Market Brief

In Asia, the sell-off in equity markets calmed down as traders tried to determine the bottom. The CSI 300 found a strong support at around 3,400 points and is currently trading slightly higher, up 0.30% over the session. In 2015, shares of tech companies out-performed other industrial sectors and also enjoyed a faster recovery after the late summer sell-off. However, those shares suffered a more severe correction at the beginning of this year as the Shenzhen Composite fell another 1.86% on Tuesday. Nevertheless, the panic is now over as China tries to stabilise markets by extending the ban on the sale of certain stocks, while state-owned funds buy stocks to end the bloodbath. The PBoC set the fixing higher to 6.5159, the highest level since early 2011.

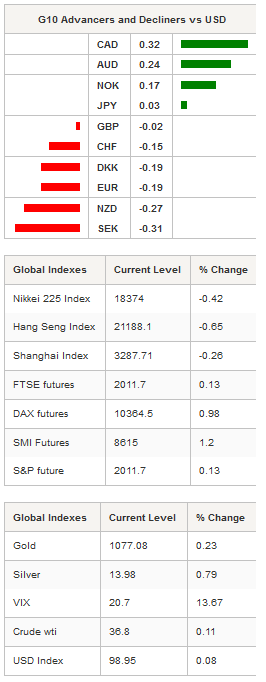

In the FX market, the US dollar has recovered since the mid-European session and erased previous losses against the Japanese yen as risk-off sentiment diminishes. The pair moved as high as 119.70 in Tokyo before stabilising around 119.50. We continue to believe that the upside is quite limited given the lack of solid fundamentals from Japan. However, the latest economic indicators from the US are far from promising as ISM manufacturing fell to 48.2 versus 49 expected and 48.6 previous reading, furthermore construction spending contracted 0.4%m/m in December, while economists were expecting an expansion of 0.6%; previous reading was revised lower to 0.3% from 1.0% initially. Finally, Markit manufacturing PMI eased to 51.2 from 51.3 first estimate but beat market expectations of 51.1. The US manufacturing sector will remain widely exposed over 2016 as the combined effects of weak global demand and strong US dollar will continue to weigh on US exports.

Commodity currencies recovered somewhat in spite of continued pressure on crude oil prices - which are exacerbated by escalating tensions between Iran and Saudi Arabia. The Canadian dollar appreciated 0.30% against the US dollar after failing to break the strong 1.40 resistance implied by the high from May 2004. USD/CAD should remain below this threshold as the lack of significant good news from the US economy prevents the greenback from appreciating further. The Aussie also traded higher in Tokyo, partially erasing yesterday losses. AUD/USD currently sits on its 50dma at around $0.72 while on the upside, the 0.7382 level will act as resistance (high from October 12th 2015).

In Europe, equity futures are wearing green this morning pointing to a higher open for all equities across Europe. The Euro Stoxx 600 was up 1.16%, the DAX 0.98%, the CAC 40 1.13% while the SMI rose 1.20%. Gold continues to enjoy its safe haven status and rose 0.23% to $1,077.10.

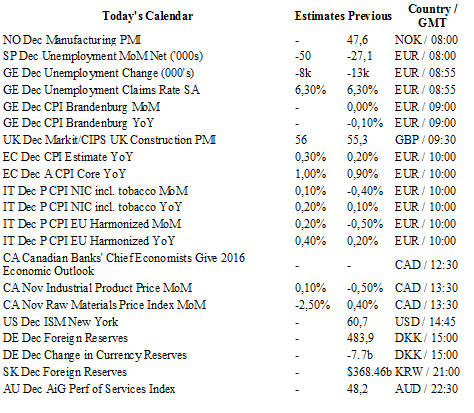

Today traders will be watching manufacturing PMI from Norway; unemployment from Spain and Germany; Markit/CPIS construction PMI from the UK; CPI report from the eurozone and Italy; industrial product price from Canada.

Currency Tech

EUR/USD

R 2: 1.1387

R 1: 1.1095

CURRENT: 1.0808

S 1: 1.0458

S 2: 1.0000

GBP/USD

R 2: 1.5529

R 1: 1.5242

CURRENT: 1.4713

S 1: 1.4566

S 2: 1.4321

USD/JPY

R 2: 125.86

R 1: 123.76

CURRENT: 119.25

S 1: 118.07

S 2: 115.57

USD/CHF

R 2: 1.0676

R 1: 1.0328

CURRENT: 1.0044

S 1: 0.9786

S 2: 0.9476