Over the last month, investors have witnessed a variety of strange events. The Republican party ungracefully bowed out of its bid to derail Obamacare during the tail end of the government shutdown. The Democrat party helplessly attempted to control damage associated with scores of consumers not being able to keep their health plans or their doctors. Meanwhile, employment data have never been more antithetical, as employers created 200,000-plus net new jobs in October, yet 900,000-plus left the work force in the very same month; the workforce participation rate is the lowest that it has been since March of 1978.

The extreme uncertainty surrounding the implementation of the Affordable Care Act as well as the potential for an adverse economic impact could have caused stocks to struggle. They have not. Similarly, the Chicago Fed estimates that retirees account for only one-fourth of the drop in labor force participation since the Great Recession’s inception. This implies that millions and millions of Americans have not been able to come back to the ranks of income-producing, middle-class consuming citizens. Still, stocks have not missed a beat.

In spite of peculiarities, oddities and heebie-jeebies, investors prefer to remain on the bullish path. The only thing that seems to matter is the probability that a Janet Yellen-led Federal Reserve means more “cowbell.” In fact, even the occasional angst over the possibility that the Fed will slowly rein in its trillion-dollar bond-buying spree has done little to deter the ingrained perception that monetary stimulus will be generous for years.

Is a singular sensation like cheap money enough to maintain a voracious risk-on appetite? Apparently so. Companies are not generating much in the way of revenue with the current price-to-sales (P/S) ratio of the S&P 500 at its highest level since the dot-com collapse. Yet stock investors are ignoring the fundamental data. Margin debt has also revisited levels that have not been witnessed since the dot-com bubble. Still, nobody cares. As long as central banks around the globe continue to create dollars and yen and euros and pounds – as long as they work together to depress global interest rates – the cheap money is finding its way back into riskier assets.

Bull markets can be rational, irrational or somewhere in between. The fact that investors may be growing complacent in this particular phase of the cycle is irrelevant, as long as one adheres to an approach for reducing the risks of participation. In essence, you can ride every kind of wave when you know the precise circumstances under which you would get off the boogie board.

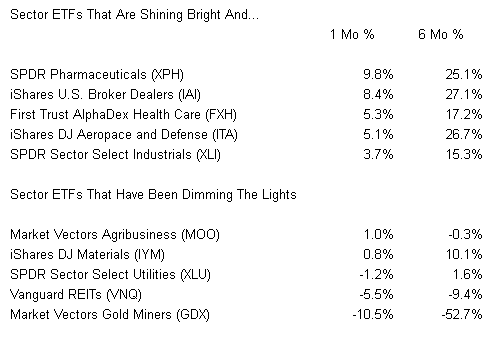

For the time being, monetary policy momentum is pushing stock ETFs to new heights. Nevertheless, some people are wondering if it is advisable to shop for value; some ask if it might make more sense to acquire underperforming sectors as opposed to the same-old stand-outs. To address that inquiry, let’s take a look at the relative strength winners and losers on a month-over-month basis:

In a relatively quick scan, we see that short-term relative strength trends (i.e., 1 month) and longer-term relative strength trends (i.e., 6 months) resemble one another. It follows that one may struggle for quite some time to realize a successful outcome in a momentum-based market with a value proposition. That does not mean there are not worthy contenders. In “What ETF Investors Might Buy Shortly After Tax-Loss Harvesting,” I suggested that the P/E near 10 and price-to-book near 1.5 for Market Vectors Agribusiness (MOO) may certainly attract value seekers.

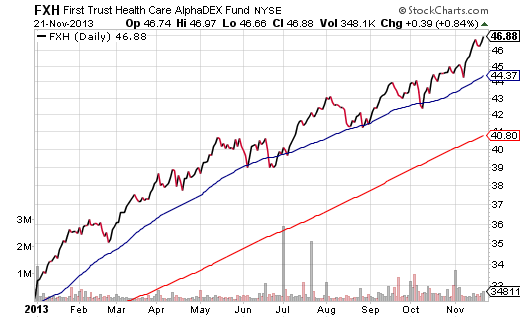

Right now, though, the market’s tone is unlikely to change. The same sector superstars provide the most likely avenue for additional capital appreciation because newcomers are buying the biggest gainers and few shareholders are keen on realizing capital gains taxes. Moreover, success in this rate-sensitive bull market has had the same prescription all year long; specifically, run with defensive sectors that do not crumple if and when interest rates move higher. Those sectors include things like health care, pharmaceuticals and defense/aerospace.

In contrast, real estate investment trusts, utilities and to some extent, telecom, may be defensive in a historical context. However, these yield-oriented income producers underperformed in the same way that bonds have been dragging on portfolios. Commodity and natural resources-related industries — metals mining, materials, agricultural-related — have not been particularly beneficial either. In large part, the drop in emerging market demand over the last few years has been a persistent thorn in the side of last decade’s biggest success stories.

In sum, if you have cash on the sidelines to put to work, there are three decent options available. You can purchase one or more of the biggest winners on near-term bullish momentum, understanding that it is wise to protect one’s interests with stop-limit loss order protection. Or, consider holding onto the cash until a more substantive pullback to a 50-day moving average occurs. These days, that might be a 5% pullback. Or, you could wait a longer time for that elusive 10% sell-off to buy near a 200-day moving average. On the other hand, waiting for the 20% bear might feel like Waiting for Godot.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

ETF Investor Implications Of An Absence In Sector Rotation

Published 11/22/2013, 02:20 AM

Updated 03/09/2019, 08:30 AM

ETF Investor Implications Of An Absence In Sector Rotation

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.