Global markets continue to decline…when will they stop?

Global markets are in panic mode as the full scale of China’s slowdown becomes clearer and the market pricing for a Fed September rate hike is unwound. Asian markets are a sea of red. WTI has fallen a further 1% in Asia trading today, and the word on everyone’s lips is deflation – poison for equity markets. The phenomenal six-year bull market may finally meet its match in China-induced global deflation. The excess supply of commodities and the potential for further devaluations in the CNY not only make a Fed rate hike in September unlikely, but increasingly even put a December rate hike at risk.

Global markets are acutely China-sensitive at the moment. Today’s Caixin manufacturing PMI came in at 47.1, below expectations for 47.7. Asian markets were already down, but saw noticeable further drops when the PMI number came out at 11.45am AEST. China’s currency devaluation, further stock market declines, and now another weak PMI appear to have put it front-and-center in investors’ minds at the moment.

The renewed swoons in commodities since July have been driven by increasingly worse China data. In a way it seems odd – China’s steady slowdown has been relatively well sign-posted by a range of deteriorating indicators for 12 months or more. And oddly enough, China’s growth prospects look likely to improve in 2H. As the deadline for 7% growth looms, all levels of government are likely to open up the fiscal purse to hit their budget targets. While this may give some support to commodities involved in fixed asset investment (iron ore etc), they will still be battling against headwinds of record over-supply in many sectors.

The most important trend in the market at the moment is the interconnection between further CNY devaluation, its global deflationary impact, and the Fed postponing rate hikes.

China likely needs to cut the reserve requirement ratio (RRR) and devalue further before the end of the year. With the Fed minutes and inflation data pushing the probability for a September rate hike down to 32%, December now seems the most likely date if they are to hike this year. However, with a range of liquidity measures continuing to tighten, China will likely be forced to act before then. The big question is what happens when a major deflationary impact hits global markets before the Fed hikes rates, how much longer will the Fed funds rates stay at zero? And can the distortions in global markets handle such a protracted period of time?

There has been a lot of research recently stating that historically US stock markets have not dropped on the first rate hike. But the question may now be: can they drop dramatically before the first rate hike? With every meeting that pushes the rate hike back, confidence about the US economy continues to fall and this hurts hopes for global growth.

The record declines overnight in the US markets were broad-based and no longer primarily focussed on the energy and materials sector. Currencies in Asia have taken a beating again today, with the MYR falling over 1.2% and the KRW dropping 0.7%. But of most interest is the central bank divergence trade unwinding. The EUR and the JPY have been some of the few currencies gaining against the USD, rising 0.34% and 0.37% respectively. Expect this to continue further as prospects for a September rate hike dissipate and the probability of a December hike continues to fall. The other big winner from the current panic is gold, which has rallied a further 0.9% today.

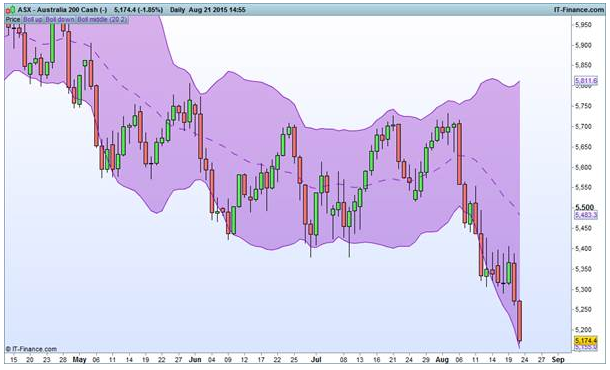

The ASX 200 has been brought low along with all other markets in Asia today. The index has now fallen 9% since 4 August.

The declines in the index have been led by the banks, with the sector down 2.8%. This is no surprise given the banks are highly leveraged to the Aussie consumer. This sort of global market volatility inevitably hits consumer sentiment as consumers’ investment portfolios are impacted. Housing loan growth may well be hit as consumers are less inclined to make major purchases. Also uncertainty over the timing of the US Fed rate rises and the China slowdown weigh greatly on the prospects for their businesses.

It is worth noting that despite the drastic moves in the Aussie market, the energy and resources sectors have not lead the declines in contrast to most of the past two weeks. Iron ore prices are starting to be impacted by the scheduled shut down of steel factories around Beijing from 20 August to 3 September, with Dalian iron ore futures down about 2% this week. However, the USD may be expected to weaken as the September hike dissipates, which could provide support to commodities priced in USD.

The main bright spot on the index today was MediBank Private’s (ASX:MPL) earnings coming in ahead of estimates. The strong 33% growth in operating profit from the health insurance division helped to offset policy churn and coverage downgrading. This saw the stock rally 13.7%.