As we outlined using an example with Facebook on October 25, the value of the ETFs in your portfolio are determined by the aggregate opinion of millions of investors around the globe. If the aggregate opinion sets asset prices, then keeping an eye on aggregate opinions falls into the prudent category.

First Team ETFs

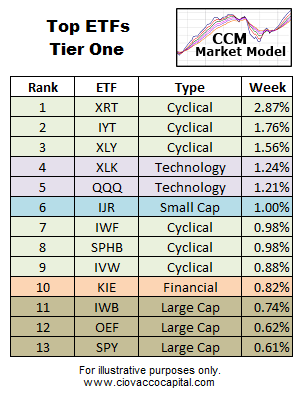

One method to track aggregate demand is to examine relative strength. ETFs that are in greater demand than the S&P 500 ETF (SPY) go up at a faster rate than SPY (they make more money). The table below contains ETFs that investors have favored over SPY in recent weeks. We can think of the list below as ETF First-Team All-Americans.

Leaders Speak To Conviction

When investors are confident about future economic outcomes they prefer to invest in stocks rather than bonds. Therefore, the fact that Treasuries (TLT) or the aggregate bond ETF (AGG) are absent from the table above tells us the market’s pricing mechanism remains net bullish regarding future outcomes related to the economy, Fed, earnings, and geopolitics.

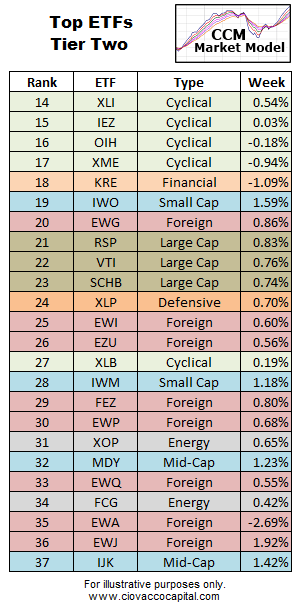

Second Team Also Aligns With Stock Bulls

Second-Team All-Americans are exceptional athletes. Our tier-two list of ETFs may not be the best performers, but they are still attracting a lot of attention from investors. The table below contains numerous economically-sensitive ETFs that point to investor confidence about future economic outcomes.

Investment Implications

We have seen some subtle shifts in ETF leadership in recent weeks. The emergence of large caps and consumer staples speaks to some economic doubt creeping into the supply and demand landscape. As we noted on November 13, Janet Yellen’s confirmation hearing could provide a catalyst for weak-dollar friendly ETFs (foreign, emerging markets, energy, etc) to move up in the pecking order. Until the composition of the tables above shifts to a more defensive bias, we will continue to hold our positions in U.S. stocks (VTI), technology (QQQ), energy (XLE), financials (XLF), small caps (IWM), foreign stocks (VEU), and emerging markets (EEM). As we noted on November 12, we would like to see some improvement in emerging markets. Should EEM remain weak, we may reduce our exposure for a second time before the markets close Friday.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

ETF Leaders Align With Risk-On Allocations

Published 11/15/2013, 01:00 PM

Updated 07/09/2023, 06:31 AM

ETF Leaders Align With Risk-On Allocations

Market’s Pricing Mechanism

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.