Each week we give out trades you can profit from. This week VelocityShares 3x Long Crude linked to S&P GSCI Crude Oil Excess Return (NYSE:UWTI) has got us over 8% of profit on half shares and over 11% on the remaining shares of the trade.

Today’s Trade Alert

There were no new Trade Alerts today. Fed minutes were released and of course the market believes anything the Fed says and reacted positively to the “talk.” Nonsense. Futures moved from a nice down from the open, higher the rest of the day.

Trade Alert Updates

UWTI triggered long on the weekly at 23.38 on Monday and we took half off the table for a 8.16% gain at 25.29. Today we never hit the stop of 23.98 and after a down open it spiked higher and my leaning towards a bullish report came to fruition and rewarded us with a move over the 25.71 mark and over 26 now.

Move stops to 25.20 and we’ll see now if we can hit the next target higher of 28.50. So far a return of 11.46% on the remaining shares and we’ll have to see now if we can get to 20%. For those that might still be in Direxion Daily Energy Bull 3X Shares (NYSE:ERX), it did get over 32.03 but no call at present. I like the fast movers better is all. Move stops up with a .50 cent trailing stop but I am not calling this one for the record.

Direxion Daily Gold Miners Bear 3X Shares (NYSE:DUST) was a buy on a break of 5.11 for aggressive traders and it moved up 4.17% today. If aggressive traders bought it, they have been rewarded, but it has not triggered long yet.

I’m still liking this play though and have added Direxion Daily Junior Gold Miners Bear 3X Shares (NYSE:JDST) and VelocityShares 3x Inverse Silver linked to S&P GSCI Silver ER Exp 14 Oct 2031 (NASDAQ:DSLV) to the blue one to watch list.

News that Can Affect Today's Trades

Initial jobless claims expected to be 266k is a gold and market mover. Philly Fed Manufacturing less so and Natural Gas storage comes out.

U.S. Stock Market

Yesterday I said we are very close to shorting the market but with the Fed minutes coming out I was hesitant to make any calls. Direxion Daily Financial Bear 3X Shares (NYSE:FAZ) (blue) was lower today and we’re just not ready to do this trade yet.

I made a mistake and said Direxion Daily S&P 500 Bull 3X Shares (NYSE:SPXL) and meant Direxion Daily S&P 500 Bear 3X Shares (NYSE:SPXS) as a potential on the report yesterday.

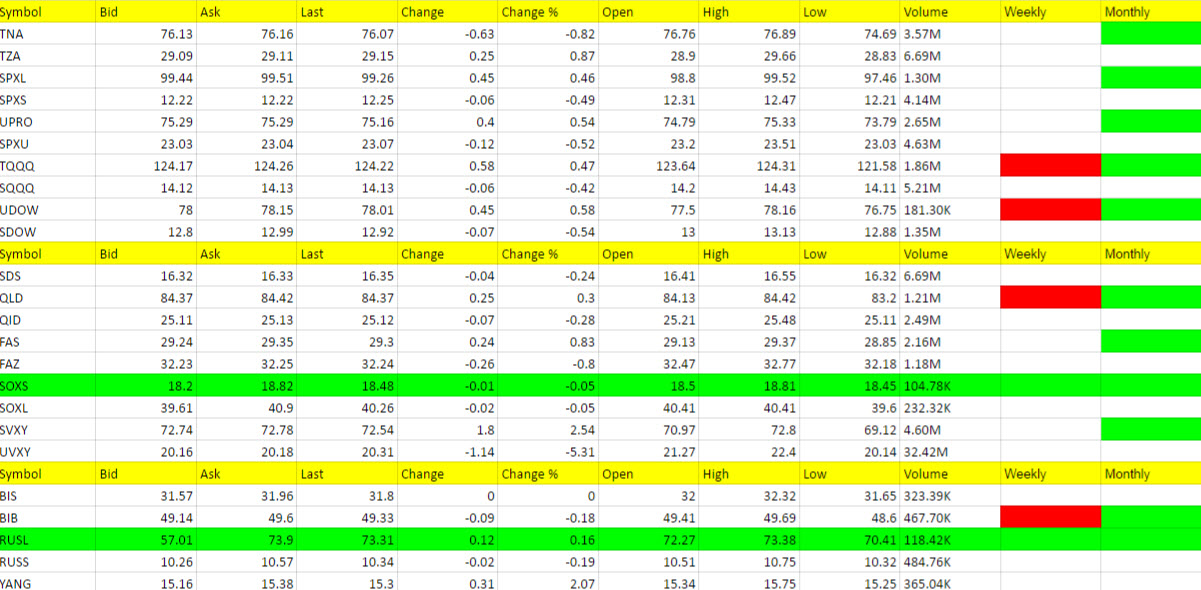

Hopefully you saw the report and knew what I meant. You’ll notice more red on the report below, but those hit before the Fed minutes were released, meaning we were establishing the trend but it was put on hold.

Call: No call at present. Patience will be rewarded.

Foreign Stock Market

Direxion Daily FTSE China Bull 3x Shares (NYSE:YINN) and Direxion Daily Russia Bull 3X Shares (NYSE:RUSL) still green but Direxion Daily Brazil Bull 3X Shares (NYSE:BRZU) and Direxion Daily Emerging Markets Bull 3X Shares (NYSE:EDC) turned red. I needed these to start turning and we should get some good mileage out of them when the opposites are called.

No call at present.

Interest Rates

iShares 20+ Year Treasury Bond (NYSE:TLT) bounced higher and is an every other day green, but no call with it churning like this. Of course I still like it longer term.

Energy

VelocityShares 3x Long Crude linked to S&P GSCI Crude Oil Excess Return (NYSE:UWTI) is a hold for more profit with stops in place.

VelocityShares 3x Inverse Natural Gas linked to S&P GSCI Natural Gas Excess Return (NYSE:DGAZ) and VelocityShares 3x Long Natural Gas linked to S&P GSCI Natural Gas Excess Return (NYSE:UGAZ) no call. Natural gas report may trigger something.

Direxion Daily Energy Bull 3X Shares (NYSE:ERX) I still like but just too slow. Stay the course if in it, moving stops up.

Precious Metals Market

DUST I had been attracted to and now like JDST and DSLV. No call as of yet but aggressive traders can buy any of these on a break of the high of the day for each (if not already in DUST this morning).

Other Calls

As I said yesterday, from time to time I will be adding individual ETFs that have triggered long or short based on market trends. These may or may not be leveraged. These types of trades will be more for longer term swing trades for IRA’s where we can catch a good directional rise. I care not what the overall market is doing with these calls and will provide entry and exit strategies.

Disclosure: Commodity Futures Trading Commission Futures and Options trading has large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. Don’t trade with capital you can’t afford to lose. This is neither a solicitation nor an offer to Purchase/Sell futures or options. No representation is being made that any account will or is likely to achieve gains or losses similar to those discussed in this outlook. The past track record of any trading system or methodology is not necessarily indicative of future results. All trades, patterns, charts, systems, etc. discussed in this outlook and the product materials are for illustrative purposes only and not to be construed as specific advisory recommendations. All ideas and material presented are entirely those of the author.