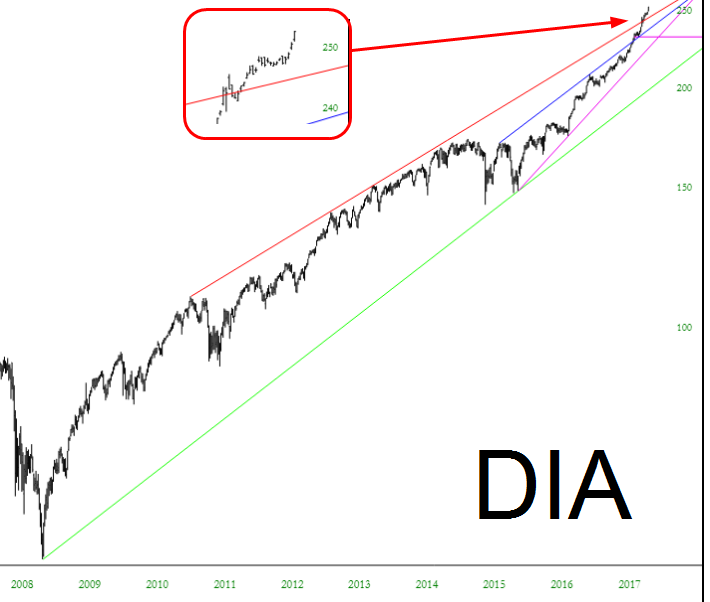

I am composing over flyover country, hence the title. Anyway, to wrap the weekend up, I thought we could look at a few ETFs. First off, here’s the Dow (SPDR Dow Jones Industrial Average (NYSE:DIA)) diamonds. As the inset shows, decade-long trendlines have been pushed aside. We’re in la-la land now, folks; the undiscovered country. Call it what you like, but new highs are a beast to assess, because they tend to feed off themselves until…………they don’t.

And just to prove trillions of dollars (or quadrillions of yen) don’t matter, look no farther than Japan via WisdomTree Japan Hedged Equity (NYSE:DXJ). Jim Cramer never looked so smart. Buy, buy, buy!

Away from equities, charts get a little more interesting. Gold, miners via VanEck Vectors Gold Miners (NYSE:GDX), and junior miners (VanEck Vectors Junior Gold Miners (NYSE:GDXJ)) all have the same challenge: to push past the descending red trendline that’s hemmed it in since September 2011. I’ve got to say, it’s getting closer. Maybe this will be the week they finally do it, but it’s going to take a weak dollar to make it so.

And in case you didn’t get the memo, the market has been a living hell for bears for going on nine years now. Just look at the Ranger Equity Bear fund (NYSE:HDGE).

I mentioned earlier how the dollar had to break to give the gold bugs a break. The dollar via PowerShares DB US Dollar Bullish (NYSE:UUP) is resting on a precipice. This has been the low point for the past few years, and a failure at this support could really give the gold bugs a needed break.

Lastly, here’s the long-term continuous contract for crude oil. It is butted up against its Fibonacci resistance, which has likewise been a high point for the past several years. My view is that it’s going to weaken soon and, at most, would finish its rally at about $67. However, I’m not sure it’s even going to get that far.