I tweeted a few facts last week that might have left “followers” believing that I am bearish on stocks. Of course, one does not get to express his thoughts in great detail when he is limited to 140 characters. I wrote: “Avg quarterly profits for Dow companies in 2013 up 2.6%. Avg quarterly sales -0.7%. Yet Dow up 22%.”

The meat of the tweet, however, came in the hashtag (#TechnicalsTrumpFundamentals”). After all, I was not hinting that investors scurry for the exits simply because price-to-earnings ratios and price-to-sales ratios are elevated. On the contrary. I was pointing out the reality that market-based securities can rise and fall on other things than consensus fair value estimates of share prices.

Right now, most stocks and most bonds are moving solely on perceptions of what central banks around the globe may or may not do. For those who claim that an improving economy is the driver of the remarkable bull rally, there’s a mayor in Toronto I’d like you to meet. Similarly, for those who erroneously attribute the run-up to consistent earnings and revenue beats, the facts on quarterly corporate data throughout 2013 speak clear and loud; profit growth is primarily attributable to share buybacks, scaled back human resources and Fed-inspired debt refinancing; sales growth is… well, negative or flat.

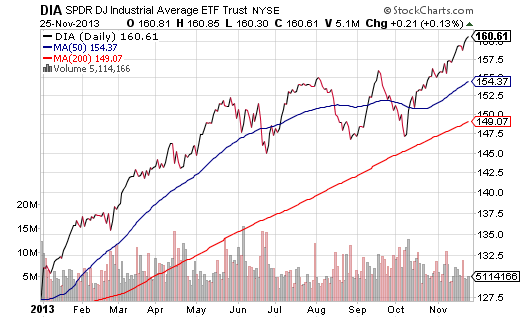

Since monetary policy is the primary driver of the boom in stock prices as well as the pressure in bond prices, and since future policy has become murky, trend analysis offers guidance that fundamental analysis does not. For instance, it has not mattered that corporations in the Dow Industrials are struggling to sell their products and services. In a momentum-based, Fed-fueled rally, what matters is that the current price of the SPDR Dow Jones Industrials (DIA) has stayed comfortably above a long-term 200-day moving average for all of 2013.

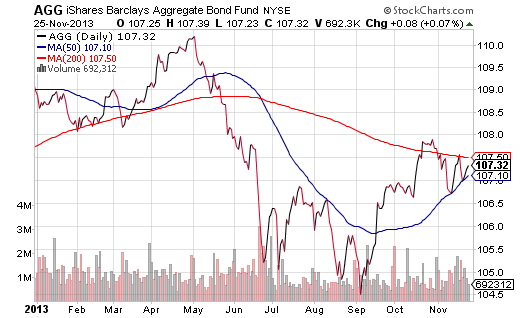

Conversely, the price of iShares Aggregate Bond (AGG) fell below a 200-day long-term trendline in mid-May. The breach occurred at roughly the same time that the Federal Reserve first began discussing the possibility of “tapering” or slowing down its controversial bond-buying program. It should also be noted that the 50-day moving average crossed below the 200-day moving average shortly thereafter — an event that is considered extremely bearish for a particular asset.

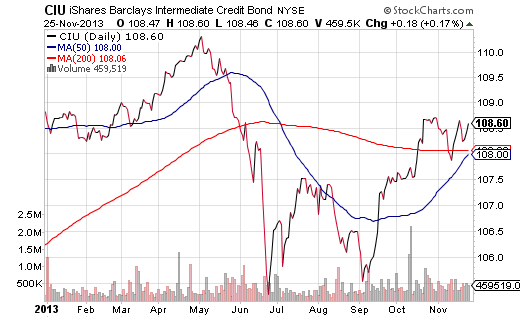

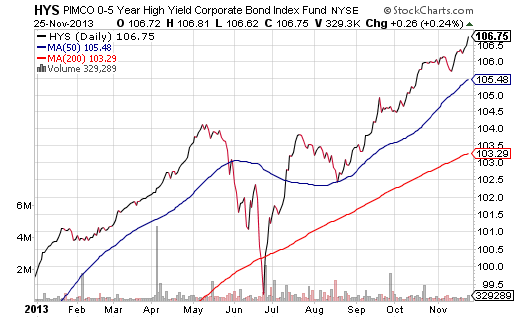

By the same token, we’ve witnessed the Fed hem and haw over its next move. Bond yields have bounced off the ropes. Bond prices have improved, in spite of large outflows from funds. And the current upswing in the 50-day moving average may be telling investors: (a) the Fed will barely taper, if at all, in the months ahead and (b) do not give up on the asset class. Still, the current trends favor corporate credit, whether that is intermediate in duration via iShares Intermediate Corporate or shorter-term high yield via PIMCO 0-5 Year High Yield (HYS).

For the most part, investors are wise to stay the course and trust the technical picture. A breakdown in a specific sector, sub-segment or entire asset class would be easy to spot. That’s why I tweeted the hashtag commentary about the technicals trumping the fundamentals. Let Shiller battle Siegel on supposed fair value – you do not need to take sides in a war that the markets themselves are ignoring.

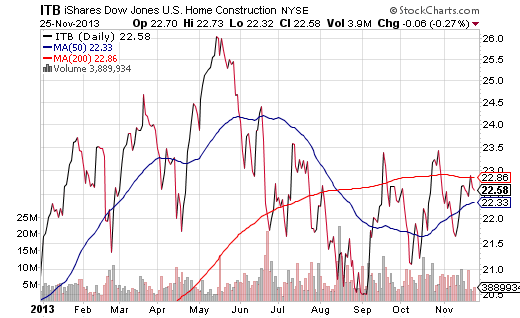

I will mention one thing that does concern me, though – the slump in pending home sales. Not only have we seen the demand slide for five consecutive months, but no amount of optimism from the National Association of Realtors is going to make up for a deadly trifecta. Specifically, exceptionally modest wage growth combined with rising home prices and rising interest rates could put home affordability out of reach. You may want to track new home construction via iShares Home Construction (ITB) for additional insight on investing in an interest rate sensitive environment.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

ETF Investing During A Rate-Sensitive Rally

Published 11/26/2013, 01:37 AM

Updated 03/09/2019, 08:30 AM

ETF Investing During A Rate-Sensitive Rally

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.