Many assume that a stock market’s direction depends on an economy’s well-being. It does not. In fact, a meaningful correlation between stocks and gross domestic product does not exist.

Why, then, do the financial media focus so intently on the current state of an economy? Presumably, if consumers and businesses are less capable of purchasing products and services from publicly-listed companies, then those companies may struggle to generate the profits that drive the perceived value of share prices. Yet its not the economic condition itself that causes the decline in share prices; rather, it is the fear of economic stagnation turning into economic collapse that sends share prices dramatically lower.

Some folks already understand that fear and greed move market-based securities. Writers and readers alike enjoy quoting Warren Buffett along the lines of being greedy when others are fearful or fearful when others are greedy. In fact, stocks often have their biggest gains smack in the middle of recessions and their largest flops in anticipation of sharp economic downturns. For instance, even though the Bureau of Labor Statistics (BLS) records the 2007-2009 recession as having started in December of 2007, the powers-that-be did not identify 12/07 as the start date until ten months later (10/08). In contrast, the stock market anticipated trouble a full year in advance (10/07) of economists.

It follows that investors can think of stock markets and bond markets as “forward indicators” of economic direction. A stock market that enjoys a significant uptrend can be indicative of economic improvement, while a treasury bond market that enters a significant uptrend can be indicative of hardships ahead. Indeed, one often expects U.S. Treasuries and stocks to move in opposite directions over a period. Conversely, when these asset classes move in the same direction for a length of time, the treasury bond market’s fear is not in sync with stock investor greed.

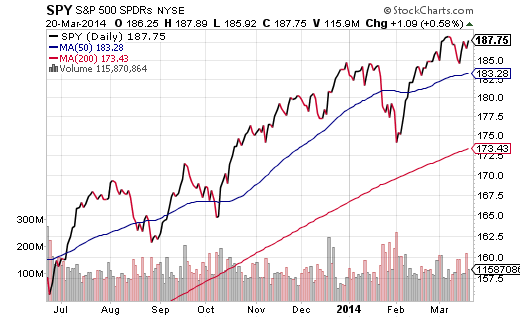

Stocks and treasury bonds have both gained ground over the first three months into 2014. Why the dichotomy? Corporations are performing well; the economy is not.

Corporate success is attributable to a wide variety of factors. Cost containment is relatively easy when there is virtually no pressure to hire or raise wages. Corporations have also enjoyed an ability to borrow cheaply to repurchase shares, equipment or even pesky up-n-coming competitors. In contrast, there are nearly 17 million Americans who cannot find full-time work — up from 10.5 million in late 2007 — and more than 50 million working-aged Americans who have retired early, chosen to study or chosen not to work at all. There is nothing healthy about an average labor force participation rate of 63.2% for 2013. Think about it. On Wednesday (3/19/14), Janet Yellen explained that the Federal Reserve has altered the way it will view “full employment” in the future. Now the Fed has greater flexibility to maintain its zero-interest-rate policy for a longer period than it originally intended — a policy that is synonymous with emergency level stimulus for an economy that cannot stand on its own.

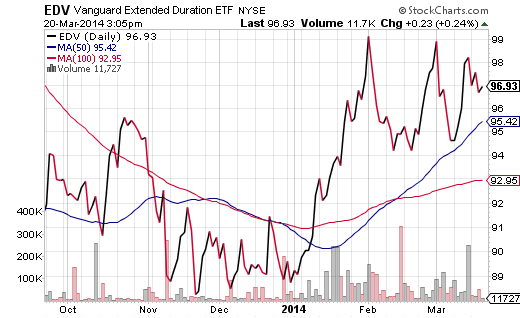

Would long-dated U.S. Treasury bonds in Vanguard Extended Duration (EDV) be flashing buy signals if the bond market believed that the economy merely had a rough go if it this past winter? Probably not.

By the same token, would U.S. stocks via the SPDR S&P 500 Trust (SPY) be sitting comfortably above key trendlines if investors were worried that the economy might slip into recession? Probably not.

Something is likely to give. If the bond gurus are correct, then the economy may be in danger of weakening. The sharp slowdown in home sales since mid-2013 coupled with four consecutive months of existing home sales declines suggests there may be something there. If dip-buying stock gurus are accurate, then the economy is improving at a moderate pace — a pace that will keep borrowing costs relatively low for at least another year or two. The upbeat manufacturing data point for March suggests that the economy is in no danger of flirting with another recession.

Investors who believe strongly in either case might best be served by heavily tilting to one side of the barbell. The near-to-immediate term future of the economy is weak? SPY 20%/EDV 80%. The near-to-immediate term future of the economy is moderate growth? SPY 80%/EDV 20%.

What if you believe, like I do, that the economy is neither weakening significantly nor strengthening significantly? All things being equal, that might be enough for stock assets to climb the proverbial “Wall of Worry” without a hitch. All things are not like 2012 or 2013, though. The Federal Reserve is slowly withdrawing emergency level accommodation, injecting greater uncertainty about how the economy might fare in absence of its rate manipulation.

For my clients, I maintain a larger-than-usual allocation to low volatility equities through funds like iShares USA Minimum Volatility (USMV), SPDR Select Health Care (XLV) and First Trust Technology Dividend (TDIV). The upside may not be as remarkable as small caps or even the S&P 500 during bullish rallies, but the drawdowns tend to be less volatile during the sell-offs. For the income side of the ledger, I have been more willing to allocate to long-term bonds like Vanguard Long-Term Bond (BLV) and Vanguard Extended Duration (EDV) than I had been in 2012 or 2013. Not only does the yield curve continue to flatten, but the diversification is smoothing out the bumpy ride.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.