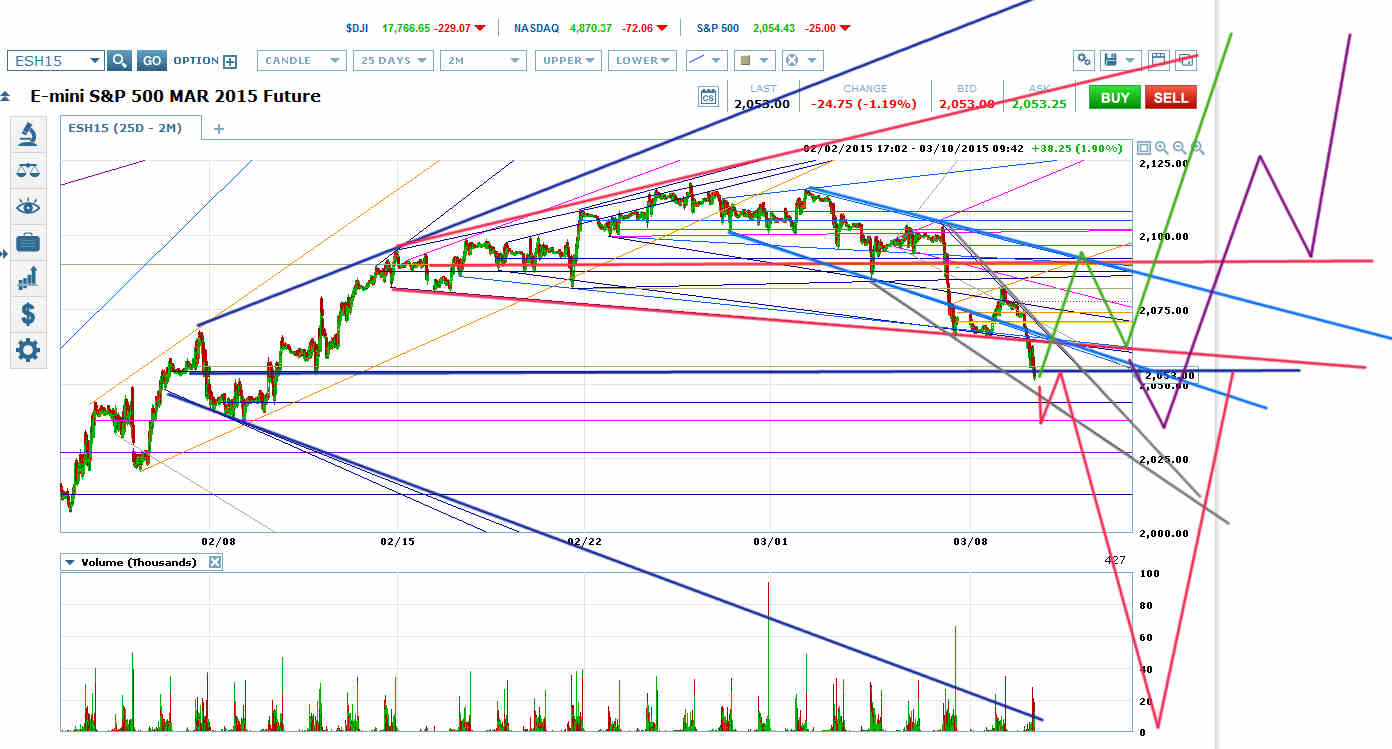

ES has now added a falling wedge (gray on chart) to its falling megaphone (bright blue) and likely megaphone bottom patterns within a collection of megaphones and interior megaphones.

The nice thing about the gray falling wedge is that if the market is really going to go to hell here, it provides us with a nice set-up to be short for it. Just short on a genuine downward breakout from the falling wedge. You would see a pierce of the bottom, a retrace into the formation, and then a breakout past the first breakout low. That would also be a breakout through the navy blue megaphone VWAP.

However, that scenario is very unlikely, partly because of the red megaphone and partly because of the falling wedge and partly because of the bright blue falling megaphone. Falling megaphones rarely break out the bottom.

What’s most likely happening is that this morning’s wave down is part of the bottoming megaphone for the bright blue falling megaphone. Most likely the next swing up within that megaphone will be to the red megaphone VWAP and top of the bright blue falling megaphone.

But falling megaphones seldom break out so far above their low, so there will likely be another wave down to a lower low for both it and the bottoming megaphone (purple scenario).

The retrace to the red megaphone VWAP will look like an even better right shoulder on the H&S, and people will short it like crazy. The (ARCA:SPY) put-call ratio ought to be through the roof heading into opex week.

That would be a perfect set-up for an opex week melt-up.

Set-Ups

At this point, traders skilled at short-term moves can play the megaphone wave back up to the red megaphone VWAP and down to a new low.

Most traders should wait for an upward breakout from the falling wedge to play a short-term long to the red megaphone VWAP. Exit the trade there, then wait for the breakout from the bright blue falling megaphone to go long again to a new high.

But everyone should get short on a genuine downward breakout from the gray falling wedge, if it occurs.