In yesterday’s ETF commentary, we pointed out the developing bullish setup in SPDR Energy ETF (XLE). However, as the ETF had not yet broken out to new highs, we said it may need another week or two of consolidation, as well as tightening of the price action near its prior high.

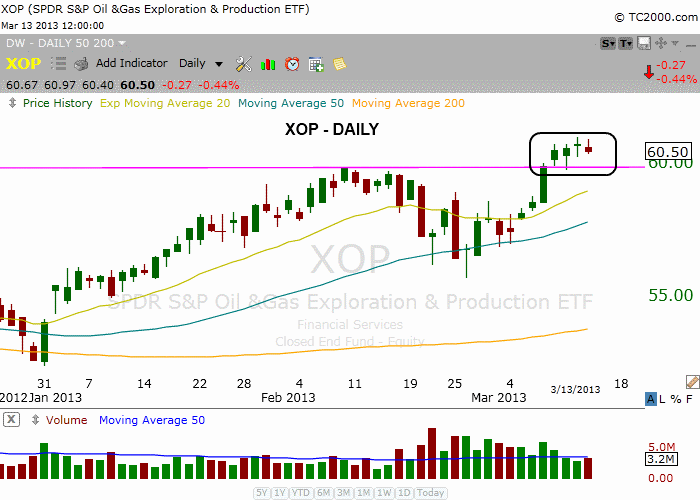

While XLE remains on our internal watchlist as a potential buy entry in the near-term, further research enabled us to actually find a better ETFs swing trade setup within the same industry sector. Below, take a look at the daily chart of SPDR Oil & Gas Exploration and Production ETF (XOP):

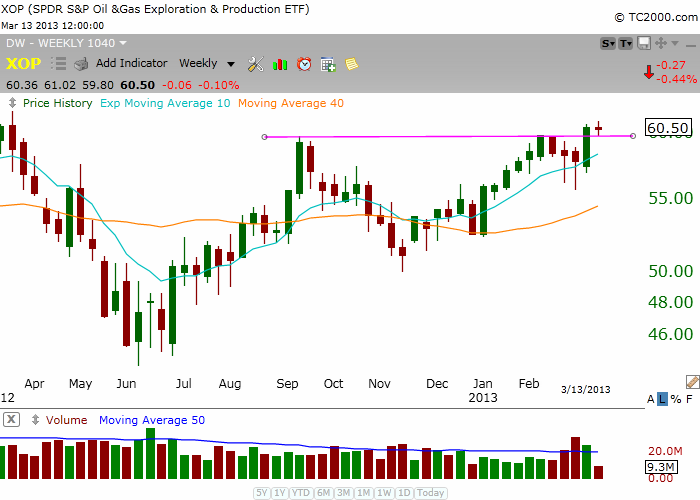

The primary difference between XLE and XOP is that the former has not yet broken out above resistance of its February 2013 high, while the latter already has. This means XOP has been showing slightly more relative strength than $XLE. On the longer-term weekly chart below, notice that XOP has also just broken out above key horizontal price resistance of its prior high from September of 2012, which should further spark bullish momentum from here:

Over the next few days, XOP may form a bull flag chart pattern by drifting slightly lower from the high of this week’s breakout (as shown on the first chart above). If it does, it could lead to an ideal swing trade setup, as new support of the February 2013 breakout level is just below the current price. However, just in case the ETF immediately continues higher from here, without forming a bull flag first, we have added XOP to today’s watchlist as an “official” trade setup going into today’s session.

Since XOP is presently only 1% above its breakout level, it’s not too far extended to take a shot from here if it continues higher. However, if the ETF trades through our trigger price (above the two-day high), we will reduce risk by only entering with partial share size on this momentum trade setup. Conversely, we may be more inclined to enter with larger share size if a bull flag pattern first develops from here instead, as that would increase the odds of follow-through to the upside.

In addition to XOP, there are two other “official” ETF swing trade setups, as well as two new individual stock trade setups, going into today.

One new ETF setup is a buy entry into ProShares Short 20+ Year Treasury Bond ETF (TBF) if it rallies above last week’s high. A similar trade to buy TBT on a breakout above last week’s high was listed on our watchlist earlier this week (Monday), but it did not trigger and we removed it. Now, we have added the short ETF back to our watchlist, but are targeting the non-leveraged ETF (TBF), rather than the leveraged one (TBT), because there will be a slightly better correlation to the underlying index if TBF triggers for buy entry.

The third and final new ETF trade setup on today’s watchlist is a potential short selling entry into SPDR Metals & Mining ETF (XME). Although our market timing model is still in “buy” mode, this sector has been absolutely dead, trading near the 52-week lows while the market trades at its highs. Therefore, because of its relative weakness, even the slightest pullback in the market should cause this ETF to fall apart to new lows.

What are your thoughts on these potential ETF swing trades? Got any others you like? Please drop us a line below.

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

ETF Swing Trade Setups: Breakout, Trend Reversal, & Short Sale

Published 03/14/2013, 07:24 AM

Updated 07/09/2023, 06:31 AM

ETF Swing Trade Setups: Breakout, Trend Reversal, & Short Sale

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.