How impressive is the rotation into energy stock ETFs? Even natural resources-heavy iShares MSCI Canada (EWC) is hitting fresh 52-week highs. Granted, the recent price movement may not make up for years of perennial underachievement. Yet it is hard to dismiss the prospect of a changing of the guard.

Some folks have expressed confidence that the surge in demand for energy-related ETFs is due to the relative attractiveness of energy stock valuations. Others attribute the intrigue to late business cycle leadership. Still others have suggested that geopolitical tension between Russia and Ukraine created a premium for energy stock ownership.

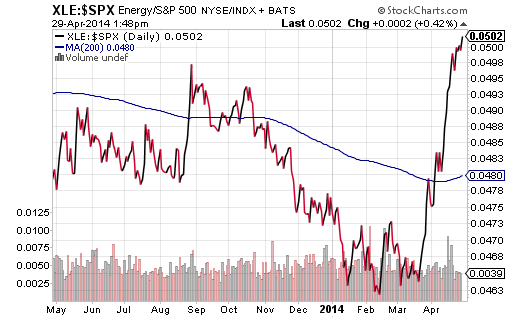

All of the above-listed ideas may help to explain the interest in energy-related ETFs like EWC as well as SPDR Select Sector Energy (ARCA:XLE). On the other hand, the timing of the dramatic climb in the XLE:S&P 500 price ratio demonstrates that the demand for energy stocks popped in mid-March. That is when Vladimir Putin signed a bill to absorb the Crimean peninsula into the Russian Federation.

My take? Growth has passed the torch to perceived safety, including a perception that there are less risks associated with the potential rewards in energy. How accurate those perceptions are remains to be seen. In truth, a shift to energy-related investments is one of many shifts in 2014 that reveal a preference for safer equity assets. Here are several others:

1. Dividends. In 2013, fear of Fed tapering caused many to shun anything with a yield. With rates having stabilized in 2014, reliable companies that reward shareholders with cash flow have recaptured imaginations. Vanguard High Dividend Yield (VYM), First Trust Value Line Dividend (FVD) and Wisdom Tree Dividend Top 100 (DTN) are all hitting all-time peaks.

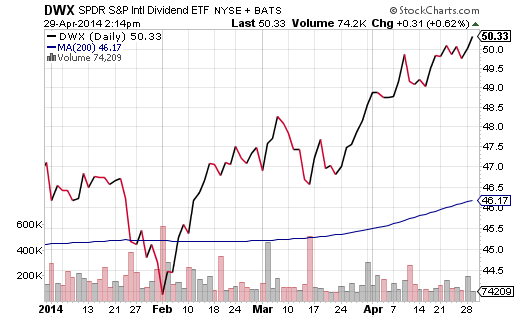

2. International Dividends. Did you believe that the shift from growth to value was a domestic phenomenon? It’s not. SPDR S&P International Dividend (DWX) is up roughly 7.0% year-to-date, while U.S. stocks are modestly positive on the year.

3. Lower Volatility. Utilities tend to be less volatile than broader benchmarks over time. The same can be said for consumer staples. Regardless of sector, however, funds like iShares USA Minimum Volatility (USMV.K) look to smooth out the ride for those who struggle with the price roller coaster. PowerShares S&P 500 Low Volatility (SPLV.K), PowerShares S&P International Developed Low Volatility (IDV) as well as iShares MSCI USA Min Volatility (USMV.K) are all registering 52-week highs.