A do-it-yourself investor would be wise to track institutional money. Are there surprising, or not so surprising, moves that advisers make via their block trades? Often, the activity will give you the heads-up if advisers like myself are on their way to a party before the rowdier guests arrive; similarly, tracking block allocations might tell you whether or not advisers, asset managers and/or hedge fund gurus are leaving an enthusiastic celebration early to watch digitally recorded episodes of “Breaking Bad.”

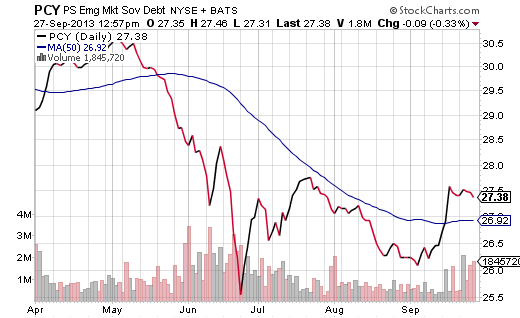

For example, PowerShares Emerging Market Sovereign Debt (PCY) has caused more portfolio pain than portfolio pleasure in 2013. Fortunately, for our clients who had owned PCY, we minimized loss with stop-limit orders during the May-June rout of higher-yielding income assets. PowerShares Emerging Market Sovereign Debt (PCY) had served us so well since 2009. Shortly after Bernanke’s taper talk on May 22nd, however, our mechanical and unemotional sell discipline removed the asset from our accounts. Then in September, the 10-year yield tickled 3%, while the Federal Reserve backtracked on its anticipated policy change. Ever since, yield sensitive assets have been gaining ground. In fact, for the past few days, PCY has picked up more than 100 million in assets on 2x the average trading volume.

Granted, there are technical traders who dumped PCY by the hundreds of millions when it crossed below the 50-day trendline back in May. So it stands to reason that many of those same technical traders have re-entered PCY… now that the asset has crossed back above a 50-day here in September. Others may be intrigued with the 5% annualized yield delivered monthly in an environment where the Fed may not slow their bond-buying after all; still others may regard the spread between emerging market debt and comparable U.S. government debt as attractive.

By way of additional disclosure, I have not added PCY to client accounts. My yield-oriented moves for clients after the Fed decision have concentrated on muni debt, including SPDR Nuveen Barclays Muni (TFI) and SPDR Nuveen Short Term Muni (SHM). I have added to held-to-maturity high yield (i.e., Guggenheim BulletShares Series) as well as senior bank loan assets like PowerShares Senior Loan (BKLN). Yet whatever the reason for the new-found interest in PowerShares Emerging Market Sovereign Debt (PCY), individual investors should recognize recent changes in institutional fund flow.

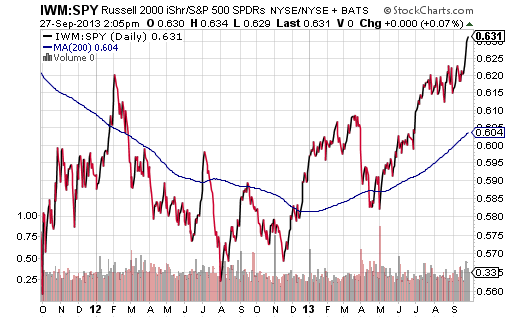

Another trend that may be perplexing to those who “value” fundamental valuations, small-cap stocks have not been this strong compared to large-cap stocks since the previous government impasse in July of 2011. The relative strength of iShares Russell 2000 (IWM) against the SPDR S&P 500 Trust (SPY) as seen in the IWM:SPY price ratio tells us that small-caps were not that concerned by rising interest rates in the 2013 May-June swoon; similarly, small-caps are not sweating the government showdowns over the budget or the debt ceiling. In fact, IWM is still a mere fraction off its record peak, whereas the S&P 500 and the Dow Jones Industrials are several percentage points below their highs.

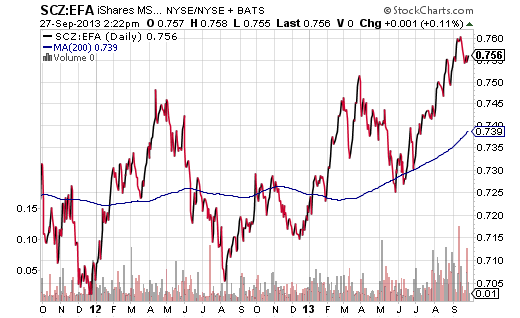

Due to overvaluation concerns, I have been less willing to add to domestic small-cap exposure. We already maintain a rather significant commitment to iShares Small Cap Value (IJS). On the other hand, noting the ability of developed market small caps to “overlook” interest rate uncertainty as well as political uncertainties, I have been willing to acquire iShares MSCI EAFE Small Cap (SCZ) for growth-oriented portfolios. (Not that a 3% yield from developed market small-caps is chopped liver.) Comparing SCZ to its bigger brother, iShares MSCI EAFE Index Fund (EFA), confirms a very similar trend to the one that is taking place in the U.S. stock market.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

ETF Trends That May Not Have Hit Your Radar Screen

Published 09/29/2013, 02:53 AM

ETF Trends That May Not Have Hit Your Radar Screen

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.