Residential real estate investment trust (“REIT”), Essex Property Trust Inc. (NYSE:ESS) delivered a better-than-expected performance for second-quarter 2017. The company reported core funds from operations (“FFO”) per share of $2.97 for the quarter, beating the Zacks Consensus Estimate of $2.92. Core FFO per share also improved 8.4% from the year-ago quarter figure of $2.74.

Results reflect solid growth in revenues. The company has also raised its outlook for full-year 2017.

Total revenue of $339.1 million in the quarter exceeded the Zacks Consensus Estimate of $336.2 million and was up 5.4% year over year.

Per the management, during the second quarter, the market environment was “more favorable than expected”, especially in Seattle and Northern California. This was partly due to the delay in the delivery of new apartments. However, “periodic disruption from large concessions” is expected to continue when a number of “competing apartment communities are simultaneously in lease-up within the same submarket”. Amid this, for the next few years, management anticipates rental growth in core coastal markets to “trend near long-term averages”.

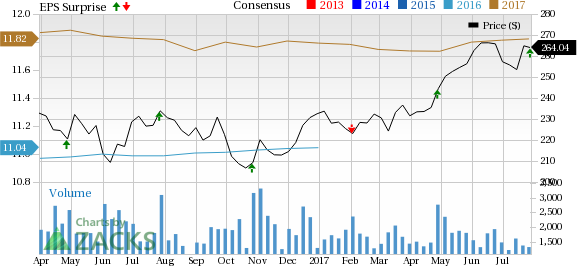

Note: The EPS numbers presented in the above chart represent funds from operations (“FFO”) per share.

Quarter in Detail

During the quarter, Essex Property’s same-property gross revenues grew 3.9% from the prior-year quarter, while same- property net operating income (NOI) improved 4.7% year over year. Financial occupancies of 96.4% expanded 40 basis points (bps) year over year.

Essex Property exited second-quarter 2017 with cash and cash equivalents, including restricted, of $199.9 million, up from $170.3 million at the end of 2016. As of Jul 24, 2017, the company had $1.025 billion in undrawn capacity on its unsecured credit facilities.

During the second quarter, the company issued 311,873 shares of common stock through its equity distribution program at an average price of $260.30. This helped in the generation of net proceeds of $80.6 million.

Outlook

Essex Property raised its guidance for 2017. The company projects core FFO per share in the range of $11.70–$11.96 from $11.56–$11.96 guided earlier, denoting an increase of 7 cents at the mid-point. The Zacks Consensus Estimate for the same is currently pegged at $11.82.

Further, the company revised estimates for same-property gross revenue growth to 3.2–4.0% from the prior range of 3.0–4.0%, indicating an uptick of 10 bps at the mid-point. Same-property NOI is now guided in the band of 3.3–4.6% from the previous range of 2.8–4.6%, marking a 30 bps expansion to the mid-point.

For third-quarter 2017, the company projects core FFO per share in the $2.88–$2.98 range. The Zacks Consensus Estimate for the same is currently pegged at $2.97.

Conclusion

We are encouraged with the better-than-expected performance of Essex Property in the reported quarter. With a strong property base and solid balance sheet, it is likely to leverage on favorable demographic trends in its markets. The company’s substantial exposure to the West Coast market, which is home to several innovation and technology companies, offers ample scope to boost its top line over the long term.

However, elevated apartment deliveries remain a concern. This results in aggressive rental concessions and moderate pricing power of landlords. In fact, such situations are expected to periodically disrupt the company’s earnings.

Essex Property currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In addition, the stock has rallied 13.6% year to date, outperforming the 6.3% gain of the industry it belongs to.

Among other residential REITs, UDR Inc. (NYSE:UDR) reported FFO as adjusted per share of 47 cents for second-quarter 2017, matching the Zacks Consensus Estimate. The figure also came higher than the prior-year quarter tally of 45 cents. Total revenue improved 3.8% year over year to $248 million. Additionally, it exceeded the Zacks Consensus Estimate of $246 million. Growth in revenues from same-store and stabilized, non-mature communities backed the increase. (Read more: UDR Q2 FFO In Line with Expectations, Revenues Increase)

Also, Equity Residential (NYSE:EQR) reported second-quarter 2017 normalized FFO per share of 77 cents, in line with the Zacks Consensus Estimate. The figure came in higher than 76 cents reported in the year-ago quarter. Results reflected enhanced same-store net operating income (NOI) and lease-up NOI. However, the company experienced adverse impact on NOI, primarily stemming from its 2016 huge disposition activity. Also, the company incurred higher interest expense in the quarter. (Read more: Equity Residential's Q2 FFO in Line, Revenues Beat)

Let us now look forward to the earnings release of well-known residential REIT – AvalonBay Communities, Inc. (NYSE:AVB) – which is expected to come up on Aug 2.

Note: FFO, a widely used metric to gauge the performance of REITs, is obtained after adding depreciation and amortization and other non-cash expenses to net income.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaries," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

AvalonBay Communities, Inc. (AVB): Free Stock Analysis Report

Equity Residential (EQR): Free Stock Analysis Report

United Dominion Realty Trust, Inc. (UDR): Free Stock Analysis Report

Essex Property Trust, Inc. (ESS): Free Stock Analysis Report

Original post

Zacks Investment Research