09/2019, 08:30 AM

ETFs For Rising Consumption And Manufacturing Activity In China

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.