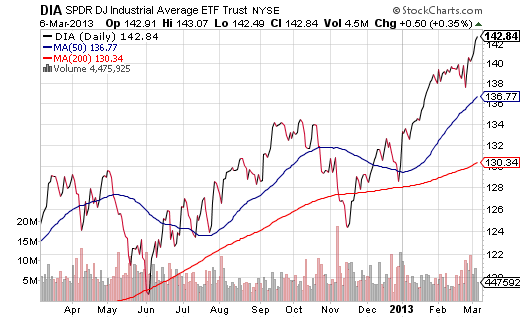

In a “Then and Now” piece, the Wall Street Journal published a number of fascinating statistics. “Then” represented October of 2007… the last time that the Dow Jones Industrials Average notched nominal highs. “Now” represents March of 2013… the first time that the price-weighted index ever closed above 14,250.

Household income has slipped 5.6% since October of 2007. In reality, the “pinch” is more like a wallop because the median dollar values are not adjusted for inflation. Equally challenging for families is the fact that college education at public universities has skyrocketed 33% in the 5 1/2 year period.

What about jobs? The Bureau of Labor Statistics broadest measure of unemployment is the “U-6″ data. It was 8.4% then, and it is 14.4% today. (Note: We might want to recognize that U-6 has gradually improved from 17% since late 2009; however, the trend toward 14.4% is hardly indicative of a robust recovery.)

One statistical comparison that goes a long way toward explaining the Dow’s journey from 14167 to 6600 and back is the rate on 12-month CDs. In October of 2007, you could park your money in a CD for a year and earn a relatively risk-free return of 4.0%. Here in March of 2013, the same 12-month CD gets a paltry 0.3%. As the president of a Registered Investment Adviser with the SEC, I regularly receive inquiries from risk-averse seniors who wonder how they might get 4%-5% today. The answer is, they must move up the risk ladder to some form of bond, loan or preferred vehicle… and they may require some help in managing the downside risk associated with individual securities or diversified ETFs.

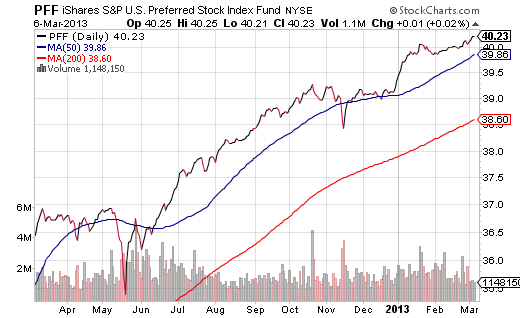

One of my core holdings for these income investors has been the iShares S&P U.S. Preferred Stock Index ETF (PFF). While I will not buy-n-hold it for seniors, I do use it. Not only is the 6% annualized yield venerable, but the price appreciation has been beneficial for several years.

Of course, the biggest statistical “side-by-side” of them all, the one that explains why iShares 7-10 Year Treasury (IEF) only offers a distribution yield of 1.5%, is the expansion of the Federal Reserve’s balance sheet.

In 2007, the Fed held nearly $890 billion in its coffers; today, that value has skyrocketed to $3100 billion, or $3.1 trillion. In essence, the central bank of the United States has been buying hundreds upon hundreds of billions of dollars of U.S. debt obligations with electronically created money that did not exist previously. With poor yield prospects for investment grade debt (e.g., CDs, treasuries, agency, etc.), and with home-buyers able to finance or refinance real estate at record low rates that are tethered to treasury yields, money found its way back into stocks.

An investor could decide that the SPDR Dow Jones Industrials Trust (DIA) is a safe way to get back in. However, it would be more sensible to wait for DIA to pull back to its 50-day for an increment. That’s roughly a 4.2% pullback from current levels.

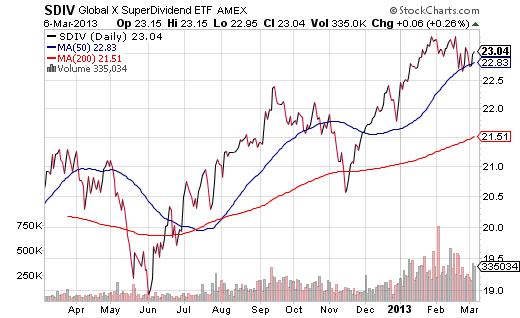

In truth, the only investments that intrigue me at the given moment are those that are closer to that 50-day and those with above average yields that might offset a larger-than-anticipated pullback. Think GlobalX SuperDividend (SDIV). This exchange-traded fund tracks an equal-weighted index of 100 of the highest yielding securities across the globe, largely from Australia and the U.S. SDIV pays out monthly at an annualized distribution yield that is approximately 7.8%. Keep in mind, SDIV is heavily allocated to REITs and telecoms.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

ETF Investors Can Chase Performance Or Exercise Discipline

Published 03/07/2013, 12:55 AM

ETF Investors Can Chase Performance Or Exercise Discipline

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.