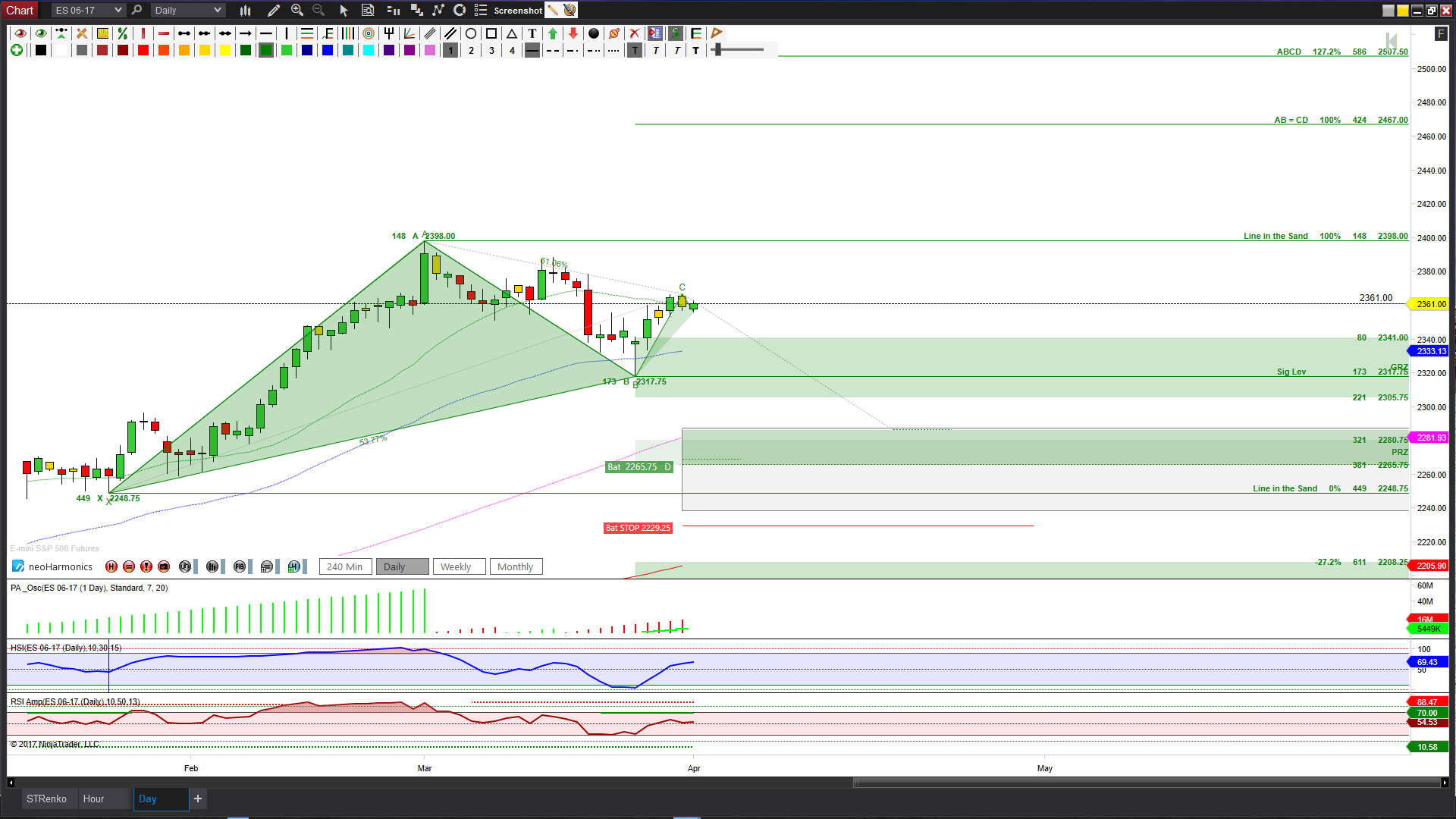

ES_F has a harmonic pattern Bat emerging on both the Day and intraday charts.

Day chart shows where price can brk & hold outside Friday’s range offers clue for initial directional bias. Above 2366.75 implies price still forming the third of four legs for this pattern with 2398 as the extreme for this scenario. Below 2356.75 increases the probability of testing first the green GRZ (Golden Ratio Zone aka the 38.2% to 61.8% fibs), this is a nice gauge region because below there highly increases the probabilty of completing the Bat at 2265.75.

