It has been five trading days since “no-taper” euphoria has passed. In that time, U.S. stock assets have been falling, though the declines have been modest. Most investors continue to believe that a last-minute deal will be struck and that a bearish retreat like the 2011 correction is improbable.

Nevertheless, different economic sectors appear to be responding differently to the current landscape. And while previous blueprints for budget uncertainty may have favored non-cyclical segments such as health care and consumer staples, old-school rules may not be applicable.

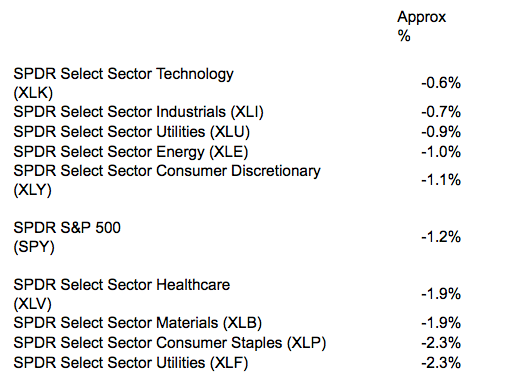

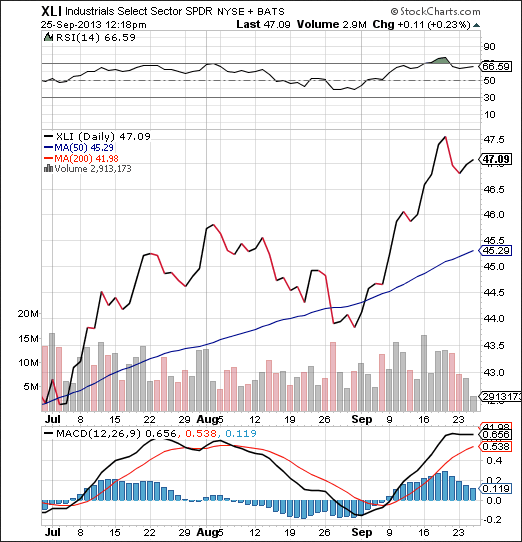

Granted, assets like SPDR Select Sector Materials (XLB) and SPDR Select Sector Financials (XLF) may be following the risk-off rules of investment anxiety. Nevertheless, it is rare to find safer havens like Health Care (XLV) and Consumer Staples (XLP) near the bottom of the barrel. Equally strange, it is a bit ironic to find economically sensitive Industrials (XLI) at the top of the leaderboard, let alone a volatile segment like Technology.

Since the budget impasse has been tied to Obamacare, I suspect some of the selling in XLV may be associated with uncertainties here. And perhaps the move away from Consumer Staples is related to an expensive sector with poor earnings prospects. Yet I am still surprised how Energy (XLE), Industrials and Tech can lead the pack in the face of rancorous non-negotiations as well as subdued profit expectations.

Warren Buffett recently claimed that he is having a difficult time finding ANYTHING to buy. What’s more, he is sitting on $49 billion in cash. Should we call this “de facto market timing?” If Buffett cannot find anything to purchase — if the Oracle of Omaha maintains that he does not see bargains after a four-and-a-half year run-up — why are economically sensitive conglomerates in the Industrials space holding up so well? It would be tough to argue that Industrials are inexpensive with a trailing P/E of 18.9, an optimistic Forward P/E of 16.4 and a price-to–book (P/B) of 3.3.

Investors should also be mindful of the fact that, even if the flatness of corporate revenue is of little concern these days, and even though short-term solutions for the budget as well as the debt ceiling are likely to emerge, the Federal Reserve’s “no-taper” decision probably injected even more uncertainty into the investing picture. Whereas some believe the decision to wait was a pleasant surprise, it only raised doubts surrounding Federal Reserve communication. Now, nobody really knows what to expect from the Fed; now, central bank decisions are not merely data-dependent, they’re also dependent on political outcomes.

For example, does the market now believe the Fed will keep on “keeping on.” Long-dated bonds are having a splendid week, with Vanguard Extended Duration (EDV) logging 3.1% and iShares 20 Year Treasury (TLT) pocketing 1.7%. This could have as much to do with the budget impasse as anything else, but the truth is, the Fed’s efforts at enhanced communication has only led to greater ambiguity.

I remain committed to equities, with allocations to highly liquid ETFs such as Vanguard Dividend Growth (VIG), Vanguard International ex U.S. (VEU) and iShares Small Cap Value (IJS). I am also “overweight” tech at this time with funds like Vanguard Information Technology (VGT) or First Trust NASDAQ Tech Dividend (TDIV). That said, like Mr. Buffett, I have been patient for months with some cash on the sidelines. I would be willing to buy into meaningful market weakness. However, if long-term trends break and stop limit loss orders hit, clients may have even more cash to protect against catastrophic bear-market losses.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

ETF Sectors React To Budget Impasse

Published 09/25/2013, 02:01 PM

ETF Sectors React To Budget Impasse

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.