Investing.com’s stocks of the week

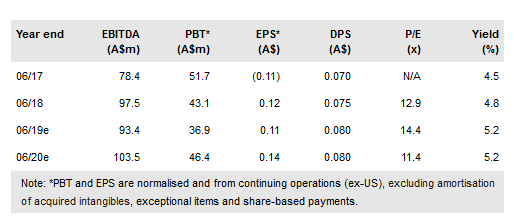

In the context of the FY18 results (23 August), ERM Power Ltd (AX:EPW) announced its intention to sell US supply activities, which we view as very positive, as we expect this business to continue to generate significant negative profit and cash flow. On an underlying basis, FY18 EBITDA was 12% better than expected, while net income was in line with our forecast. On the negative side, the company moved from a net cash position to a net debt position as a result of cash outflows related to derivatives variation margins. Overall, we see the announcement of the US business sale as a major positive catalyst and expect the stock to reverse the negative share price performance since the US outlook downgrade at the end of May.

Intention to sell US business a positive

ERM Power announced its intention to sell its entire US business by 31 December 2018 and that the process is “well advanced”. We view the news very positively as: 1) ERM Power has struggled to improve the financial performance of this business over the past few years and unitary margins have reduced significantly; 2) we expect the business to generate A$20m+ negative cash flow and a similar negative impact on group net income in FY19, with a large impact on the group; and 3) the recent US outlook downgrade drove large share price underperformance (-27% since May to 22 August).

To read the entire report Please click on the pdf File Below: