Sometimes, it pays to be lucky and skilled when deploying technical analysis and price theory. We caught an early move in ERY back in June 2019 for a nice profit.

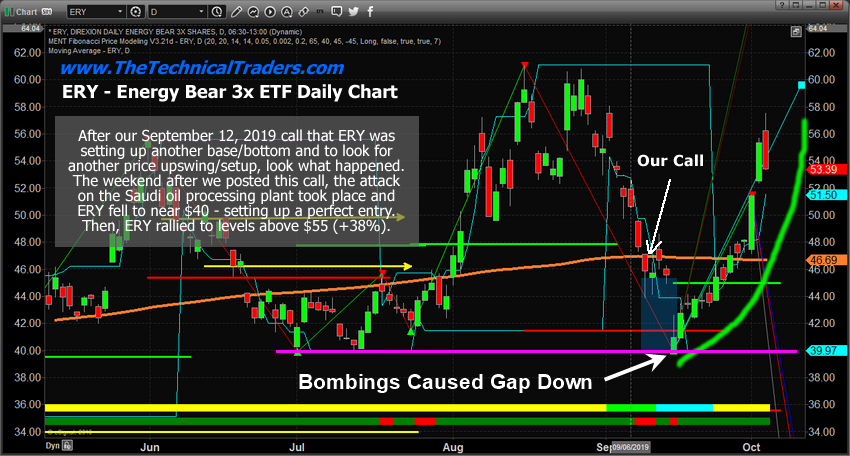

Then watched as price fell back towards the $44 price level – expecting another base/bottom setup to form. On September 12, 2019, we issued a research post suggesting to our followers that ERY is reaching a key low point and that traders should start looking for the next move.

We had no idea that Yemen would launch a drone attack on Saudi Arabia crippling their oil production capacity within 5 days of that research post. All we knew was that ERY was moving back towards a historical low price level that would present another opportunity for skilled traders – an opportunity for profits.

At that time, we believed any price level near of below $45 would qualify as a solid entry point and warned our followers to “watch for any deeper price moves below $45” for key entry levels. 5 days later, a very deep price level printed (near $40) after the attack on the Saudi oil plant. What happened next?

September 12, 2019: ENERGY SECTOR REACHES KEY LOW POINT – START LOOKING FOR THE NEXT MOVE

Daily ERY – Energy Sector ETF Chart

The first real opportunity for a deeper price move below $45 happened on the following Monday after the attack near $40. This constituted a very deep price decline and provided multiple days of opportunity for entry below $44.

Nearly 3 weeks later, the ERY price rallied to levels above $56 reaching a solid +35% gain. As we stated, sometimes it pays to be lucky and skilled when trading. We hope some of you were able to follow our research and catch a part of this move?

Concluding Thoughts:

Get ready for the next big move in ERY, folks. If our research is correct, another setup will happen before the end of October with another basing level below $45 and another attempt at a rally in ERY with upside targets settling near $55 or higher. It’s just a matter of time before this new basing/bottom setup takes place. We’ll keep you informed when we believe the timing is right to look for new entry points.

As a technical analysis and trader since 1997, I have been through a few bull/bear market cycles. I believe I have a good pulse on the market and timing key turning points for both short-term swing trading and long-term investment capital. The opportunities are massive/life-changing if handled properly.