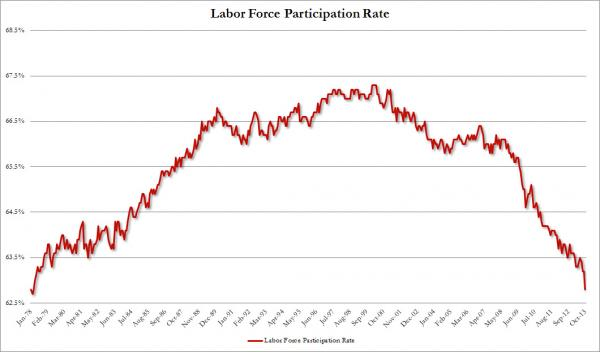

Working-aged adults are leaving the workforce at a faster rate than those who are entering. For all the hoopla surrounding the 200,000 jobs created last month, investors paid very little attention to the 930,000 people who left the labor force in October. These are not 930,000 new retirees; most of these folks have given up hope of landing a job.

Investors should not ignore a frightening trend of the current century. It is one thing to recognize that an aging population will sync up with a gradual decline in the percentage of participants working. On the other hand, the rate of the decline has accelerated dramatically since 2008. At the current rate, the number of non-workers will exceed the number of workers in four years time. How on earth will the minority (employed individuals) financially support the majority (unemployed and non-employed individuals)?

Lowest Since March 1978 I realize the potential to come across as alarmist, and that is not my intention. I am not abandoning stocks in a technical uptrend; fund flows into stock assets remain vibrant; corporations have refinanced their debts at the Fed’s ultra-low and ultra-manipulated rates. In essence, the bull market has not yet run its course.

Nevertheless, I believe it is foolish to overlook some of the more daunting realities of jobs in America. The average duration of unemployment is roughly 3x longer than the historical median going back to 1948. Does this reflect an economy that is healing? If one adjusts the unemployment rate of 7.3% for labor force participation in 2008, the unemployment rate would be 11%. Is this a sign of economic improvement?

Media hype of labor market improvement, rising bond yields as well as political pressure may combine to force the Federal Reserve to pull back the reins on its dollar devaluing, rate manipulating program. If this occurs in the next few months, the initial reaction by stock market bulls would be positive; the spin would be that the Fed must believe that the U.S. economy is capable of supporting itself without the emergency stimulus of the last five years. In truth, however, the Fed succumbing to such pressures would result in a flattening of home demand as well as continued reservations by corporations to hire. (Why add employees in a rising rate environment and waning consumer activity when those costs may adversely affect profit margins?) Stocks in the intermediate-term would likely get slammed as well.

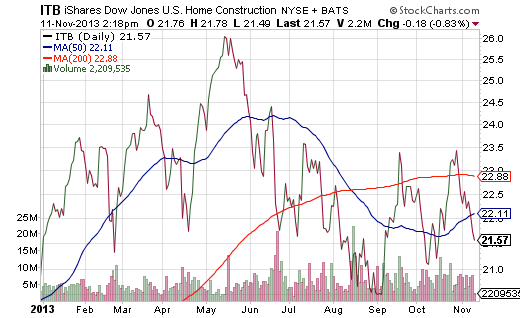

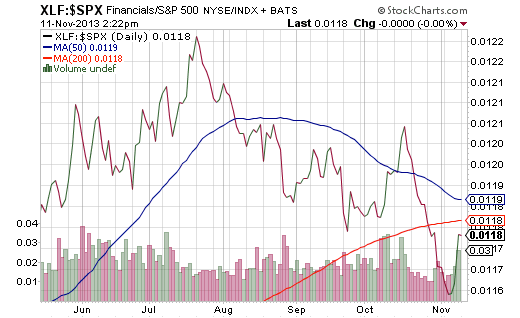

ETF enthusiasts should not ignore two major trends that have been in play since the Fed first suggested that it might “taper” its U.S. bond buying. First, homebuilders via iShares DJ Home Construction (ITB) have failed to gain any traction since the world first received wind of the potential for a Fed shift. Equally concerning, financial stocks via SPDR Select Financials (XLF) have drastically dropped from the ranks of sector leadership. The XLF:S&P 500 price ratio demonstrates the dwindling faith in financial corporations and an extraordinary amount of relative weakness.

The Fed should never have left emergency stimulus in place for five years; rather, the U.S. had an opportunity to struggle a bit through the Great Recession and eventually get through it. Instead, the financial markets are now entirely dependent on the drug fixation of ultra-accommodative rates whereby deflating the balloon slowly may or may not be possible.

The Fed may be hoping and praying that the shrinking labor force will compel employers to raise wages to maintain talented human resources and/or hire high-quality talent. Unfortunately, I think that hope remains elusive. Small businesses that make up the bulk of hiring capacity will be reluctant to add full-timers in the wake of the Affordable Health Care law.

My advice? Keep riding the wave as long as it is working, regardless if the reasons are rational are irrational. Stick with dividend growers via funds like Vanguard Dividend Growth (VIG) and/or aristocrats via SPDR S&P Dividend (SPY). When a respective trend breaks, or a stop-limit loss order hits, honor it. There’s no shame in locking in gains or small losses — only foolishness in holding until your portfolio suffers monstrous losses in a foreseeable crisis.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

ETF Casualties Of The October Jobs Report

Published 11/11/2013, 03:02 PM

Updated 07/09/2023, 06:31 AM

ETF Casualties Of The October Jobs Report

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.