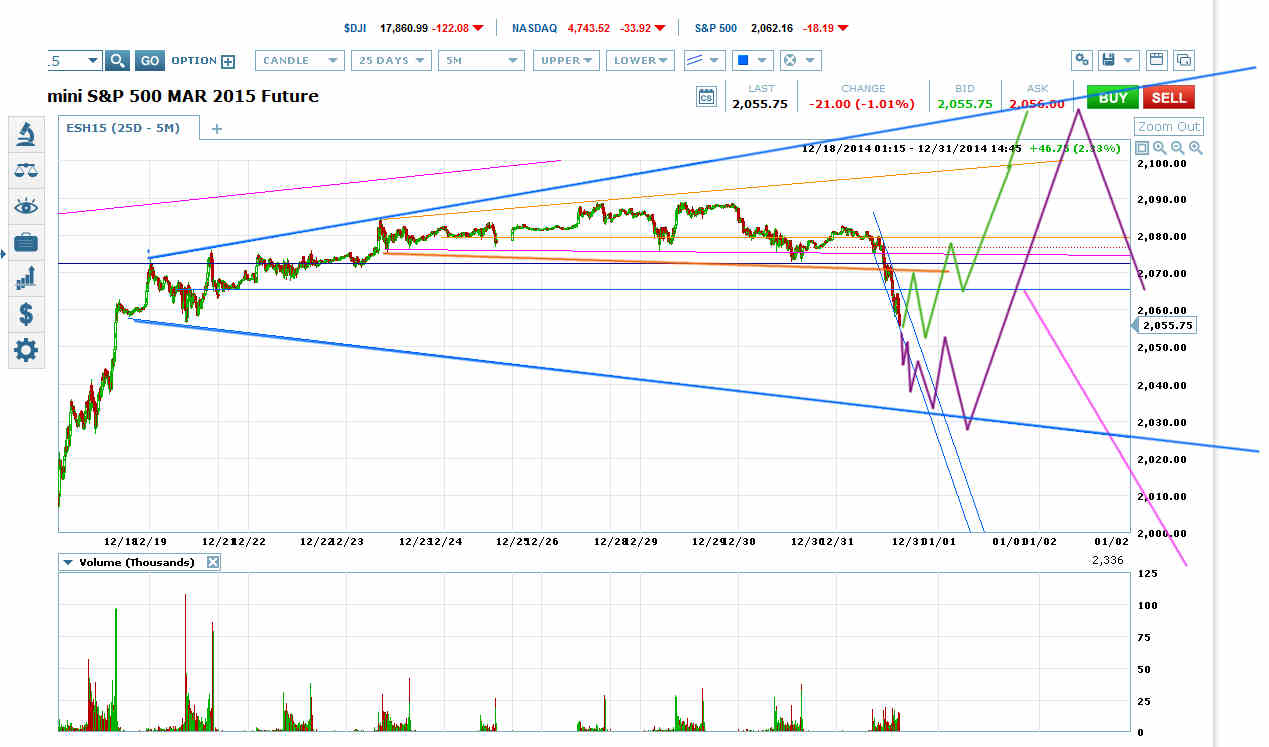

ES-Yesterday's move down has formed a small price channel (blue on chart), which means the dip will be small.

It could be bottoming now, across roughly VWAP of the bright blue megaphone on the chart. Or it could still go all the way to the bright blue megaphone bottom (it’s deciding as I type this).

Either way, the next target is the bright blue megaphone top.

If the price should get all the way to the blue megaphone bottom, there’s about a 30% chance that the price will retrace only to the blue megaphone VWAP and reverse there into a dip with a target of the 3-year price channel bottom at (ARCA:SPY) 190ish. And I wouldn’t be surprised to see a smallish breakout through that channel bottom.

Update: Here is the price channel and roll-over channel as the action died down after the close.

ES got hung up at the end of the day yesterday at the bottom of the rolldown price channel, and looks like it will continue to the bright blue megaphone bottom in the course of forming a bottom for yesterday's dip.

Then it’s up to at least the bright blue megaphone VWAP at roughly ES 2065, and probably back to the bright blue megaphone top somewhere over 2100. The next top should lead to a pretty serious correction, but still not yet The Big One.