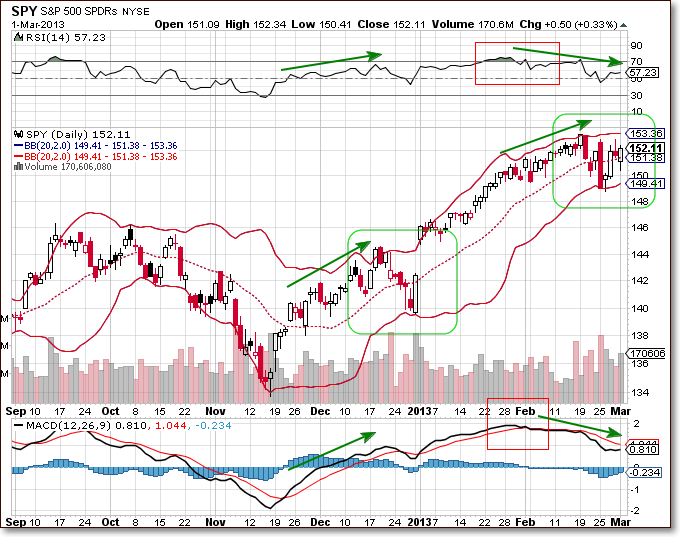

RS I- since the last time I observed the RSI indicator when the stock appeared to have us ended its first leg up, I noticed that it was still moving up. But this time the RSI is moving down, and a negative divergence is taking place. My observation indicates that the stock may finally have reached the top of its present bullish trend.

Bollinger Bands: like the last time, the stock has touched the bottom Bollinger band and it appears that tit may have reached a strong resistance level unlike the last move, where it gapped way up after it and the first leg of its bullish run.

MACD: after the same manner, the MACD indicator was also moving up last time the stock reached the end of its first bullish leg up. But this present move now I have identified as a top in the stock is now moving down. This supports the theory that we have possibly reached the top of this bullish move up.

Summary

There are enough signs between the RSI indicator and the MACD indicator that the stock could possibly have reached its top. This is a new high which could be struggling to try to push through, but the indicators are just showing that there is a lot of weakness right now, and it isn't sure it can push through, at least not right now.

Current Events

Next Friday's unemployment report and the hefty spending cuts will be at the forefront.

Major U.S. stock indexes will make another attempt at reaching all-time records, but the fitful pace that has dominated trading is likely to continue. The importance of whether equities can reach and sustain those highs is more than Wall Street's usual fixation on numbers with psychological significance. Breaking through to uncharted territory is seen as a test of investors' faith in the rally.

Flare-ups in the eurozone's sovereign debt crisis and next Friday's report on the U.S. labor market could jostle the market, though U.S. job indicators have generally been trending in a positive direction.

Signs that investors are becoming concerned about the rally's pace is evident in the options market, where the ratio of put activity to call activity has recently shifted in favor of puts, which represent expectations for a stock to fall. The put-to-call ratio representing an aggregate of about 562 financial stocks is 1:1, when normally, calls should be outnumbering puts.

While lackluster data has been a catalyst in the past for stock market gains as investors bet it would ensure continued stimulus from the Federal Reserve, that sentiment may be wearing thin.

Markets stumbled last week following worries that the Fed might wind down its quantitative easing program sooner than expected.

The dreaded deadline for the federal "sequestration" spending cuts has now passed. That's the good news.

The bad news is that the $85 billion hatchet-chop is now leading to indiscriminate furloughs, job losses, and spending reductions across almost the entire federal government, including programs that most Americans love.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

ETF/SPY: A Lot Of Resistance To The Move Up

Published 03/03/2013, 03:22 AM

Updated 07/09/2023, 06:31 AM

ETF/SPY: A Lot Of Resistance To The Move Up

Technically Speaking

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.