• Less risky portfolios gave higher returns

• Corporate & long govt.

• bonds outperformed equities• Longer-dated Eurozone bonds were the star of the show

By Teis Knuthsen

In this note we update our ETF portfolios with returns for the first four months of 2014.

Positive but moderate returns in 2014

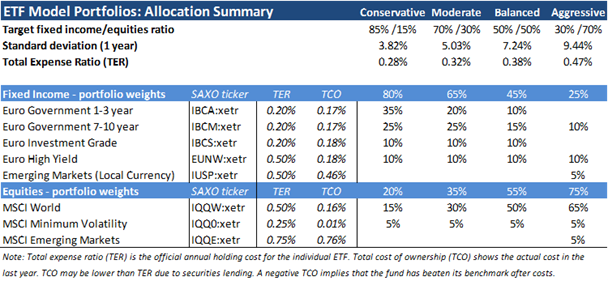

The four ETF portfolios are constructed as global, multi-asset portfolios with a European investor in mind. To reduce currency exposure, we have concentrated fixed income exposure on EUR-denominated asset classes, except for emerging market bonds. Equity exposure is invested in global, developed markets (MSCI World) and emerging markets (MSCI EM), replicating an MSCI All-Countries universe. In general, we aim to provide a transparent, familiar and robust asset allocation universe, suitable for medium to long-term investors. The model portfolios are optimised subject to a volatility constraint. The ETFs are UCITS compliant. You can more about them here.

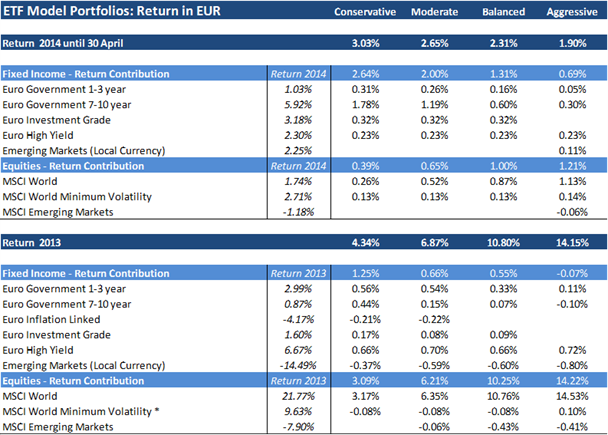

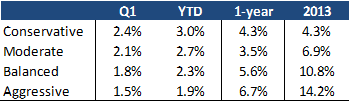

The four portfolios have delivered positive, if moderate returns in 2014, ranging from 1.9 percent to 3.0 percent. Unlike in 2013, however, this year the highest returns have been achieved by the less risky portfolios. This reflects that longer-dated government bonds and corporate bonds all have yielded higher returns than global equities so far this year.

The strongest performance this year comes from longer-dated Eurozone government bonds, which have gained 5.9 percent. This development reflects a sustained decline in bond yields as well as a continued narrowing of peripheral yield spreads. Corporate bonds have also yielded respectable returns. In contrast, global equities have returned just 1.7 percent, well below returns at the same time last year. Nonetheless, all primary asset classes have seen positive returns so far this year.

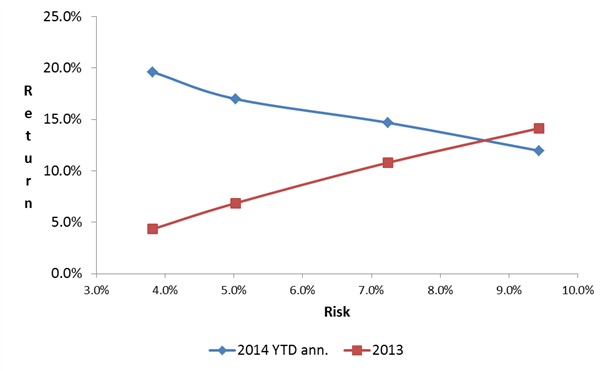

In the chart below we plot combinations of risk (measured as the standard deviation) and returns for the four portfolios, where the returns for 2014 have been annualised for comparison. The distinct risk/return difference between the two periods can be seen clearly.

Figure 2: Risk and return

We continue to recommend a moderate overweight of equities relative to bonds, and an underweight of emerging markets relative to a MSCI All Countries reference. The only change to the portfolios this time is minor adjustment of bond duration (less/more duration for defensive/aggressive portfolios).

In the tables below we show a detailed breakdown of the performance as well as of the portfolio composition.