Canada, India, Turkey, Australia, China and Denmark. What do all of these countries have in common? The central bank of each nation has eased monetary policy to stimulate respective economies in 2015. What’s more, none of these actions had been anticipated; rather, the media described rate cuts as “surprising” or diminished reserve requirements as “unexpected.”

In the case of Denmark, recent stimulus has been creative as well as startling. For the fourth time in less than three weeks, the Danish central bank lowered its deposit rate to keep its krone in line with the weakened euro. Maintaining the peg of the Danish Krone to the severely weakened euro is a means by which Denmark can spark export-driven growth. Depositors are now being charged 0.75% (what is known as a negative deposit rate) to let money sit at a financial institution. In effect, Danish depositors are now paying for the privilege of “hoarding” the krone – a risk some might be willing to take in order to preserve capital from rapid euro depreciation.

At this moment in time, nearly every significant central bank (excluding the U.S. Federal Reserve and the Swiss National Bank) is engaging in some form of rate lowering and/or currency devaluation. Perhaps ironically, even the Fed has merely telegraphed a shift towards tightening the monetary reins. In actuality, it has been more than six years of zero percent interest rate policy (ZIRP) with no specific measure taken to raise overnight lending rates. So Switzerland, which removed the franc’s cap against the euro on January 15, is the only warrior in the “currency wars” that believes a strong currency is beneficial as opposed to detrimental.

| U.S. and Switzerland: The Only Countries In A Tightening State Of Mind | ||||||

| Approx YTD % | ||||||

| CurrencyShares Swiss Franc (NYSE:FXF) | 7.9% | |||||

| PowerShares U.S. Dollar Bullish (NYSE:UUP) | 3.3% | |||||

| CurrencyShares Japanese Yen Trust (ARCA:FXY) | 1.9% | |||||

| CurrencyShares British Pound (NYSE:FXB) | -1.7% | |||||

| CurrencyShares Australian Dollar (NYSE:FXA) | -4.4% | |||||

| CurrencyShares Euro Trust (NYSE:FXE) | -5.2% | |||||

| CurrencyShares Canadian Dollar (NYSE:FXC) | -6.2% | |||||

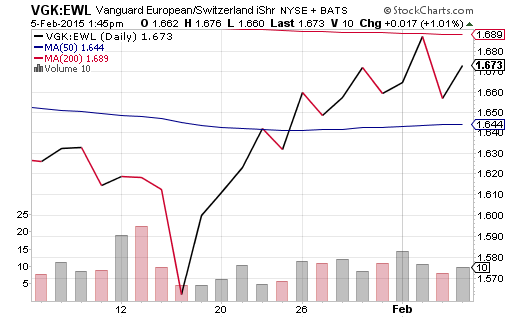

The Swiss consumer may benefit from a stronger franc. Yet Swiss businesses have been bemoaning the fate of their exports. Additionally, investors appear more intrigued by the prospect of euro-zone asset price gains than the possibility of Swiss company success as demonstrated by the Vanguard Europe (ARCA:VGK):iShares MSCI Switzerland (NYSE:EWL) price ratio. VGK:EWL since January 15 shows that the early money is betting on asset price reflation occurring in the euro-zone where the European Central Bank (ECB) is engaged in a large-scale electronic money printing program (a.k.a. quantitative easing) to revive the economies of member nations.

Clearly, “stimulus fever” is sweeping the globe, suppressing interest rates and bolstering risk assets. The question an investor may wish to ask, however, is whether or not the efforts are doing anything beyond creating temporary “wealth effects” for the investing class. In other words, is Switzerland onto something by refusing to play the game, or is the U.S. blueprint for economic revival worthy of imitation?

Until the global investment community gives up on the notion that any stimulus is good stimulus – that any financial engineering designed to inspire risk taking will reward risk takers – expect the uptrends in respective stock markets to continue moving higher. I prefer removing the currency aspect from the equation with funds like iShares Currency Hedged Germany (HEWG), WisdomTree International (Europe) Hedged Equity (NYSE:HEDJ) and/or Deutsche X-trackers MSCI AC Asia Pacific ex Japan Hedged Equity ETF (NYSE:DBAP).

Yet I am equally convinced of the necessity to hedge against a monumental shift in central bank sentiment. There’s a reason that negative yields on sovereign bonds in Europe — Netherlands, Austria, Germany, Finland and Switzerland are becoming increasingly common. For one thing, negative yields can become even more negative, extending price gains for buyers of the debt. For another, there’s a remarkable demand for safe storage. Government bonds, even with negative yields, might be considered safer than cash deposits, particularly when those cash deposits are substantial. (Think Cyprus!)

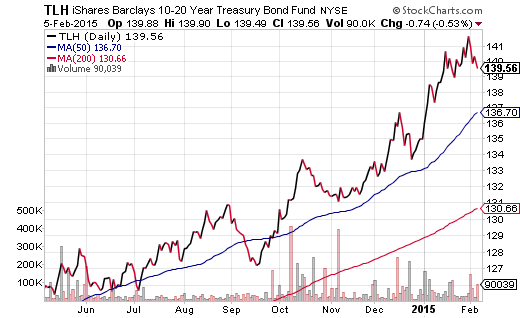

I am by no means recommending that an investor rush out to purchase negative -yielding sovereign debt; rather, I anticipate the U.S. bond rally to stay the course on relative value. If the U.S. 10-Year yields 1.82%, but German 10-Year’s offer 0.3% and the Swiss 10-Year offers a negative yield, is there any reason to suspect that a fund like iShares 10-20 Year Treasury (NYSE:TLH) will fail to find buyers? Consider incremental purchases of an exchange-traded fund like TLH when it revisits its 50-day moving average.

Disclaimer: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.