Delays in closing contracts in the core business resulted in a revenue shortfall for eServGlobal Ltd (AX:ESV) in FY17, although some of these have now been signed and will contribute from FY18. Continued efforts to reduce the cost base should reduce the break-even revenue level to c €12.5m/A$19min FY18, which the company is aiming to achieve through focusing on additional sales to its existing customer base. eServGlobal participated in the recent HomeSend funding round, marginally increasing its stake to 35.7%.

Delayed contract signings hit FY17 revenues

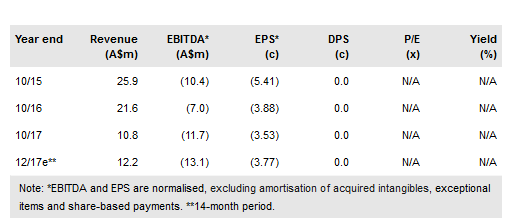

eServGlobal expects to report FY17 (14 months to 31 December 2017) revenues of €8.3-8.5m/A$12.1-12.4m, below its guidance range of €9.7-11m. This was due to some of the contracts expected to sign in Q417 actually being signed in January. These contracts are worth €3m/A$4.6m over three years. The company is making progress in cutting its cost base: it expects to enter FY18 with an annualised cost base of €12.8m/A$19.6m and hopes to reduce this to €12-12.5m/A$18.4-19.1m through the course of the year.

To read the entire report Please click on the pdf File Below: