ERM Power (ASX:EPW) has announced a takeover offer by Shell (LON:RDSa) Energy Australia for 100% of its share capital at a cash price of A$2.465 per share, broadly in line with our DCF-based base case valuation of A$2.4/share. ERM’s directors and the largest shareholder, Trevor St Baker, support the proposal, which will be subject to shareholder approval – likely in or around early November 2019.

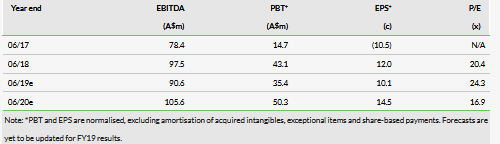

Shell (LON:RDSa) proposes to acquire 100% of ERM’s share capital for a cash price of A$2.465 per share. ERM’s directors support the proposal and unanimously recommended that shareholders vote in favour. Trevor St Baker, who currently owns 27.39% of ERM Power, has confirmed to the directors that he intends to vote in favour of the proposal. The cash offer represents a 43.3% premium to closing price on 21 August 2019 of $1.72 and implies 23.6x 2019 P/E, reducing to 14.6x in 2021 based on our current forecasts.

The offer is broadly consistent with our base case, sum-of-the-parts DCF valuation of A$2.4/share, which assumes no value for the Energy Solutions business (as it has not yet reached break-even). Our investment case for ERM is focused on the strong cash flow generation of the core retail activities, and the long-term growth opportunities for Energy Solutions and power generation activities. At the same time as the takeover announcement, ERM reported FY19 results in line with our forecasts, although the result from the Energy Solutions business was lower than we expected, offset by stronger retail and power generation. The outlook for FY20 was slightly below our forecast, owing to a lower contribution from Energy Solutions and slightly lower margins in retail.

Business description

ERM Power is an Australian commercial and industrial energy retailer and trader founded in 1980 and listed in 2010. It operates an electricity supply business (second-largest retailer to C&I customers) and two gas-fired generation plants. A key area of growth is energy solutions.