Equity Residential (NYSE:EQR) has announced an increase in its first-quarter 2019 dividend. The company will now pay 60.25 cents per share, which reflects a hike of 6.2% from the prior dividend of 56.75 cents.

Based on the hiked rate of 60.25 cents for the quarter, the annual dividend comes to $2.41 per share. This new dividend will be paid out on Apr 13 to the company’s shareholders of record on Mar 23, 2020. At this new rate, annualized yield comes in at 3.44%, based on the stock’s closing price of $70.01 on Mar 12.

This residential REIT also announced that its annual meeting of shareholders will be held on Jun 25 in Chicago, IL.

The latest raise reflects Equity Residential’s ability to generate a solid cash flow through its operating platform and high-quality portfolio. With the current cash flow growth rate of 23.84%, ahead of its industry’s average of 15.08%, the increased dividend is likely to be sustainable.

Earlier in January, the company reported fourth-quarter 2019 normalized funds from operations (FFO) per share of 91 cents, surpassing the Zacks Consensus Estimate of 89 cents. Moreover, normalized FFO per share figure was 8.3% higher than the 84 cents reported in the year-ago quarter. Results mirrored improved same-store net operating income and growth in average rental rate.

Notably, Equity Residential is poised for growth amid job-market gains, favorable demographics, lifestyle transformation and creation of households. Furthermore, the company is anticipated to benefit from its portfolio-repositioning efforts in high barrier-to-entry/core markets.

The company has a proven track record of opportunistic acquisitions, timely dispositions and focused development. Moreover, on the capital front, it is actively capitalizing on the favorable environment. In November, Equity Residential fortified its financial position by entering into a $2.5-billion multi-currency revolving credit facility, replacing its prior $2-billion credit agreement. The company also expanded the maximum scale of its unsecured commercial paper note program from $500 million to $1 billion. Such strategic measures are aimed at strengthening the company’s outstanding balance sheet, liquidity and financial flexibility.

However, new apartment supply across its markets might partly impede the company’s growth momentum in the future, straining lease rates, occupancy and retention as well as offering high concessions.

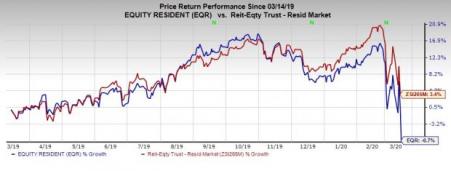

Shares of this Zacks Rank #3 (Hold) company have declined 6.7% over the past year compared with the industry’s growth of 3.4%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Stocks to Consider

Boston Properties (NYSE:BXP) currently carries a Zacks Rank #2 (Buy). The company’s FFO per share estimate for first-quarter 2020 has been revised 1.1% upward to $1.82 in two months’ time.

Highwoods Properties’ (NYSE:HIW) currently carries a Zacks Rank of 2 and the Zacks Consensus Estimate for the current-year FFO per share has moved marginally upward to $3.64 over the past month.

Piedmont Office Realty Trust (NYSE:PDM) is currently Zacks #2 Ranked. The company’s FFO per share estimate for 2020 has been revised 3.2% upward to $1.96 in two months’ time.

Note: Anything related to earnings presented in this write-up represents funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

Zacks Top 10 Stocks for 2020

In addition to the stocks discussed above, would you like to know about our 10 finest buy-and-hold tickers for the entirety of 2020?

Last year's 2019 Zacks Top 10 Stocks portfolio returned gains as high as +102.7%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys.

Access Zacks Top 10 Stocks for 2020 today >>

Highwoods Properties, Inc. (HIW): Free Stock Analysis Report

Boston Properties, Inc. (BXP): Free Stock Analysis Report

Equity Residential (EQR): Free Stock Analysis Report

Piedmont Office Realty Trust, Inc. (PDM): Free Stock Analysis Report

Original post

Zacks Investment Research

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Equity Residential (EQR) Announces 6.2% Hike In Dividend

Published 03/13/2020, 12:04 AM

Updated 10/23/2024, 11:45 AM

Equity Residential (EQR) Announces 6.2% Hike In Dividend

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.