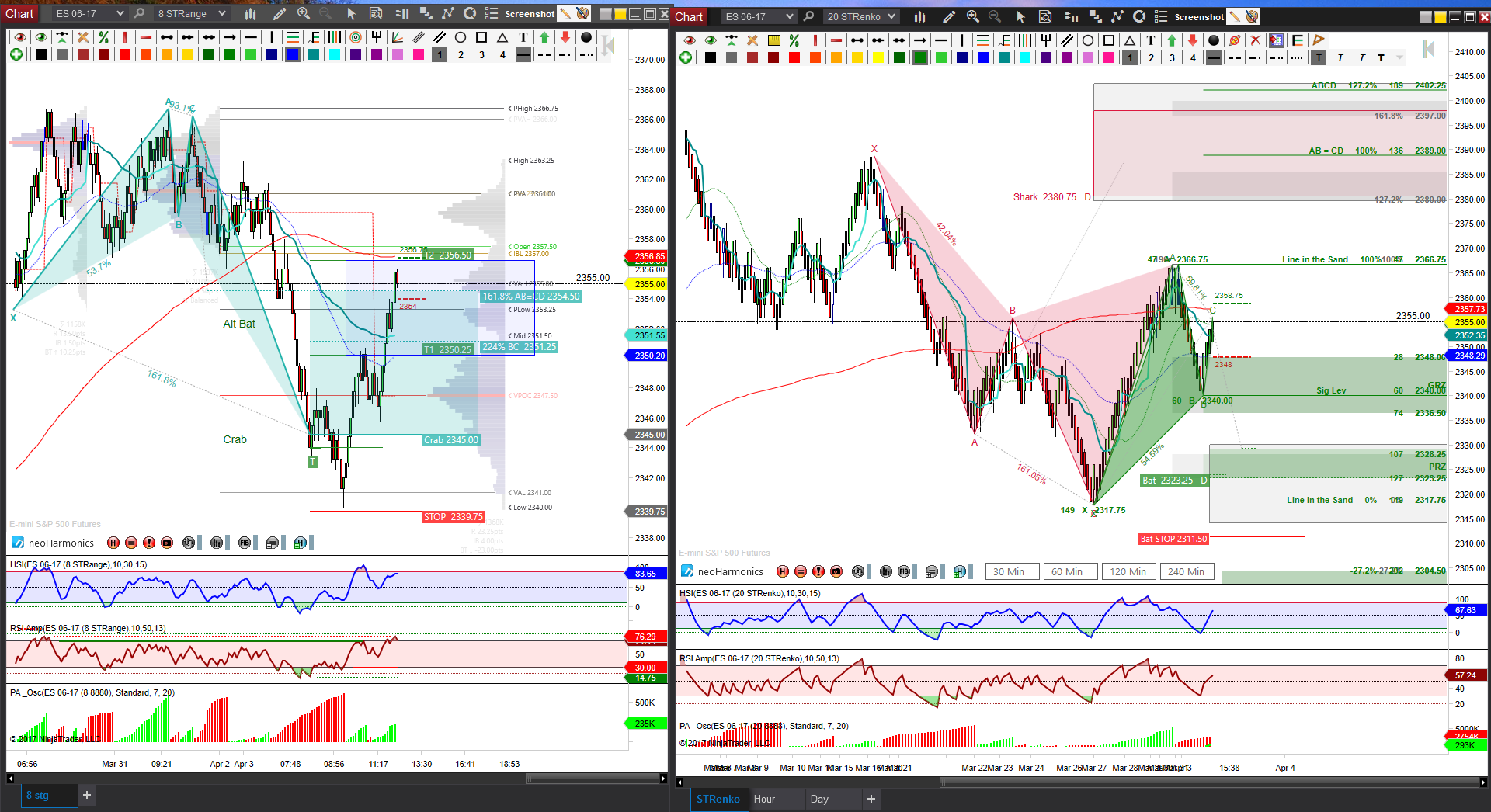

For the intraday perspective, I’m using an STRenko 20 bar chart on right and STRange 8 bar chart on left.

The STRenko 20 chart shows price is in between opposing emerging patterns but currently on upside pull thanks to STRange 8 retracing a cyan colored bullish Crab. Thus far ES has had an expansion day with very important resistance test at 2356.5 to 2357.5 region.

A hold above 2357.5 has magnet at 2361 area but harmonically speaking the ideal target is 2380, however due to existing expansion, the probability of latter target being tested today is not very high.

As long as price holds below 2356.5, the initial pullback target for key support test is 2350.25 to 2348, a break down there increases the probability of playing out the emerging green Bat at 2323.25.